Fill in the grey areas using excel.

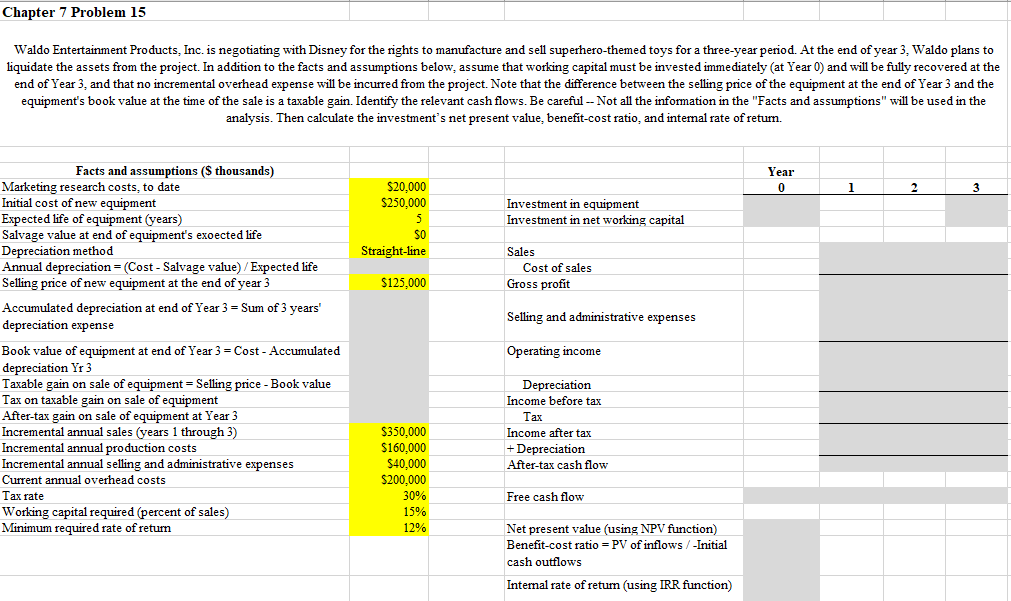

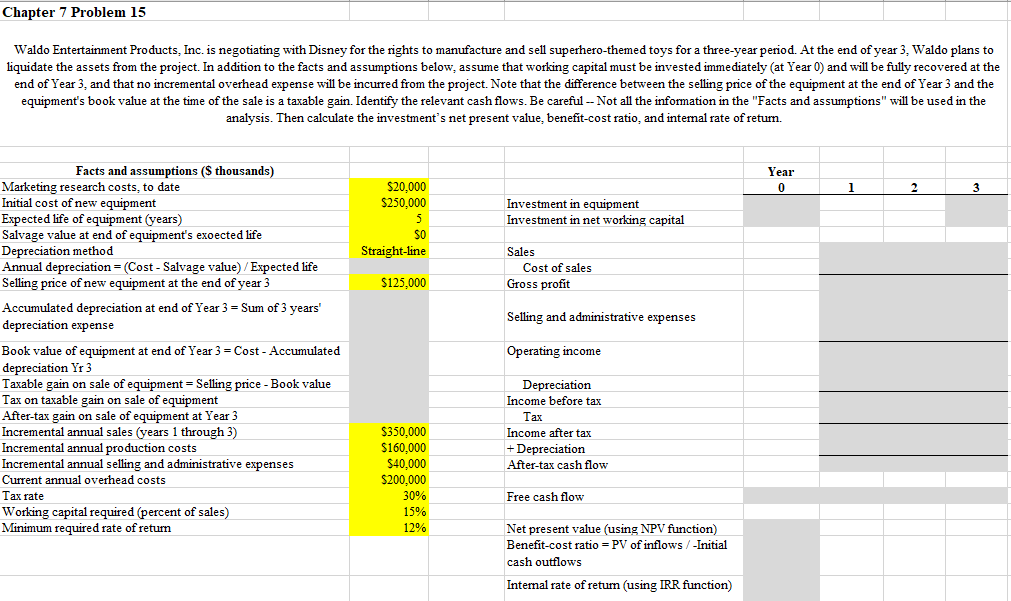

Chapter 7 Problem 15 Waldo Entertainment Products, Inc. is negotiating with Disney for the rights to manufacture and sell superhero-themed toys for a three-year period. At the end of year 3, Waldo plans to liquidate the assets from the project. In addition to the facts and assumptions below, assume that working capital must be invested immediately (at Year 0) and will be fully recovered at the end of Year 3, and that no incremental overhead expense will be incurred from the project. Note that the difference between the selling price of the equipment at the end of Year 3 and the equipment's book value at the time of the sale is a taxable gain. Identify the relevant cash flows. Be careful -- Not all the information in the "Facts and assumptions" will be used in the analysis. Then calculate the investment's net present value, benefit-cost ratio, and intemal rate of retum. Year 0 1 2 3 $20,000 $250,000 5 So Straight-line Investment in equipment Investment in net working capital Sales Cost of sales Gross profit $125.000 Selling and administrative expenses Facts and assumptions ($ thousands) Marketing research costs, to date Initial cost of new equipment Expected life of equipment (years) Salvage value at end of equipment's exoected life Depreciation method Annual depreciation = (Cost - Salvage value) / Expected life Selling price of new equipment at the end of year 3 Accumulated depreciation at end of Year 3 = Sum of 3 years' depreciation expense Book value of equipment at end of Year 3 = Cost - Accumulated depreciation Yr 3 Taxable gain on sale of equipment Selling price - Book value Tax on taxable gain on sale of equipment After-tax gain on sale of equipment at Year 3 Incremental annual sales (years 1 through 3) Incremental annual production costs Incremental annual selling and administrative expenses Current annual overhead costs Tax rate Working capital required (percent of sales) Minimum required rate of return Operating income Depreciation Income before tax Tax Income after tax + Depreciation After-tax cash flow $350,000 $160,000 $40,000 $200,000 30% 15% 12% Free cash flow Net present value (using NPV function) Benefit-cost ratio = PV of inflows / -Initial cash outflows Internal rate of return (using IRR function) Chapter 7 Problem 15 Waldo Entertainment Products, Inc. is negotiating with Disney for the rights to manufacture and sell superhero-themed toys for a three-year period. At the end of year 3, Waldo plans to liquidate the assets from the project. In addition to the facts and assumptions below, assume that working capital must be invested immediately (at Year 0) and will be fully recovered at the end of Year 3, and that no incremental overhead expense will be incurred from the project. Note that the difference between the selling price of the equipment at the end of Year 3 and the equipment's book value at the time of the sale is a taxable gain. Identify the relevant cash flows. Be careful -- Not all the information in the "Facts and assumptions" will be used in the analysis. Then calculate the investment's net present value, benefit-cost ratio, and intemal rate of retum. Year 0 1 2 3 $20,000 $250,000 5 So Straight-line Investment in equipment Investment in net working capital Sales Cost of sales Gross profit $125.000 Selling and administrative expenses Facts and assumptions ($ thousands) Marketing research costs, to date Initial cost of new equipment Expected life of equipment (years) Salvage value at end of equipment's exoected life Depreciation method Annual depreciation = (Cost - Salvage value) / Expected life Selling price of new equipment at the end of year 3 Accumulated depreciation at end of Year 3 = Sum of 3 years' depreciation expense Book value of equipment at end of Year 3 = Cost - Accumulated depreciation Yr 3 Taxable gain on sale of equipment Selling price - Book value Tax on taxable gain on sale of equipment After-tax gain on sale of equipment at Year 3 Incremental annual sales (years 1 through 3) Incremental annual production costs Incremental annual selling and administrative expenses Current annual overhead costs Tax rate Working capital required (percent of sales) Minimum required rate of return Operating income Depreciation Income before tax Tax Income after tax + Depreciation After-tax cash flow $350,000 $160,000 $40,000 $200,000 30% 15% 12% Free cash flow Net present value (using NPV function) Benefit-cost ratio = PV of inflows / -Initial cash outflows Internal rate of return (using IRR function)