Question

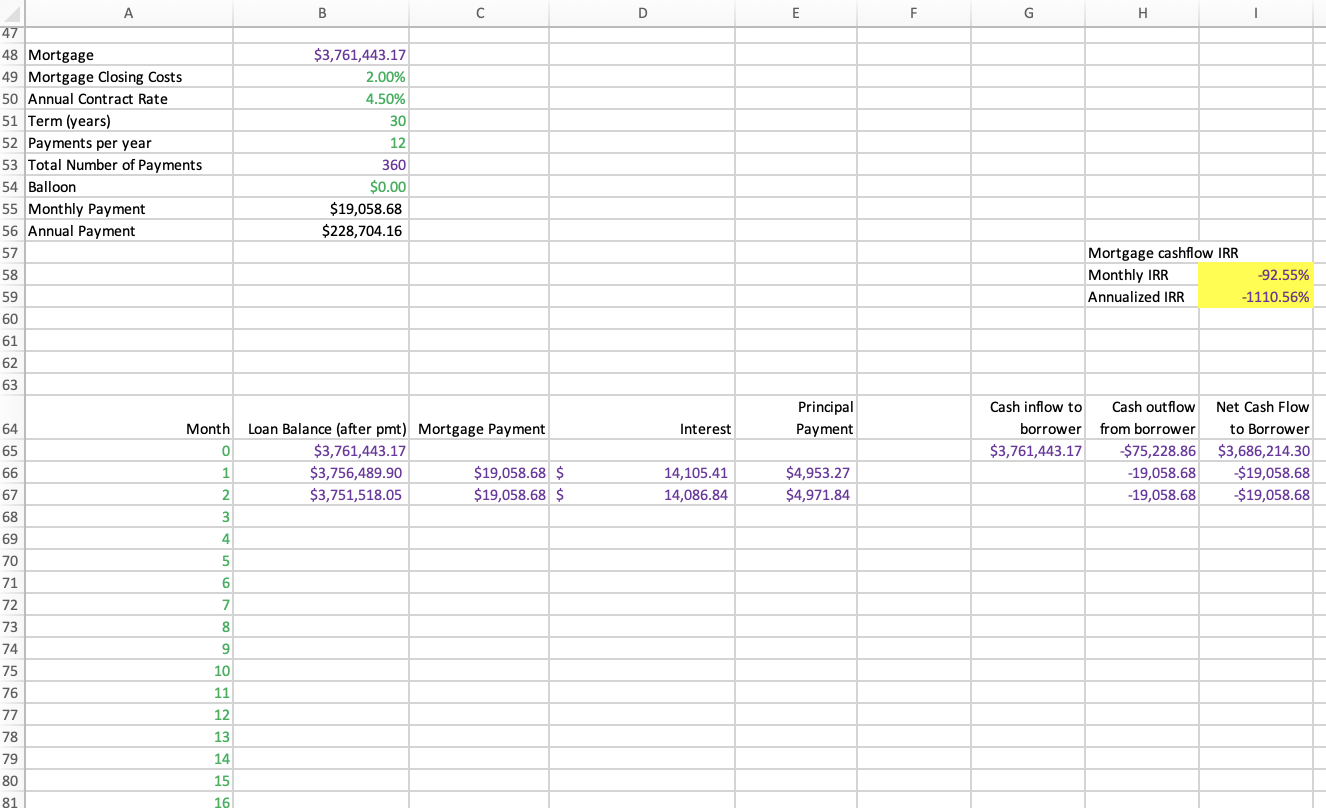

Fill in the sheet titled NPV-IRR. You will buy the property now (Year 0), collect NOI for 5 years Year 1-Year 5, and sell it

Fill in the sheet titled NPV-IRR.

You will buy the property now (Year 0), collect NOI for 5 years Year 1-Year 5, and sell it at the end of Year 5.

Your loan has a 5/4/3/2/1 prepayment penalty structure, so if you prepay in the first year, you will pay a penalty equal to 5% of the balance, in the second year you will pay a penalty equal to 4% of the balance etc. Payoff the loan balance, the prepayment penalty and any transaction costs.

You forecast NOI will grow at 3% per year, compounded annually.

You forecast you can sell the property at the end of year 5 at a 5.25% cap rate.

Recall: Sale Price in Year 5 = NOI6cap rate5

(3.a) How much will You sell the property for in Year 5?

(3.b) What is Your IRR for this investment?

(3.c) What is your cash on cash return for Year 1? Recall that the cash on cash return is equal to your annual Net Cash Flow divided by your total cash investment at closing. The formula = cash on cash return = NCF1NCF0

For the following questions, change only the variable indicated. Keep the others as dictated above.

(3.d) What is your IRR if NOI growth is 5% compounded annually (all other variables held constant)?

(3.e) What is your IRR if your exit cap rate is 4.75% (all other variables held constant)?

(3.f) Complete the data table using the What-If Analysis in Excel.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started