Question

(fill in the blanks with select answer options) Question 1. The first step in the arbitrage trade is to borrow in Select: [CAD or USD]

(fill in the blanks with select answer options)

Question 1.

The first step in the arbitrage trade is to borrow in Select: ["CAD" or "USD"] at the rate of Select: ["4%", or " 5%", or "7%", or "8%"]

Question 2.

The next step is to convert the borrowed money into Select : ["USD", "CAD"] and invest it an account offering Select: ["5%", "7%", "8%", "4%"] interest rate

Question 3.

In 1 year, you will have the proceeds from your loan. You will convert that at:

a. The forward rate of 1.8

b. The spot rate of 1.75

c. The spot rate in 1 year

Question 4.

Assuming you started with $1 million USD, what is your profit in USD in 1 year?

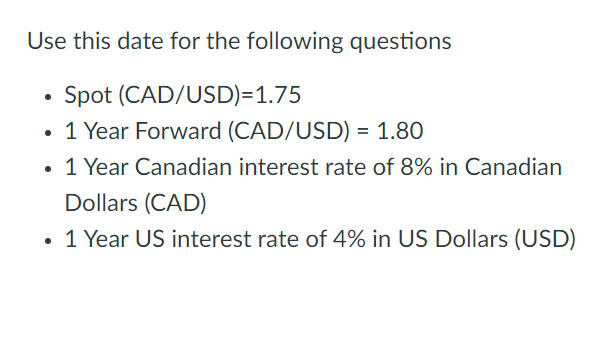

Use this date for the following questions - Spot (CAD/USD)=1.75 - 1 Year Forward (CAD/USD) =1.80 - 1 Year Canadian interest rate of 8% in Canadian Dollars (CAD) - 1 Year US interest rate of 4% in US Dollars (USD)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started