Answered step by step

Verified Expert Solution

Question

1 Approved Answer

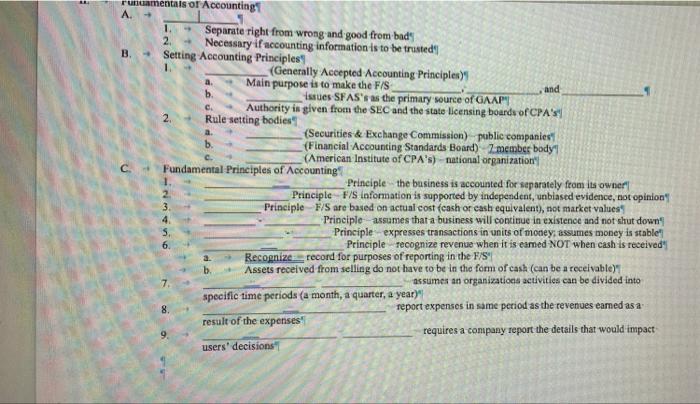

FILL IN THE BLANKS 1. Separate right from wrong and good from bad 2. - Necessary if accounting information is to be trusted| B. Setting

FILL IN THE BLANKS

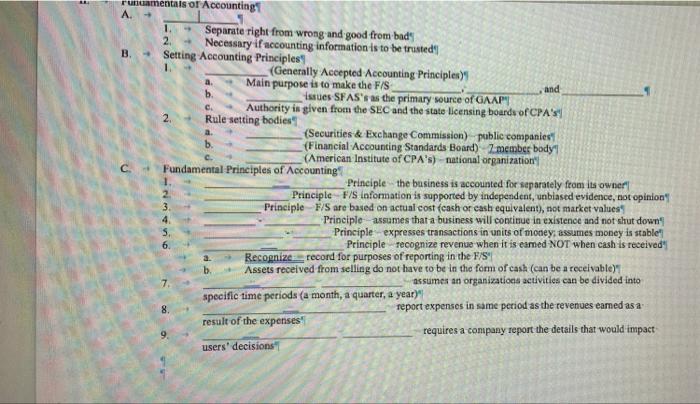

1. Separate right from wrong and good from bad" 2. - Necessary if accounting information is to be trusted"| B. Setting Accounting Principles= 1. (Generally Accepted Accounting Principles) a. Main purpose is to make the FiS b. Issues-SFAS's as the primary source of GAAP: c. Authority in given from the SEC and the state licensing boards of CPA's 2. Rule setting bodies? a. (Securities \& Exchange Commission) public companiest) b. 2 (Financial Accounting Standards Board) - Zmember body" c. Principles of Accounting? C. - Fundamental Principles of Accounting : Principle the basiness is accounted for separately from its owner! Principle F/S information is supported by independent, unbiased evidence, not opinion" 3. Principle - F/S are based on actual cost (cash or eash equivalent, not market values? 4. Principle - assumes that a business will contizue in existence and not shut down? Principle - expresses transactions in units of money; assumes money is stablet Principle recognize revenue when it is eamed NOT when cash is received" 6.4 3. Recognize = record for purposes of reporting in the FiS' b. Assets received from selling do not have to be in the form of cash (can be a receivable)" 7. speciflc time periods (a month, a quarter, a year)" assumes an organizatiocs activities can be divided into 8. - reportexpensesinsameperiodastherevenueseamedasa:resultoftheexpenses? 9. users'decisions" requires a company report the details that would impact: 1. Separate right from wrong and good from bad" 2. - Necessary if accounting information is to be trusted"| B. Setting Accounting Principles= 1. (Generally Accepted Accounting Principles) a. Main purpose is to make the FiS b. Issues-SFAS's as the primary source of GAAP: c. Authority in given from the SEC and the state licensing boards of CPA's 2. Rule setting bodies? a. (Securities \& Exchange Commission) public companiest) b. 2 (Financial Accounting Standards Board) - Zmember body" c. Principles of Accounting? C. - Fundamental Principles of Accounting : Principle the basiness is accounted for separately from its owner! Principle F/S information is supported by independent, unbiased evidence, not opinion" 3. Principle - F/S are based on actual cost (cash or eash equivalent, not market values? 4. Principle - assumes that a business will contizue in existence and not shut down? Principle - expresses transactions in units of money; assumes money is stablet Principle recognize revenue when it is eamed NOT when cash is received" 6.4 3. Recognize = record for purposes of reporting in the FiS' b. Assets received from selling do not have to be in the form of cash (can be a receivable)" 7. speciflc time periods (a month, a quarter, a year)" assumes an organizatiocs activities can be divided into 8. - reportexpensesinsameperiodastherevenueseamedasa:resultoftheexpenses? 9. users'decisions" requires a company report the details that would impact

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started