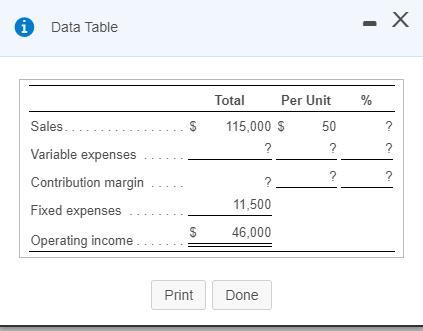

Sunflower Company manufactures and sells a single product. The company s sales and expenses for last year follow: (Click the icon to view the

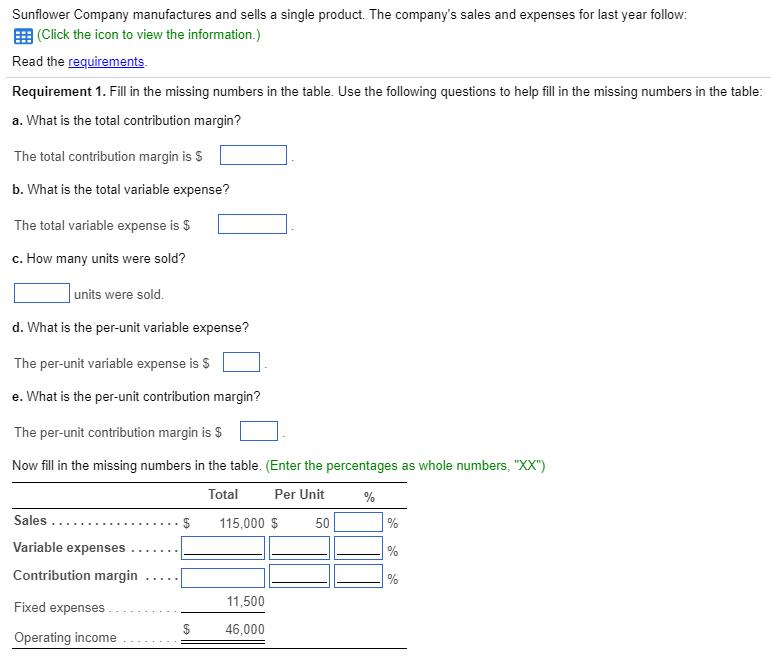

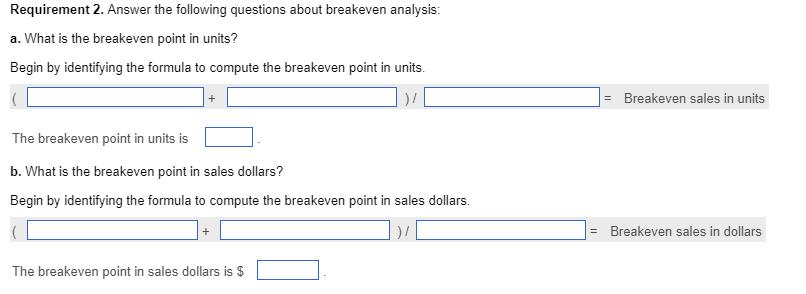

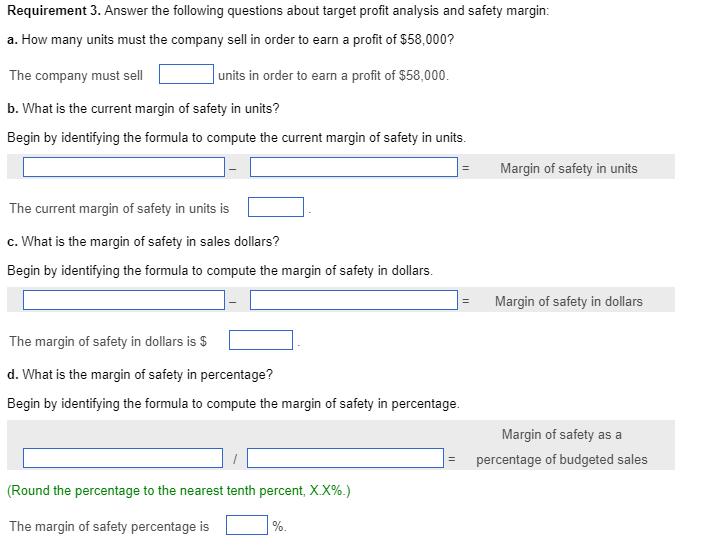

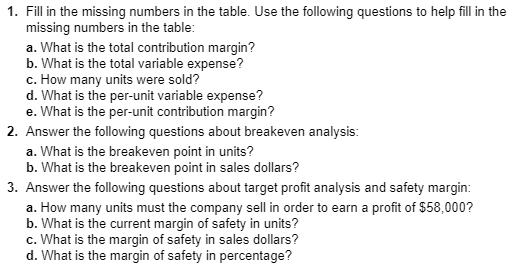

Sunflower Company manufactures and sells a single product. The company s sales and expenses for last year follow: (Click the icon to view the information.) Read the requirements. Requirement 1. Fill in the missing numbers in the table. Use the following questions to help fill in the missing numbers in the table: a. What is the total contribution margin? The total contribution margin is $ b. What is the total variable expense? The total variable expense is $ c. How many units were sold? units were sold. d. What is the per-unit variable expense? The per-unit variable expense is $ e. What is the per-unit contribution margin? The per-unit contribution margin is $ Now fill in the missing numbers in the table. (Enter the percentages as whole numbers, XX ) Total Per Unit % 115,000 $ 50 Sales Variable expenses Contribution margin Fixed expenses Operating income $ $ 11,500 46,000 % % Requirement 2. Answer the following questions about breakeven analysis: a. What is the breakeven point in units? Begin by identifying the formula to compute the breakeven point in units. The breakeven point in units is b. What is the breakeven point in sales dollars? Begin by identifying the formula to compute the breakeven point in sales dollars. The breakeven point in sales dollars is $ = Breakeven sales in units = Breakeven sales in dol Requirement 3. Answer the following questions about target profit analysis and safety margin: a. How many units must the company sell in order to earn a profit of $58,000? The company must sell b. What is the current margin of safety in units? Begin by identifying the formula to compute the current margin of safety in units. units in order to earn a profit of $58,000. The current margin of safety in units is c. What is the margin of safety in sales dollars? Begin by identifying the formula to compute the margin of safety in dollars. The margin of safety in dollars is $ d. What is the margin of safety in percentage? Begin by identifying the formula to compute the margin of safety in percentage. (Round the percentage to the nearest tenth percent, X.X%.) The margin of safety percentage is %. = Margin of safety in units Margin of safety in dollars Margin of safety as a percentage of budgeted sales 1. Fill in the missing numbers in the table. Use the following questions to help fill in the missing numbers in the table: a. What is the total contribution margin? b. What is the total variable expense? c. How many units were sold? d. What is the per-unit variable expense? e. What is the per-unit contribution margin? 2. Answer the following questions about breakeven analysis: a. What is the breakeven point in units? b. What is the breakeven point in sales dollars? 3. Answer the following questions about target profit analysis and safety margin: a. How many units must the company sell in order to earn a profit of $58,000? b. What is the current margin of safety in units? c. What is the margin of safety in sales dollars? d. What is the margin of safety in percentage? i Data Table Sales Variable expenses Contribution margin Fixed expenses Operating income $ CA Print Total 115,000 $ ? ? 11,500 46,000 Done Per Unit 50 ? ? - X % ? ?

Step by Step Solution

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635de5329e9f5_179778.pdf

180 KBs PDF File

635de5329e9f5_179778.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started