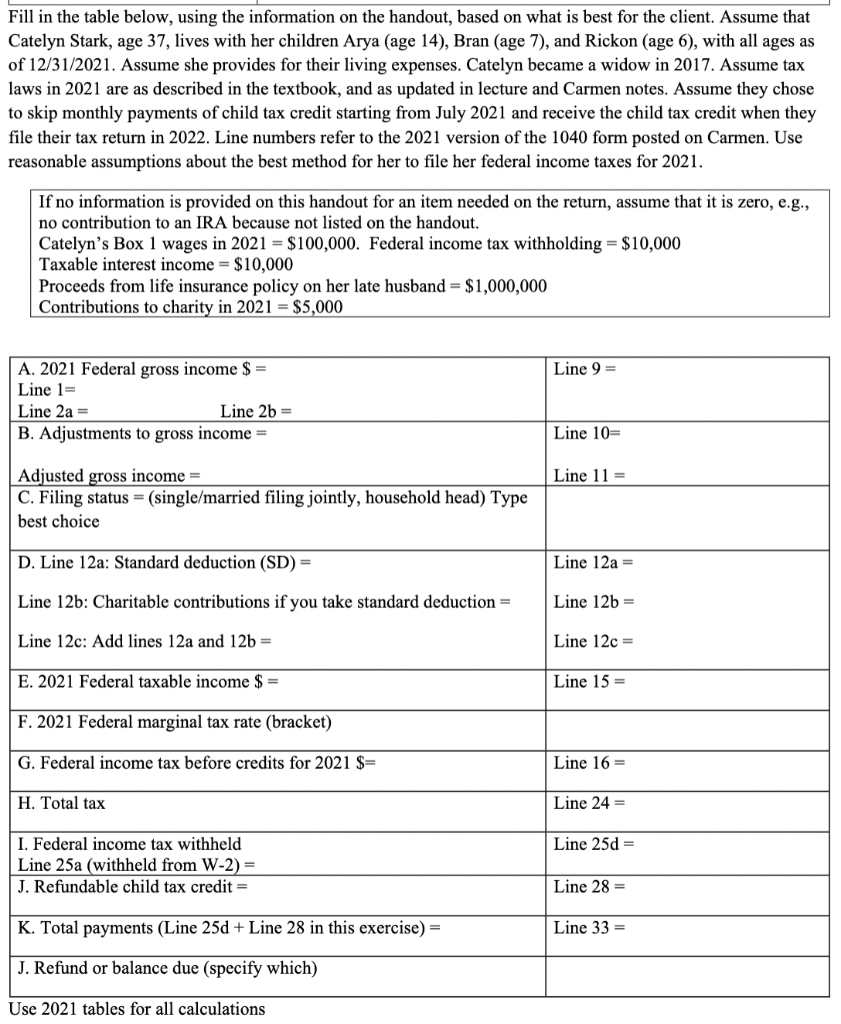

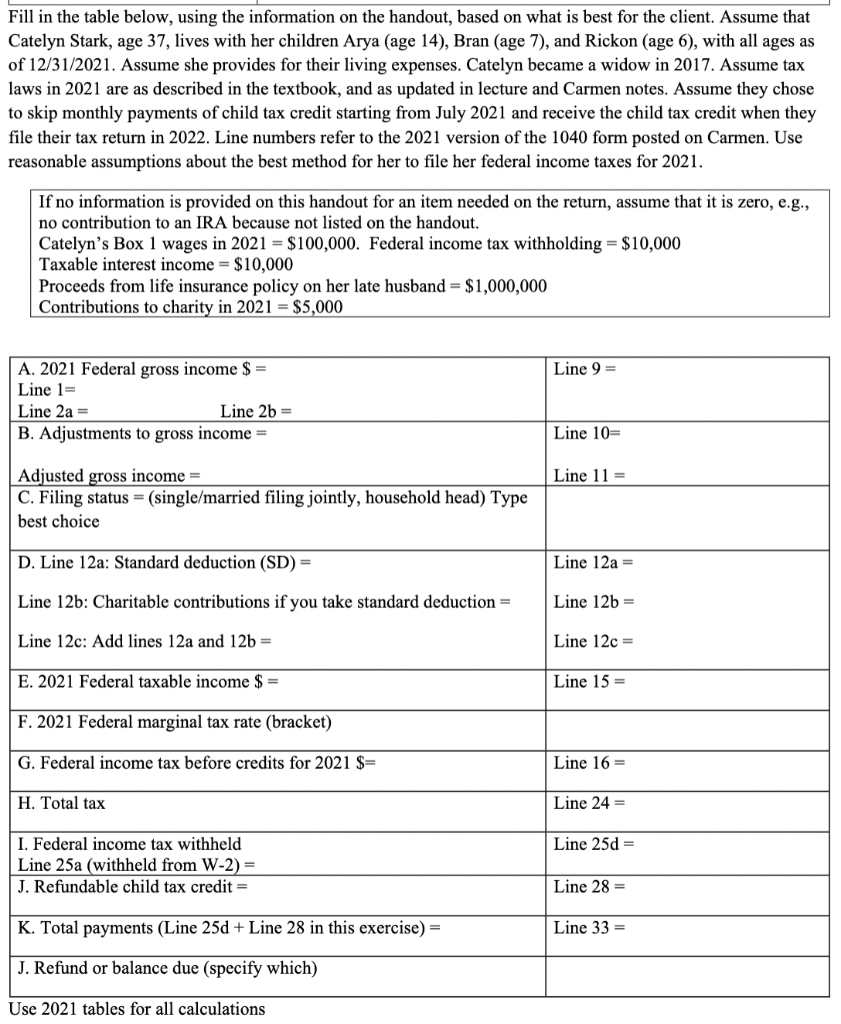

Fill in the table below, using the information on the handout, based on what is best for the client. Assume that Catelyn Stark, age 37, lives with her children Arya (age 14), Bran (age 7), and Rickon (age 6), with all ages as of 12/31/2021. Assume she provides for their living expenses. Catelyn became a widow in 2017. Assume tax laws in 2021 are as described in the textbook, and as updated in lecture and Carmen notes. Assume they chose to skip monthly payments of child tax credit starting from July 2021 and receive the child tax credit when they file their tax return in 2022. Line numbers refer to the 2021 version of the 1040 form posted on Carmen. Use reasonable assumptions about the best method for her to file her federal income taxes for 2021. If no information is provided on this handout for an item needed on the return, assume that it is zero, e.g., no contribution to an IRA because not listed on the handout. Catelyn's Box 1 wages in 2021 = $100,000. Federal income tax withholding = $10,000 Taxable interest income = $10,000 Proceeds from life insurance policy on her late husband = $1,000,000 Contributions to charity in 2021 = $5,000 Line 9= A. 2021 Federal gross income $ = Line 15 Line 2a = Line 2b = B. Adjustments to gross income = Line 10 Line 11 = Adjusted gross income = C. Filing status = (single/married filing jointly, household head) Type best choice D. Line 12a: Standard deduction (SD) = Line 12a = Line 126: Charitable contributions if you take standard deduction = Line 12b = Line 12c: Add lines 12a and 12b = Line 12c = E. 2021 Federal taxable income $ = Line 15 = F. 2021 Federal marginal tax rate (bracket) G. Federal income tax before credits for 2021 $= Line 16 = H. Total tax Line 24 = Line 25d= I. Federal income tax withheld Line 25a (withheld from W-2) = J. Refundable child tax credit = Line 28 = K. Total payments (Line 25d + Line 28 in this exercise) = Line 33 = J. Refund or balance due (specify which) Use 2021 tables for all calculations Fill in the table below, using the information on the handout, based on what is best for the client. Assume that Catelyn Stark, age 37, lives with her children Arya (age 14), Bran (age 7), and Rickon (age 6), with all ages as of 12/31/2021. Assume she provides for their living expenses. Catelyn became a widow in 2017. Assume tax laws in 2021 are as described in the textbook, and as updated in lecture and Carmen notes. Assume they chose to skip monthly payments of child tax credit starting from July 2021 and receive the child tax credit when they file their tax return in 2022. Line numbers refer to the 2021 version of the 1040 form posted on Carmen. Use reasonable assumptions about the best method for her to file her federal income taxes for 2021. If no information is provided on this handout for an item needed on the return, assume that it is zero, e.g., no contribution to an IRA because not listed on the handout. Catelyn's Box 1 wages in 2021 = $100,000. Federal income tax withholding = $10,000 Taxable interest income = $10,000 Proceeds from life insurance policy on her late husband = $1,000,000 Contributions to charity in 2021 = $5,000 Line 9= A. 2021 Federal gross income $ = Line 15 Line 2a = Line 2b = B. Adjustments to gross income = Line 10 Line 11 = Adjusted gross income = C. Filing status = (single/married filing jointly, household head) Type best choice D. Line 12a: Standard deduction (SD) = Line 12a = Line 126: Charitable contributions if you take standard deduction = Line 12b = Line 12c: Add lines 12a and 12b = Line 12c = E. 2021 Federal taxable income $ = Line 15 = F. 2021 Federal marginal tax rate (bracket) G. Federal income tax before credits for 2021 $= Line 16 = H. Total tax Line 24 = Line 25d= I. Federal income tax withheld Line 25a (withheld from W-2) = J. Refundable child tax credit = Line 28 = K. Total payments (Line 25d + Line 28 in this exercise) = Line 33 = J. Refund or balance due (specify which) Use 2021 tables for all calculations