Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fill in the information below on your desired business. Owner/Operator (self; paid monthly) Monthly salary of: $______________________ Full Time Employee (paid bi-weekly) Hourly wage of:

- Fill in the information below on your desired business.

- Owner/Operator (self; paid monthly) Monthly salary of: $______________________

- Full Time Employee (paid bi-weekly) Hourly wage of: $________________________

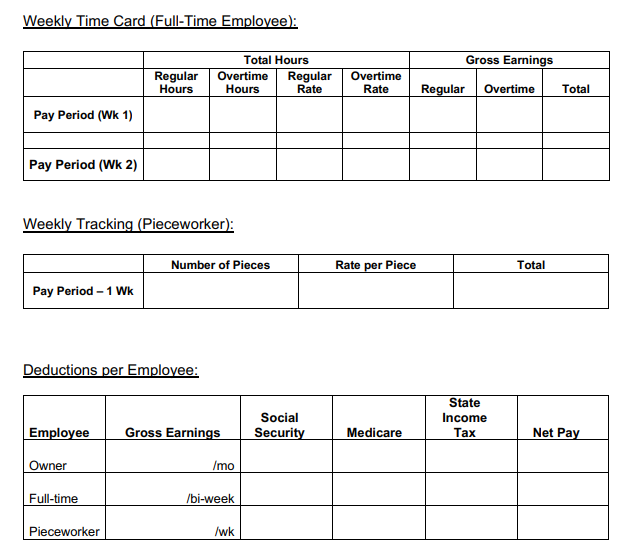

- Use the Weekly Timecard on the second page and fill out both weeks to calculate total bi-weekly gross pay

- Include some overtime hours (more than 40 hours in a week), and compute the pay at time-and-a-half for those hours in your tally. - Bi-weekly gross pay of: $______________________

- Pieceworker (paid weekly)

- Identify type of pay (What specifically is the piece/client/class for your business?): ____________________

- Identify the rate per piece/client/class: $____________________

- Use the Weekly Tracking on the second page and fill out the number of pieces, rate of pay per piece and compute the total pay for that week.

- Weekly gross pay of: $____________________________________

- Calculate Net Pay

- Complete the table on the second page using the respective pay periods: Owner - monthly; Full-time employee - bi-weekly; Pieceworker - weekly.

- Determine Social Security and Medicare dollar amounts withheld for yourself and each of your employees. Ensure you know the difference between self-employed versus employee status and how that effects Social Security and Medicare withholding.

- Calculate State Income Tax

- If your business is located in Colorado, use 4.63% of gross earnings.

- If your business is located in another state, research and find your states income tax rate. State: ______________, Tax Rate: _______ o

- Note: some states do not have a state income tax. Do not calculate federal income tax withholding.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started