Answered step by step

Verified Expert Solution

Question

1 Approved Answer

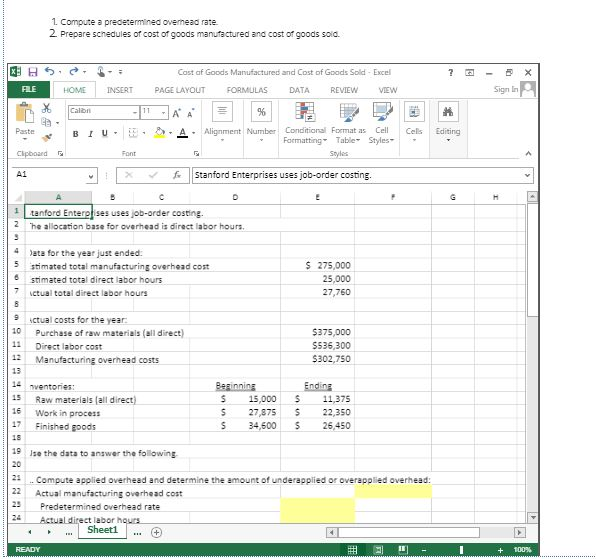

Fill in the boxes using the EXACT FORMULA that would give the final answer in that box. 1 Compute a predetermined overmead rate 2 Prepare

Fill in the boxes using the EXACT FORMULA that would give the final answer in that box.

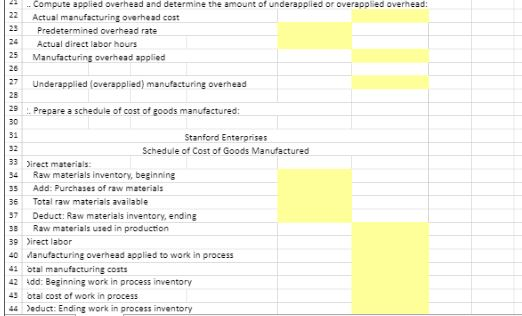

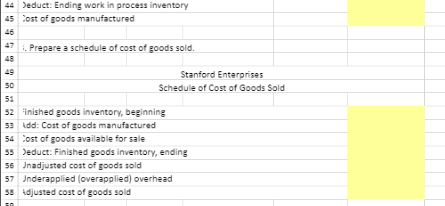

1 Compute a predetermined overmead rate 2 Prepare schedules of cost of goods manufactured and cost of goods sold. X H Cast af Goods Manufactured and Cost of Goods Sold Excel FLE PAGE LAYOUT Sign In HOME INSERT FORMULAS DATA REVIEW VIEW TTT Calbi A A % Conditional Format as Farmatting Table Styles P A- Cell Paste EC Alignment Number Cells Editing B IU- Font Styles Cipboard Stanford Enterprises uses job-order costing. A1 A c H tanford Enterptises uses job-order costing. he allocation base for overhead is direct labor hours. ata for the year just ended S 275,000 stimated total manufacturing overhead cost 25,000 stimated total direct labor hours 7 27,760 ictual total direct labor hours Actual costs for the year 10 S375,000 Purchase of raw materials (all direct) 11 S536,300 Direct labor cost 12 $302,750 Manufacturing overhead costs 13 nventories Beginning 14 Ending 15 15,000 Raw materials (all direct) 11,375 16 22,350 Work in process 27,875 17 Finished goods 34,600 26,450 19 Ise the data to answer the following 20 21 Compute applied overhead and determine the amount of underapplied or overapplied overhead: 22 Actual manufacturing overhead cost 25 Predetermined overhead rate 24 Actual direct labor hours Sheet1 READY 100% A .Compute applied overhead and determine the amount of underapplied or overapplied overhead 22 Actual manufacturing overhead cost 23 Predetermined overhead rate 24 Actual direct labor hours 25 Manufacturing overhead applied 26 27 Underapplied (overapplied) manufacturing overhead 28 29 Prepare a schedule of cost of goods manufactured: 30 31 Stanford Entorprises 32 Schedule of Cost of Goods Manufactured 33 irect materials Raw materials inventory, beginning 34 Add: Purchases of raw materials Total raw materials available 36 Deduct: Raw materials inventory, ending Raw materials used in production 97 38 39 irect labor 40 Manufacturing overhead applied to work in process otal manufacturing costs dd: Beginning work in process inventory 41 42 43 otal cost of work in process educt: Ending work in process inventory 44 44Deduct: Ending work in process inventory 45 ost of goods manufactured 46 47Prepare a schedule of cost of goods sold. 48 48 Stanford Enterprises s0 Schedule of Cost of Goods Sold 51 52 inished goods inventory, beginning 53dd: Cost of goods manufactured 54 ost of goods available for sale s5 educt: Finished goods inventory, ending 56 Jnadjusted cost of goods sold Underapplied (overapplied) overhead 57 ss djusted cost of goods soldStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started