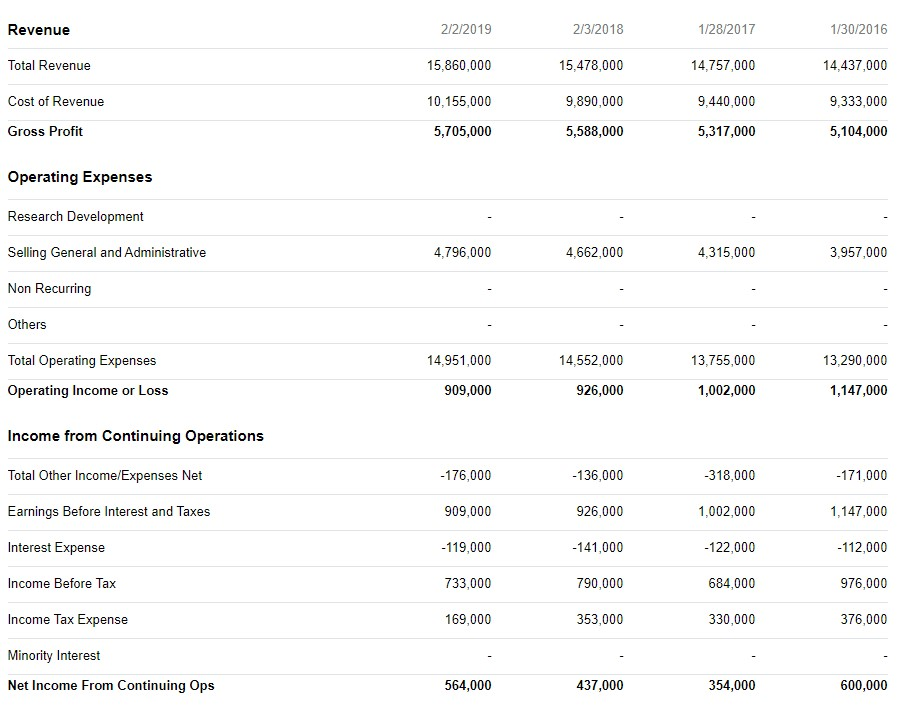

Fill in the table below based on the upper income statement

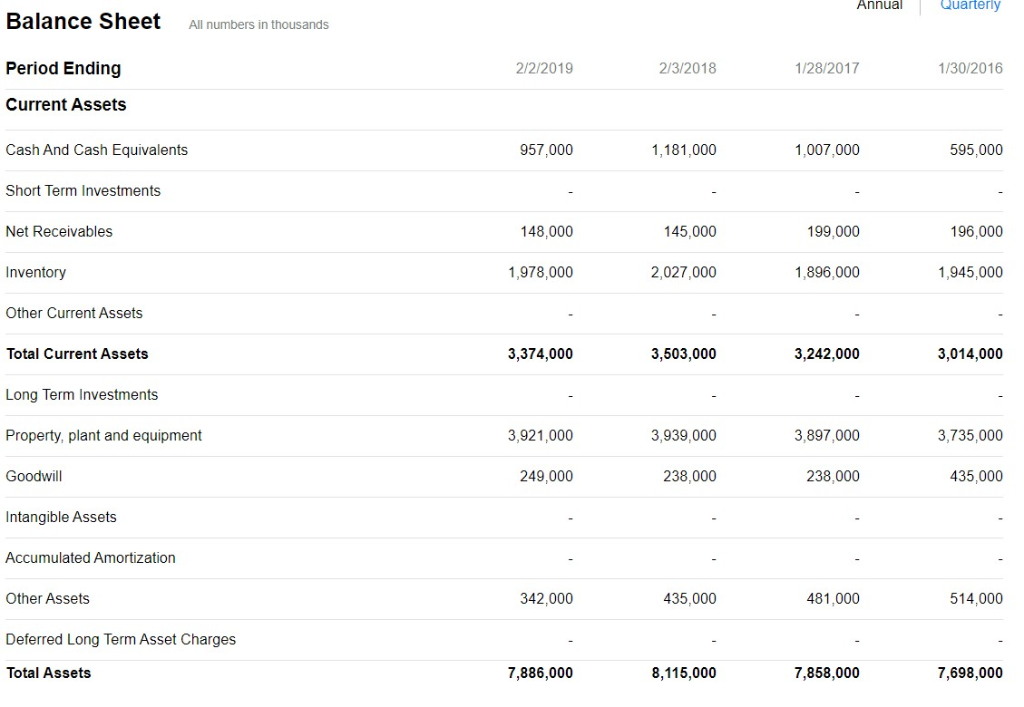

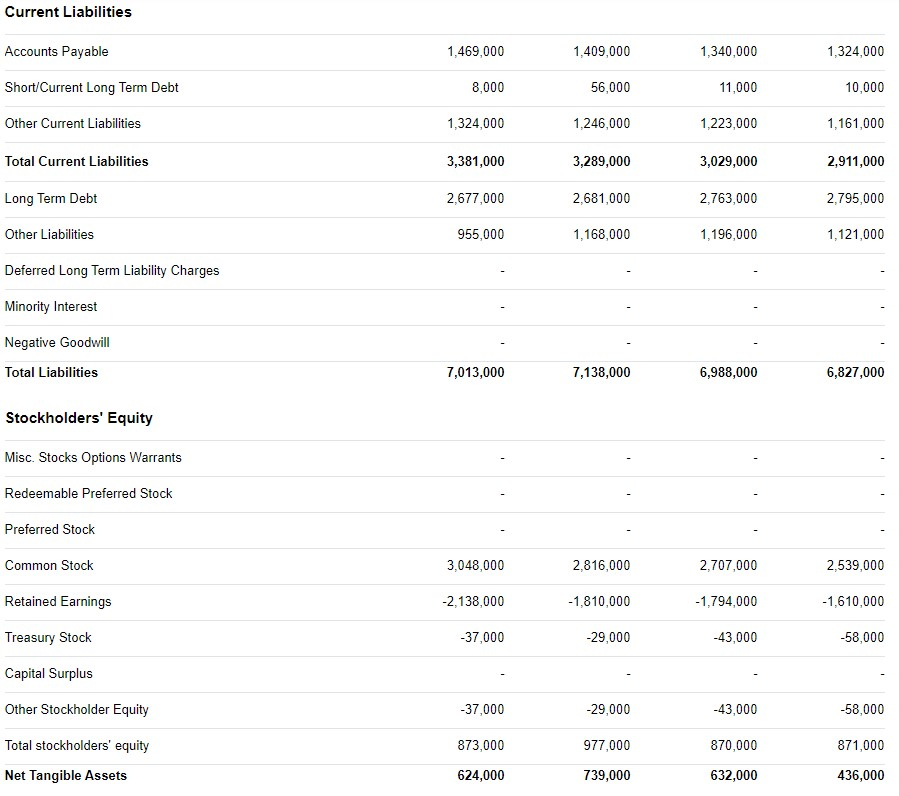

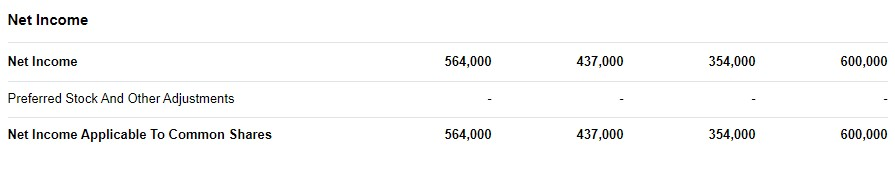

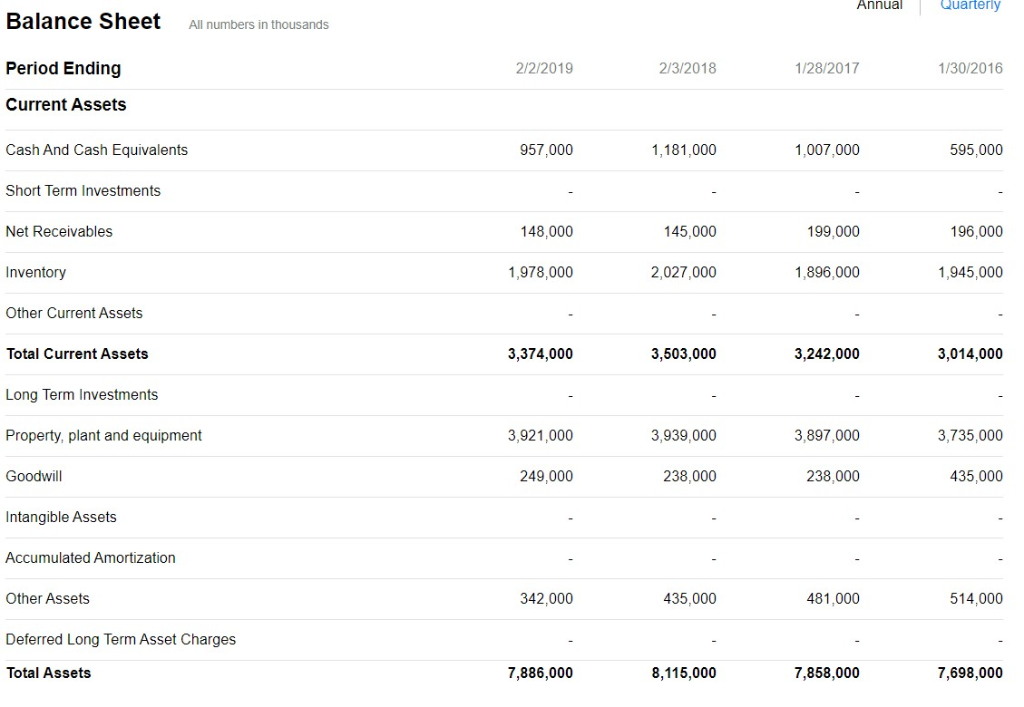

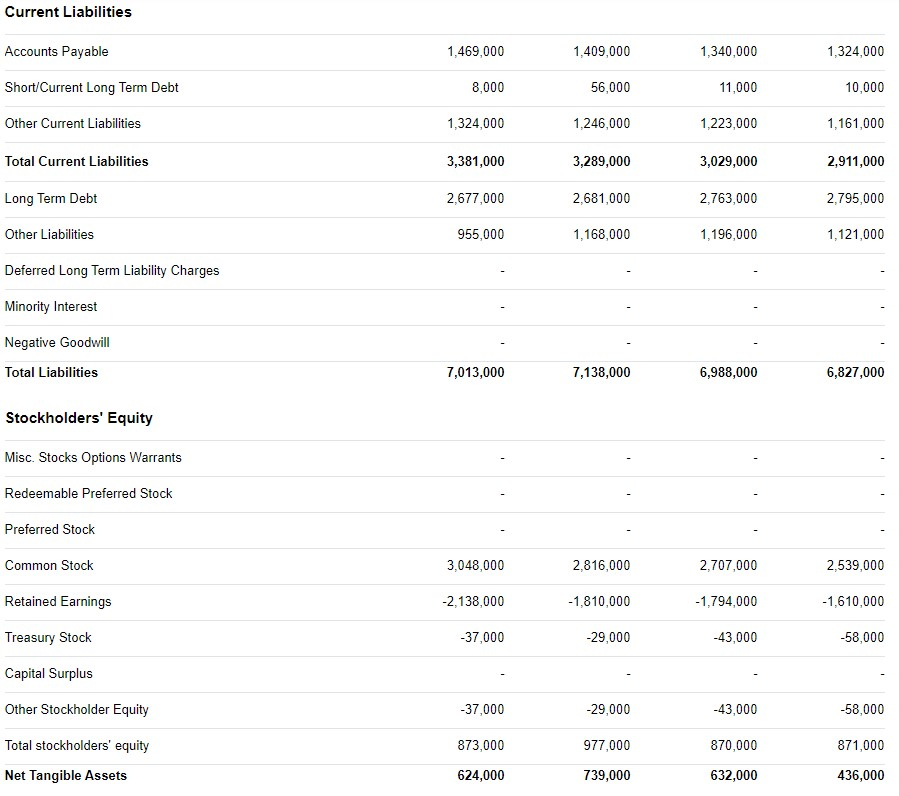

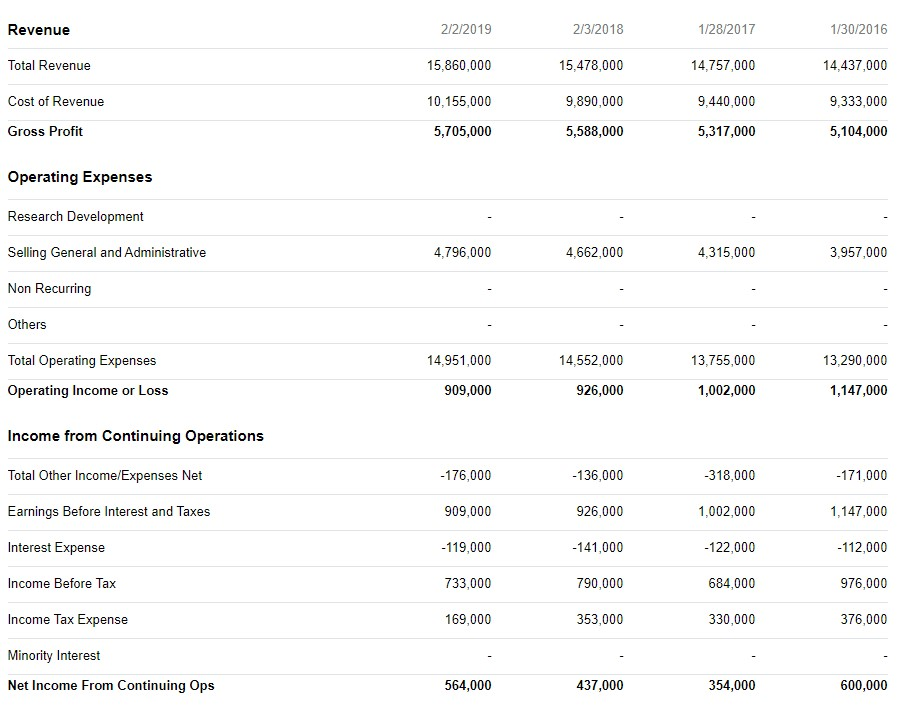

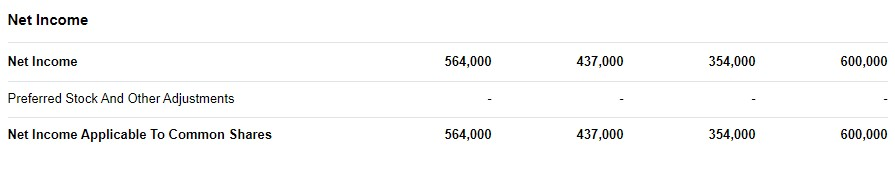

Annual Quarterly Balance Sheet All numbers in thousands Period Ending 2/3/2018 2/2/2019 1/28/2017 1/30/2016 Current Assets Cash And Cash Equivalents 957,000 1,181,000 1,007,000 595,000 Short Term Investments 148,000 199,000 Net Receivables 145,000 196,000 Inventory ,978,000 2,027,000 ,896,000 1,945,000 Other Current Assets 3,242,000 Total Current Assets 3,374,000 3,503,000 3,014,000 Long Term Investments Property, plant and equipment 3,921,000 3,939,000 3,897,000 3,735,000 Goodwill 249,000 238,000 238,000 435,000 Intangible Assets Accumulated Amortization 342,000 435,000 481,000 Other Assets 514,000 Deferred Long Term Asset Charges Total Assets 7,886,000 8,115,000 7,858,000 7,698,000 Current Liabilities Accounts Payable 1,324,000 1,469,000 1,409,000 1,340,000 10,000 Short/Current Long Term Debt 8,000 56,000 11,000 1,161,000 Other Current Liabilities 1,324,000 1,246,000 1,223,000 3,289,000 2,911,000 Total Current Liabilities 3,381,000 3,029,000 2,763,000 Long Term Debt 2,677,000 2,681,000 2,795,000 1,121,000 Other Liabilities 955,000 1,168,000 1,196,000 Deferred Long Term Liability Charges Minority Interest Negative Goodwill 7,013,000 Total Liabilities 7,138,000 6,988,000 6,827,000 Stockholders' Equity Misc. Stocks Options Warrants Redeemable Preferred Stock Preferred Stock 2,816,000 2,539,000 Common Stock 3,048,000 2,707,000 Retained Earnings 1,610,000 -2,138,000 1,810,000 -1,794,000 -43,000 Treasury Stock -37,000 29,000 58,000 Capital Surplus Other Stockholder Equity -37,000 29,000 -43,000 -58,000 Total stockholders' equity 977,000 873,000 870,000 871,000 Net Tangible Assets 624,000 739,000 632,000 436,000 Revenue 2/2/2019 2/3/2018 1/28/2017 1/30/2016 15,478,000 14,757,000 Total Revenue 15,860,000 14,437,000 9,890,000 9,333,000 Cost of Revenue 10,155,000 9,440,000 5,317,000 Gross Profit 5,705,000 5,588,000 5,104,000 Operating Expenses Research Development Selling General and Administrative 4,796,000 4,662,000 4,315,000 3,957,000 Non Recurring Others Total Operating Expenses 13,290,000 14,951,000 14,552,000 13,755,000 Operating Income or Loss 909,000 926,000 1,002,000 1,147,000 Income from Continuing Operations Total Other Income/Expenses Net -318,000 -176,000 -136,000 -171,000 Earnings Before Interest and Taxes 909,000 926,000 1,002,000 1,147,000 Interest Expense -119,000 -141,000 -122,000 -112,000 Income Before Tax 790,000 733,000 684,000 976,000 Income Tax Expense 376,000 169,000 353,000 330,000 Minority Interest Net Income From Continuing Ops 564,000 437,000 354,000 600,000 Net Income 437,000 Net Income 564,000 354,000 600,000 Preferred Stock And Other Adjustments Net Income Applicable To Common Shares 564,000 437,000 354,000 600,000 Profitability 2017 2-2019 2018 2016 Gross Profit Rate Return on Sales Return on Assets Return on Stockholders' Equity Net Profit Margin