Answered step by step

Verified Expert Solution

Question

1 Approved Answer

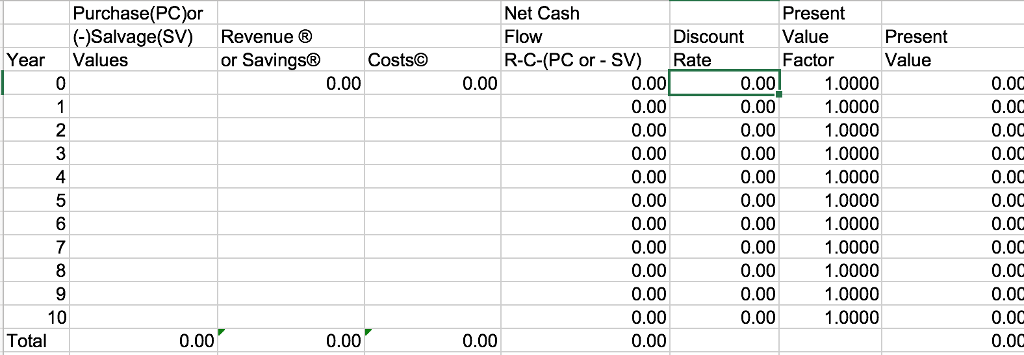

Fill out the excel, Explain how the Year 1 and 2 savings and costs were calculated, Explain why the farmer should or should not invest

Fill out the excel, Explain how the Year 1 and 2 savings and costs were calculated, Explain why the farmer should or should not invest in the facility.

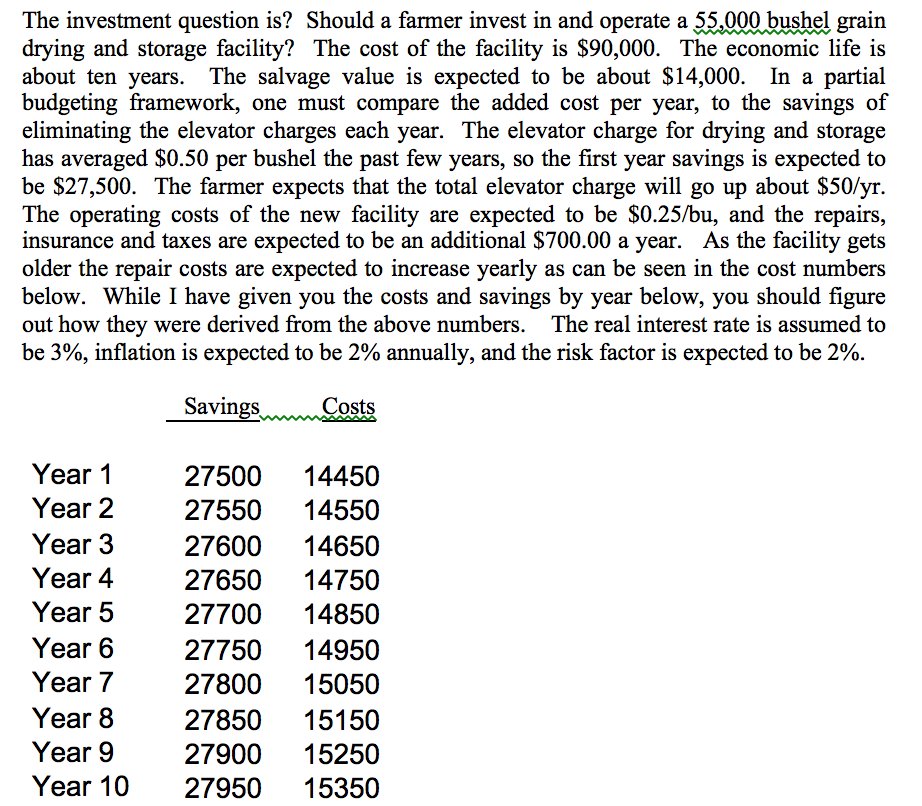

The investment question is? Should a farmer invest in and operate a 55,000 bushel grain drying and storage facility? The cost of the facility is $90,000. The economic life is about ten years. The salvage value is expected to be about $14,000. In a partial budgeting framework, one must compare the added cost per year, to the savings o eliminating the elevator charges each year. The elevator charge for drying and storage has averaged 50 per bushel the past few years, so the first year savings is expected to be $27,500. The farmer expects that the total elevator charge will go up about $50/yr The operating costs of the new facility are expected to be $0.25/bu, and the repairs, insurance and taxes are expected to be an additional $700.00 a year. As the facility gets older the repair costs are expected to increase yearly as can be seen in the cost numbers below. While I have given you the costs and savings by year below, you should figure out how they were derived from the above numbers The real interest rate is assumed to be 3%, inflation is expected to be 2% annually, and the risk factor is expected to be 2%. Savings Costs Year 1 27500 14450 Year 2 27550 14550 Year 3 27600 14650 Year 4 27650 14750 Year 5 27700 14850 Year 6 27750 14950 Year 7 27800 15050 Year 8 27850 15150 Year 9 27900 15250 Year 10 27950 15350Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started