FILL IN THE FINANCIAL FORECAST FOR AND ENGINEERING BASED BUISNESS QUESTION:

BASED ON THE FINANCIAL FORECAST

ANSWER THESE QUESTIONS

THIS IS ALL THATS GIVEN THE REST CAN BE RANDOM VALUES THAT MAKE SENSE

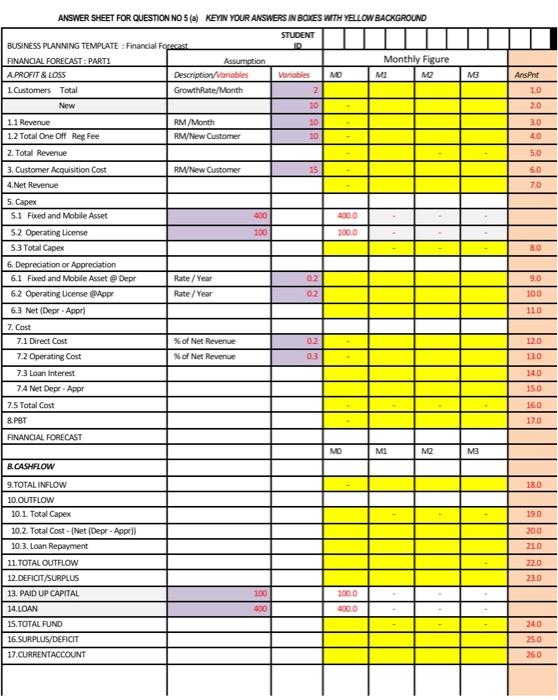

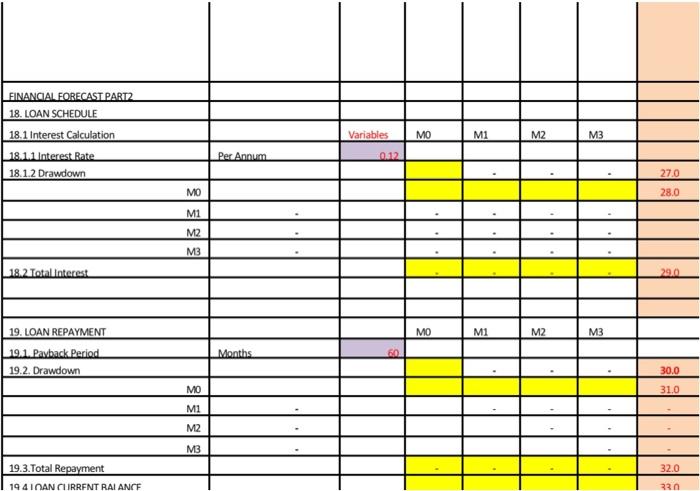

a) Spreadsheets Q4(a) is an incomplete brief monthly financial forecast with customer acquisition cost is set to be RM15 per new customer. Create a complete financial forecast by filling up the items (IN YELLOW Cells ONLY) on each rows marked ONE to THIRTY THREE (1.0 - 33.0) under "AnsPnt" column. The relevant cells are editable for your answers. (15 marks) ANSWER SHEET FOR QUESTION NO5 () KEYIN YOUR ANSWERS IN BOXES WITH YELLOW BACKGROUND STUDENT Monthly Figure MI M MO M3 Ansprit Variables 2 10 10 2.0 BUSINESS PLANNING TEMPLATE Financial Forecast FINANCIAL FORECASTA PARTI Assumption APROFIT & LOSS Description Variables 1. Customers Total Growth Rate/Month New 1.1 Revenue RM /Month 1.2 Total One Off Reg Fee RM New Customer 2. Total Revenue 3. Customer Acquisition Cost RIW New Customer 4. Net Revenue 30 10 3.0 4.0 5.0 15 6.0 7.0 400 4000 100.0 8.0 5. Capex 5.1 Fixed and Mobile Asset 5.2 Operating License 5.3 Total Capex 6. Depreciation or Appreciation 6.1 Fixed and Mobile Asset @ Depr 6.2 Operating License Appr 6.3 Net Depr. Apprl 02 9.0 Rate / Year Rate/Year 100 110 12.0 % of Net Revenue % of Net Revenue 03 13.0 14.0 7. Cost 7.1 Direct Cost 7.2 Operating cost 7.3 Loan Interest 74 Net Depr. Appr 7.5 Total Cost 8.PBT FINANCIAL FOR CAST 15.0 160 17.0 MO MI MO MB B.CASHFLOW 18.0 190 200 210 220 9. TOTAL INFLOW 10.OUTFLOW 10.1. Total Capex 10.2. Total Cost - (Net (Depr - Appr}} 10.3. Loan Repayment 11. TOTAL OUTFLOW 12. DEFICIT/SURPLUS 13. PAID UP CAPITAL 14.LOAN 15. TOTAL FUND 16. SURPLUS/DEFICIT 17.CURRENTACCOUNT 23.0 100 1000 400.0 400 24.0 25.0 26.0 FINANCIAL FORECAST PART2 18. LOAN SCHEDULE 18.1 Interest Calculation 18.1.1 Interest Rate 18.1.2 Drawdown Variables MO M1 M2 M3 Per Annum 012 27.0 MO 28.0 MI M2 M3 18.2 Total Interest 290 19. LOAN REPAYMENT MO M1 M2 M3 Months 191. Payback Period 19.2. Drawdown 30.0 31.0 MO MI M2 M3 19.3.Total Repayment 32.0 1941CAN CURRENT RAIANCE 230 b) Compose an executive financial summary which covers : 1. Total customers and New customer registration, 2. Tariff Structures, Total Revenue and Net Revenue, 3. Customer Acquisition Cost and Net Revenue. 4. Total Cost. 5. Profit and Loss Before Tax. 6. Cash In Flow and Out Flow, 7. 4 Months Spending Pattern, 8. Funding Requirement and 9. Current Account (10 marks ) a) Spreadsheets Q4(a) is an incomplete brief monthly financial forecast with customer acquisition cost is set to be RM15 per new customer. Create a complete financial forecast by filling up the items (IN YELLOW Cells ONLY) on each rows marked ONE to THIRTY THREE (1.0 - 33.0) under "AnsPnt" column. The relevant cells are editable for your answers. (15 marks) a) Spreadsheets Q4(a) is an incomplete brief monthly financial forecast with customer acquisition cost is set to be RM15 per new customer. Create a complete financial forecast by filling up the items (IN YELLOW Cells ONLY) on each rows marked ONE to THIRTY THREE (1.0 - 33.0) under "AnsPnt" column. The relevant cells are editable for your answers. (15 marks) ANSWER SHEET FOR QUESTION NO5 () KEYIN YOUR ANSWERS IN BOXES WITH YELLOW BACKGROUND STUDENT Monthly Figure MI M MO M3 Ansprit Variables 2 10 10 2.0 BUSINESS PLANNING TEMPLATE Financial Forecast FINANCIAL FORECASTA PARTI Assumption APROFIT & LOSS Description Variables 1. Customers Total Growth Rate/Month New 1.1 Revenue RM /Month 1.2 Total One Off Reg Fee RM New Customer 2. Total Revenue 3. Customer Acquisition Cost RIW New Customer 4. Net Revenue 30 10 3.0 4.0 5.0 15 6.0 7.0 400 4000 100.0 8.0 5. Capex 5.1 Fixed and Mobile Asset 5.2 Operating License 5.3 Total Capex 6. Depreciation or Appreciation 6.1 Fixed and Mobile Asset @ Depr 6.2 Operating License Appr 6.3 Net Depr. Apprl 02 9.0 Rate / Year Rate/Year 100 110 12.0 % of Net Revenue % of Net Revenue 03 13.0 14.0 7. Cost 7.1 Direct Cost 7.2 Operating cost 7.3 Loan Interest 74 Net Depr. Appr 7.5 Total Cost 8.PBT FINANCIAL FOR CAST 15.0 160 17.0 MO MI MO MB B.CASHFLOW 18.0 190 200 210 220 9. TOTAL INFLOW 10.OUTFLOW 10.1. Total Capex 10.2. Total Cost - (Net (Depr - Appr}} 10.3. Loan Repayment 11. TOTAL OUTFLOW 12. DEFICIT/SURPLUS 13. PAID UP CAPITAL 14.LOAN 15. TOTAL FUND 16. SURPLUS/DEFICIT 17.CURRENTACCOUNT 23.0 100 1000 400.0 400 24.0 25.0 26.0 FINANCIAL FORECAST PART2 18. LOAN SCHEDULE 18.1 Interest Calculation 18.1.1 Interest Rate 18.1.2 Drawdown Variables MO M1 M2 M3 Per Annum 012 27.0 MO 28.0 MI M2 M3 18.2 Total Interest 290 19. LOAN REPAYMENT MO M1 M2 M3 Months 191. Payback Period 19.2. Drawdown 30.0 31.0 MO MI M2 M3 19.3.Total Repayment 32.0 1941CAN CURRENT RAIANCE 230 b) Compose an executive financial summary which covers : 1. Total customers and New customer registration, 2. Tariff Structures, Total Revenue and Net Revenue, 3. Customer Acquisition Cost and Net Revenue. 4. Total Cost. 5. Profit and Loss Before Tax. 6. Cash In Flow and Out Flow, 7. 4 Months Spending Pattern, 8. Funding Requirement and 9. Current Account (10 marks ) a) Spreadsheets Q4(a) is an incomplete brief monthly financial forecast with customer acquisition cost is set to be RM15 per new customer. Create a complete financial forecast by filling up the items (IN YELLOW Cells ONLY) on each rows marked ONE to THIRTY THREE (1.0 - 33.0) under "AnsPnt" column. The relevant cells are editable for your answers. (15 marks)