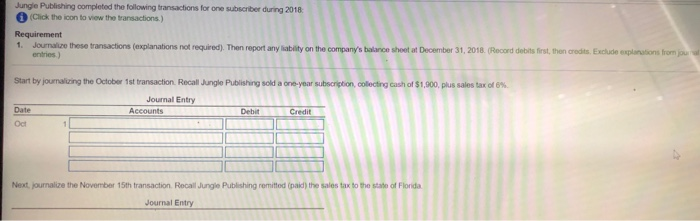

fill in the cells in the format displayed.

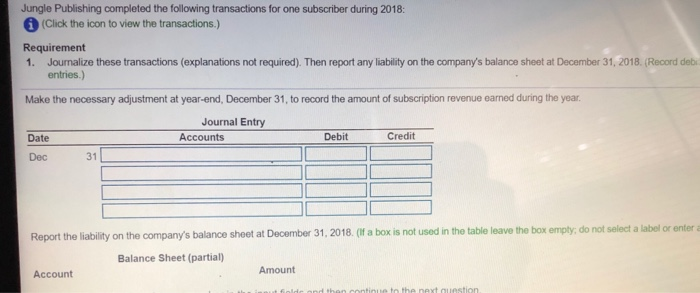

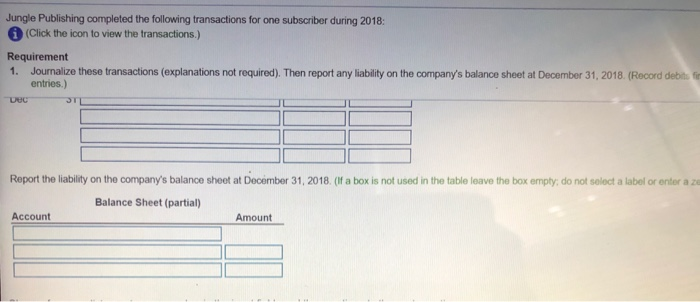

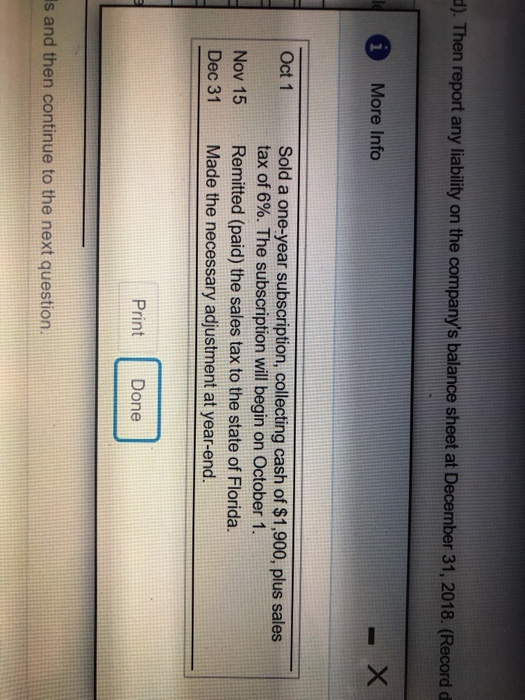

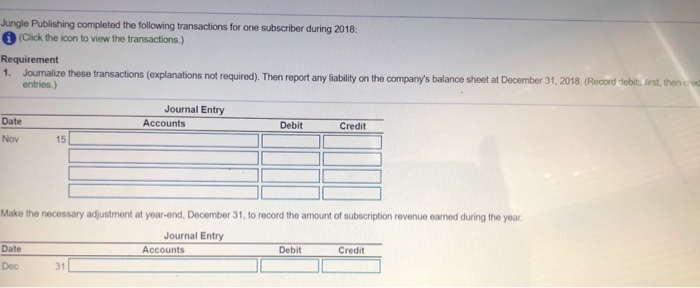

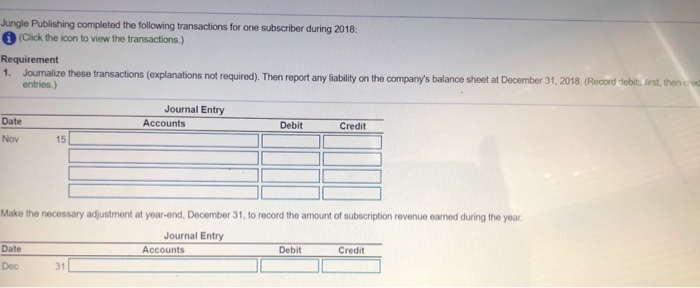

Jungle Publishing completed the following transactions for one subscriber during 2018 (Click the icon to view the transactions) Requirement Journalize these transactions (explanations not required). Then report any liablity on the company's balance sheet at December 31, 2018. (Record debits first, then aredits. Exclude explanations from jour al 1. entries) Start by journalizing the October 1st transaction. Recall Jungle Publishing sold a one-year subscription, collecting cash of $1,900, plus sales tax of 6% Journal Entry Accounts Date Debit Credit Oct Next, journalize the November 15th transaction. Recall Jungle Publishing remitted (paid) the sales tax to the state of Florida Journal Entry Jungle Publishing completed the following transactions for one subscriber during 2018 (Click the icon to view the transactions.) Requirement 1. Journalize these transactions (explanations not required). Then report any liability on the company's balance sheet at December 31, 2018. (Record debits irst, then red entries.) Journal Entry Date Accounts Debit Credit Nov 15 Make the necessary adjustment at year-end, December 31, to record the amount of subscription revenue eaned during the year Journal Entry Date Credit Accounts Debit Dec 31 Jungle Publishing completed the following transactions for one subscriber during 2018: (Click the icon to view the transactions.) Requirement Journalize these transactions (explanations not required). Then report any liability on the company's balance sheet at December 31, 2018. (Record deb entries.) 1. Make the necessary adjustment at year-end, December 31, to record the amount of subscription revenue earned during the year Journal Entry Credit Accounts Debit Date 31 Dec in the table leave the box empty; do not select a label or enter Report the liability on the company's balance sheet at December 31, 2018. (If a box is Balance Sheet (partial) Amount Account fiolde and then continue to the next auestion Jungle Publishing completed the following transactions for one subscriber during 2018: i (Click the icon to view the transactions.) Requirement 1. Journalize these transactions (explanations not required). Then report any liability on the company's balance sheet at December 31, 2018. (Record debits fin entries.) Dec Report the liability on the company's balance sheet at December 31, 2018. (If a box is not used in the table leave the box empty; do not selecta label or enter a ze Balance Sheet (partial) Account Amount d). Then report any liability on the company's balance sheet at December 31, 2018. (Record d i - X More Info Oct 1 Sold a one-year subscription, collecting cash of $1,900, plus sales tax of 6%. The subscription will begin on October 1 Remitted (paid) the sales tax to the state of Florida. Made the necessary adjustment at year-end. Nov 15 Dec 31 Print Done s and then continue to the next

fill in the cells in the format displayed.

fill in the cells in the format displayed.