Answered step by step

Verified Expert Solution

Question

1 Approved Answer

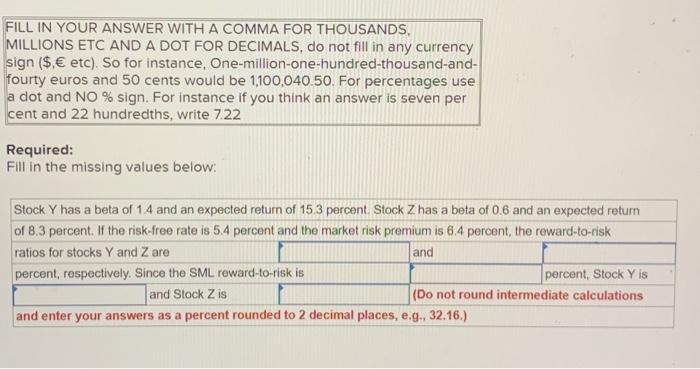

FILL IN YOUR ANSWER WITH A COMMA FOR THOUSANDS, MILLIONS ETC AND A DOT FOR DECIMALS, do not fill in any currency sign ($,

FILL IN YOUR ANSWER WITH A COMMA FOR THOUSANDS, MILLIONS ETC AND A DOT FOR DECIMALS, do not fill in any currency sign ($, etc). So for instance, One-million-one-hundred-thousand-and- fourty euros and 50 cents would be 1,100,040.50. For percentages use a dot and NO % sign. For instance if you think an answer is seven per cent and 22 hundredths, write 7.22 Required: Fill in the missing values below: Stock Y has a beta of 1.4 and an expected return of 15.3 percent. Stock Z has a beta of 0.6 and an expected return of 8.3 percent. If the risk-free rate is 5.4 percent and the market risk premium is 6.4 percent, the reward-to-risk ratios for stocks Y and Z are and percent, respectively. Since the SML reward-to-risk is and Stock Z is and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) percent, Stock Y is (Do not round intermediate calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

This problem is related to finance specifically the Capital Asset Pricing Model CAPM which is used t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started