Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fill out 1120 Tax form for the year 2019 given the data above. Schedule M-1 steps are what I am in need of assistance for.

Fill out 1120 Tax form for the year 2019 given the data above. Schedule M-1 steps are what I am in need of assistance for.

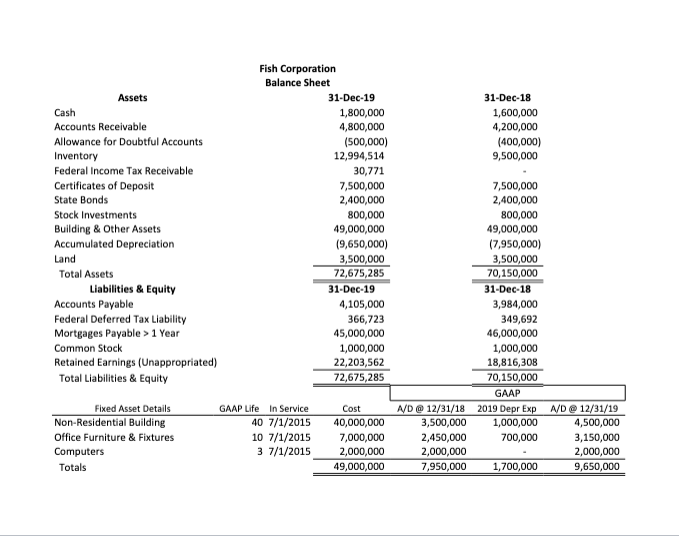

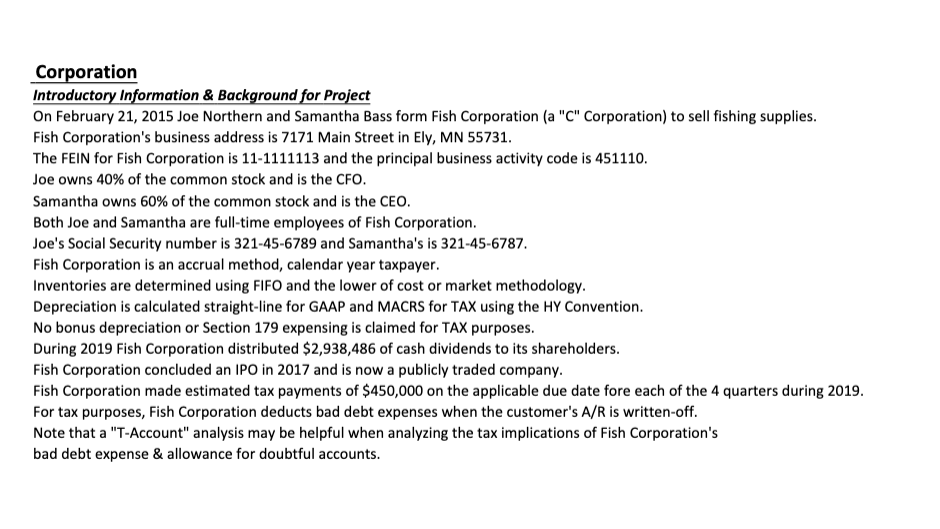

31-Dec-18 1,600,000 4,200,000 (400,000) 9,500,000 Assets Cash Accounts Receivable Allowance for Doubtful Accounts Inventory Federal Income Tax Receivable Certificates of Deposit State Bonds Stock Investments Building & Other Assets Accumulated Depreciation Land Total Assets Liabilities & Equity Accounts Payable Federal Deferred Tax Liability Mortgages Payable > 1 Year Common Stock Retained Earnings (Unappropriated) Total Liabilities & Equity Fish Corporation Balance Sheet 31-Dec-19 1,800,000 4,800,000 (500,000) 12,994,514 30,771 7,500,000 2,400,000 800,000 49,000,000 (9,650,000) 3,500,000 72,675,285 31-Dec-19 4,105,000 366,723 45,000,000 1,000,000 22,203,562 72,675,285 7,500,000 2,400,000 800,000 49,000,000 (7,950,000) 3,500,000 70,150,000 31-Dec-18 3,984,000 349,692 46,000,000 1,000,000 18,816,308 70,150,000 GAAP 2019 Depr Exp 1,000,000 700,000 A/D Fixed Asset Details Non-Residential Building Office Furniture & Fixtures Computers Totals GAAP Life in Service 40 7/1/2015 10 7/1/2015 3 7/1/2015 Cost 40,000,000 7,000,000 2,000,000 49,000,000 A/D @ 12/31/18 3,500,000 2,450,000 2,000,000 7,950,000 12/31/19 4,500,000 3,150,000 2,000,000 9,650,000 1,700,000 Corporation Introductory Information & Background for Project On February 21, 2015 Joe Northern and Samantha Bass form Fish Corporation (a "C" Corporation) to sell fishing supplies. Fish Corporation's business address is 7171 Main Street in Ely, MN 55731. The FEIN for Fish Corporation is 11-1111113 and the principal business activity code is 451110. Joe owns 40% of the common stock and is the CFO. Samantha owns 60% of the common stock and is the CEO. Both Joe and Samantha are full-time employees of Fish Corporation. Joe's Social Security number is 321-45-6789 and Samantha's is 321-45-6787. Fish Corporation is an accrual method, calendar year taxpayer. Inventories are determined using FIFO and the lower of cost or market methodology. Depreciation is calculated straight-line for GAAP and MACRS for TAX using the HY Convention. No bonus depreciation or Section 179 expensing is claimed for TAX purposes. During 2019 Fish Corporation distributed $2,938,486 of cash dividends to its shareholders. Fish Corporation concluded an IPO in 2017 and is now a publicly traded company. Fish Corporation made estimated tax payments of $450,000 on the applicable due date fore each of the 4 quarters during 2019. For tax purposes, Fish Corporation deducts bad debt expenses when the customer's A/R is written-off. Note that a "T-Account" analysis may be helpful when analyzing the tax implications of Fish Corporation's bad debt expense & allowance for doubtful accounts. 31-Dec-18 1,600,000 4,200,000 (400,000) 9,500,000 Assets Cash Accounts Receivable Allowance for Doubtful Accounts Inventory Federal Income Tax Receivable Certificates of Deposit State Bonds Stock Investments Building & Other Assets Accumulated Depreciation Land Total Assets Liabilities & Equity Accounts Payable Federal Deferred Tax Liability Mortgages Payable > 1 Year Common Stock Retained Earnings (Unappropriated) Total Liabilities & Equity Fish Corporation Balance Sheet 31-Dec-19 1,800,000 4,800,000 (500,000) 12,994,514 30,771 7,500,000 2,400,000 800,000 49,000,000 (9,650,000) 3,500,000 72,675,285 31-Dec-19 4,105,000 366,723 45,000,000 1,000,000 22,203,562 72,675,285 7,500,000 2,400,000 800,000 49,000,000 (7,950,000) 3,500,000 70,150,000 31-Dec-18 3,984,000 349,692 46,000,000 1,000,000 18,816,308 70,150,000 GAAP 2019 Depr Exp 1,000,000 700,000 A/D Fixed Asset Details Non-Residential Building Office Furniture & Fixtures Computers Totals GAAP Life in Service 40 7/1/2015 10 7/1/2015 3 7/1/2015 Cost 40,000,000 7,000,000 2,000,000 49,000,000 A/D @ 12/31/18 3,500,000 2,450,000 2,000,000 7,950,000 12/31/19 4,500,000 3,150,000 2,000,000 9,650,000 1,700,000 Corporation Introductory Information & Background for Project On February 21, 2015 Joe Northern and Samantha Bass form Fish Corporation (a "C" Corporation) to sell fishing supplies. Fish Corporation's business address is 7171 Main Street in Ely, MN 55731. The FEIN for Fish Corporation is 11-1111113 and the principal business activity code is 451110. Joe owns 40% of the common stock and is the CFO. Samantha owns 60% of the common stock and is the CEO. Both Joe and Samantha are full-time employees of Fish Corporation. Joe's Social Security number is 321-45-6789 and Samantha's is 321-45-6787. Fish Corporation is an accrual method, calendar year taxpayer. Inventories are determined using FIFO and the lower of cost or market methodology. Depreciation is calculated straight-line for GAAP and MACRS for TAX using the HY Convention. No bonus depreciation or Section 179 expensing is claimed for TAX purposes. During 2019 Fish Corporation distributed $2,938,486 of cash dividends to its shareholders. Fish Corporation concluded an IPO in 2017 and is now a publicly traded company. Fish Corporation made estimated tax payments of $450,000 on the applicable due date fore each of the 4 quarters during 2019. For tax purposes, Fish Corporation deducts bad debt expenses when the customer's A/R is written-off. Note that a "T-Account" analysis may be helpful when analyzing the tax implications of Fish Corporation's bad debt expense & allowance for doubtful accountsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started