Answered step by step

Verified Expert Solution

Question

1 Approved Answer

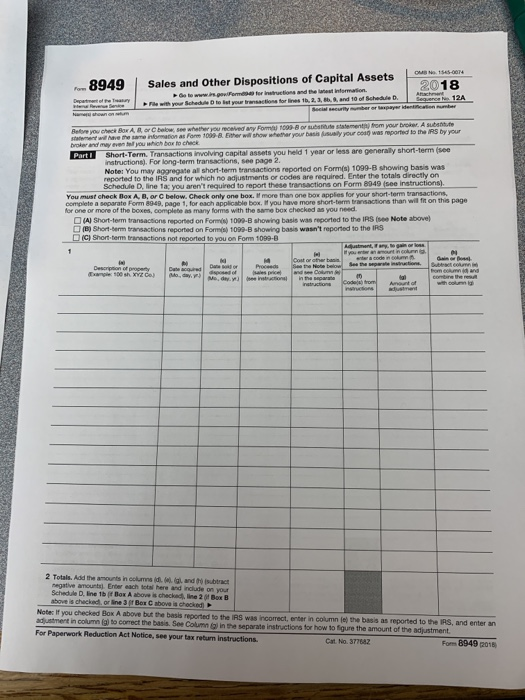

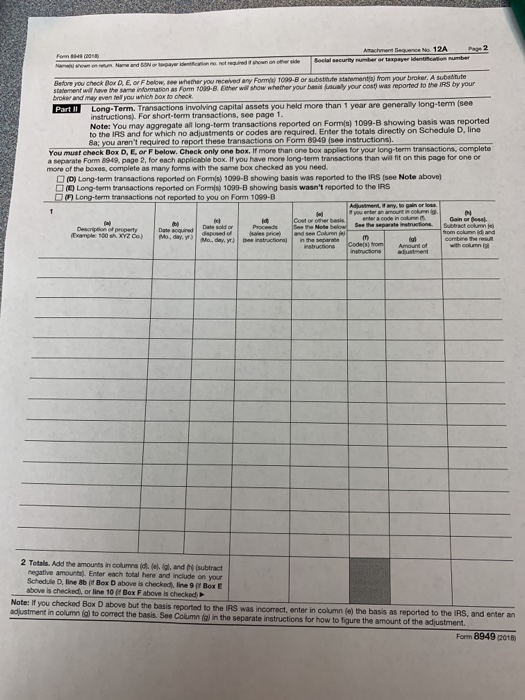

Fill out the following Form 8949 Note: This problem is for the 2018 tax year. Beth R. Jordan lives at 2322 Skyview Road, Mesa, AZ

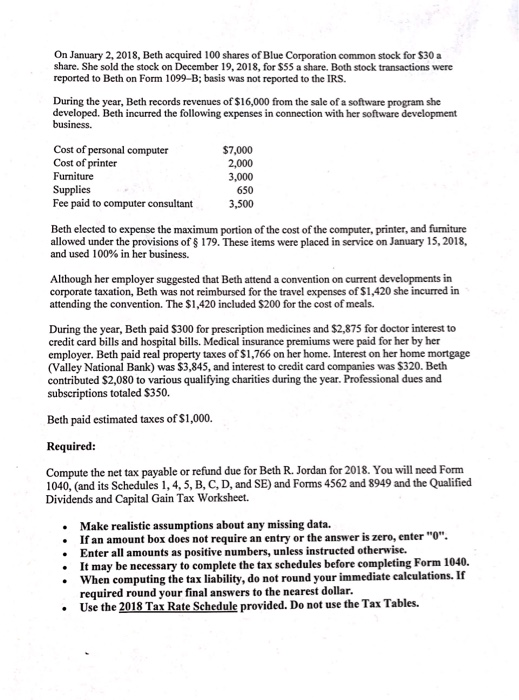

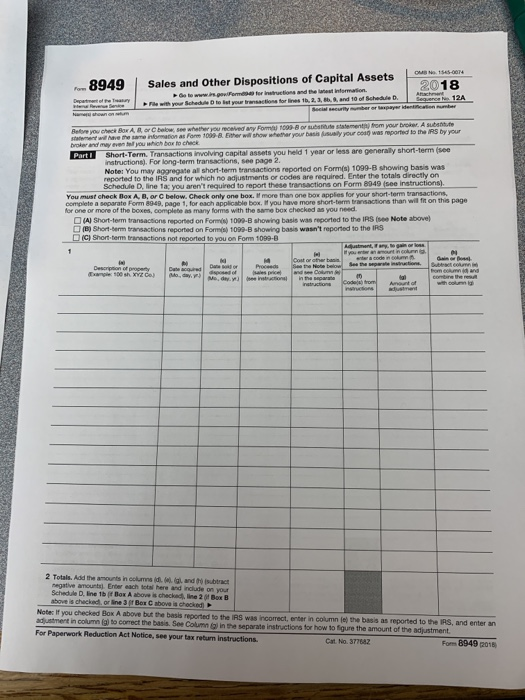

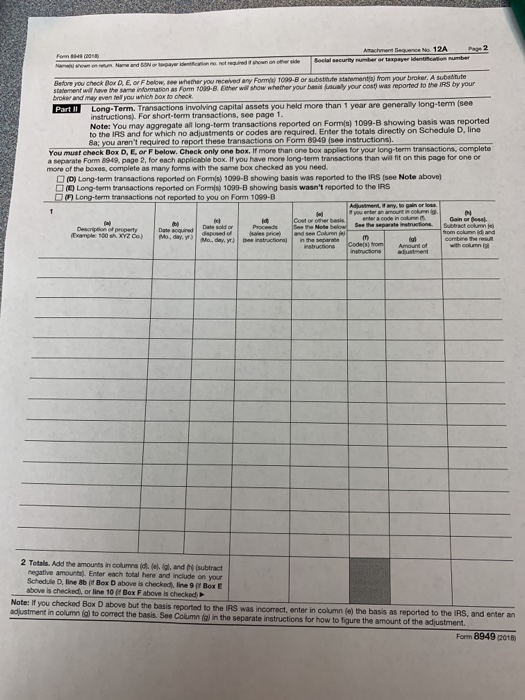

Fill out the following Form 8949

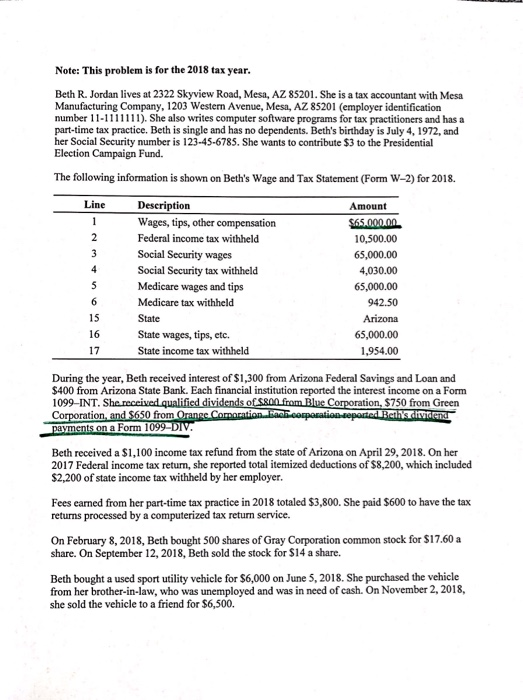

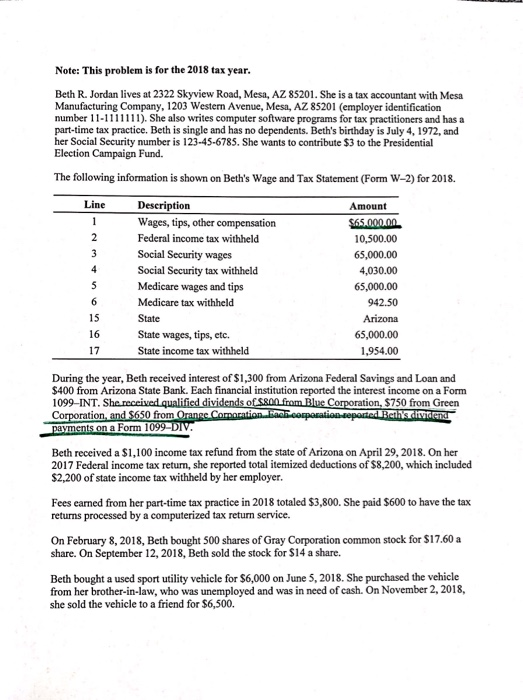

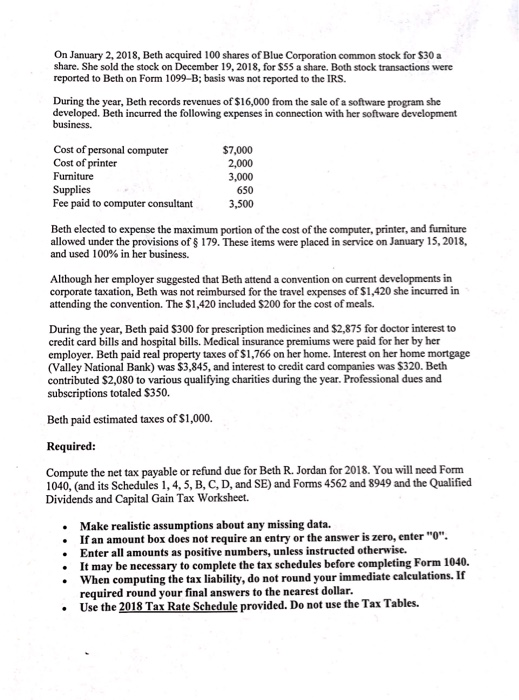

Note: This problem is for the 2018 tax year. Beth R. Jordan lives at 2322 Skyview Road, Mesa, AZ 85201. She is a tax accountant with Mesa Manufacturing Company, 1203 Western Avenue, Mesa, AZ 85201 (employer identification number 11-1111111). She also writes computer software programs for tax practitioners and has a part-time tax practice. Beth is single and has no dependents. Beth's birthday is July 4, 1972, and her Social Security number is 123-45-6785. She wants to contribute $3 to the Presidential Election Campaign Fund. The following information is shown on Beth's Wage and Tax Statement (Form W-2) for 2018. Line Description Wages, tips, other compensation Federal income tax withheld Social Security wages Social Security tax withheld Medicare wages and tips Medicare tax withheld State State wages, tips, etc. State income tax withheld Amount $65.000.00 10,500.00 65,000.00 4,030.00 65,000.00 942.50 Arizona 65,000.00 1,954.00 17 During the year, Beth received interest of $1,300 from Arizona Federal Savings and Loan and $400 from Arizona State Bank. Each financial institution reported the interest income on a Form 1099-INT. She received qualified dividends of $800.from Blue Corporation, $750 from Green Corporation, and $650 from Orange Corporation has comparation.copotted Bell payments on a Form 1099-DIV. Beth received a $1,100 income tax refund from the state of Arizona on April 29, 2018. On her 2017 Federal income tax return, she reported total itemized deductions of $8,200, which included $2,200 of state income tax withheld by her employer. Fees earned from her part-time tax practice in 2018 totaled $3,800. She paid $600 to have the tax returns processed by a computerized tax return service. On February 8, 2018, Beth bought 500 shares of Gray Corporation common stock for $17.60 a share. On September 12, 2018, Beth sold the stock for $14 a share. Beth bought a used sport utility vehicle for $6,000 on June 5, 2018. She purchased the vehicle from her brother-in-law, who was unemployed and was in need of cash. On November 2, 2018, she sold the vehicle to a friend for $6,500. On January 2, 2018, Beth acquired 100 shares of Blue Corporation common stock for $30 a share. She sold the stock on December 19, 2018, for $55 a share. Both stock transactions were reported to Beth on Form 1099-B; basis was not reported to the IRS. During the year, Beth records revenues of $16,000 from the sale of a software program she developed. Beth incurred the following expenses in connection with her software development business. Cost of personal computer Cost of printer Furniture Supplies Fee paid to computer consultant $7,000 2,000 3,000 3,500 Beth elected to expense the maximum portion of the cost of the computer, printer, and furniture allowed under the provisions of $ 179. These items were placed in service on January 15, 2018, and used 100% in her business. Although her employer suggested that Beth attend a convention on current developments in corporate taxation, Beth was not reimbursed for the travel expenses of $1,420 she incurred in attending the convention. The $1,420 included $200 for the cost of meals. During the year, Beth paid $300 for prescription medicines and $2,875 for doctor interest to credit card bills and hospital bills. Medical insurance premiums were paid for her by her employer. Beth paid real property taxes of $1,766 on her home. Interest on her home mortgage (Valley National Bank) was $3,845, and interest to credit card companies was $320. Beth contributed $2,080 to various qualifying charities during the year. Professional dues and subscriptions totaled $350. Beth paid estimated taxes of $1,000. Required: Compute the net tax payable or refund due for Beth R. Jordan for 2018. You will need Form 1040, (and its Schedules 1, 4, 5, B, C, D, and SE) and Forms 4562 and 8949 and the Qualified Dividends and Capital Gain Tax Worksheet. Make realistic assumptions about any missing data. . If an amount box does not require an entry or the answer is zero, enter"0". . Enter all amounts as positive numbers, unless instructed otherwise. It may be necessary to complete the tax schedules before completing Form 1040. When computing the tax liability, do not round your immediate calculations. If required round your final answers to the nearest dollar. Use the 2018 Tax Rate Schedule provided. Do not use the Tax Tables. -8949 Sales and Other Dispositions of Capital Assets 2018 Os to www.in.gulform for tions and the West Information fe with your Bahadure to let your transactions fornes 1. 2. 3 . 4 and 10 of Schedule D o ctor 12A yearlicata nila Before you check Box A b bwsee whether you received any Form 1090-8 subote statement from your broker. A substitute statement w ave the same as For 1009- ther will show whether your basis usually your c010 was reported to the IRS by your broker and may even for you in DOK Part 1 Short-Term. Transactions involving capital assets you held 1 year or less are generally short-term (see instructions). For long-term transactions, see page 2 Note: You may aggregate all short-term transactions reported on Forms) 1099-B showing basis was reported to the IRS and for which no adjustments or codes are required. Enter the totals directly on Schedule D line Ta you aren't required to report these transactions on Form 8949 (see instructions) You must check Box AB, or below. Check only one box. more than one box applies for your short-term transactions complete a separate Form 8049. page 1, for each applicable box. If you have more short-term tractions than wil in on this page for one or more of the boxes, complete as many forms with the same box checked as you need (A Short-term transactions reported on Form ) 1009-B showing basis was reported to the IRS Note above) B) Short-term transactions reported on Forms 1099-B showing basis wasn't reported to the IRS (C) Short term transactions not reported to you on For 1099-8 yo Contraherba Descron 100 property XYZCO) Mesh 2 Totals. Add the amount inclus d a n be negative amounts Enter each other and include on your Schedule D. line 1b Box A above is checked. line 21 Box B above is checked, or line 3 Box Cabove is checked Note: If you checked Box A above but the basis reported to the IRS was incorrect, enter in column the basis as reported to the IRS, and enter an adjustment in column to correct the basis. See Columns in the separate instructions for how to figure the amount of the adjustment For Paperwork Reduction Act Notice, see your tax return instructions Cat No. 377842 For 8949 2015 12A 2 Before you check for Fawwe water you received any Form 1090-8 or substitute amants from your brokar. A substitute w e the same informational Form 1038 her wishow whether your b l y your was reported to the IRS by your B rand may even you bow to check Par Long-Term Transactions involving capital assets you hold more than 1 year are generally long-term (see instructions For short-term transactions, see page 1. Note: You may aggregate all long-term transactions reported on Forms) 1099-B showing basis was reported to the IRS and for which no adjustments or codes are required. Enter the totals directly on Schedule D line Bas you aren't required to report these transactions on Form 8949 (en instructions You must check Box D, E, F below. Check only one bo more than one bon e for your long-term transactions, complete r e Form 1940. page 2. for each problebox you have more long-term transactions than will it on this page for one or more of the boxes, complete as many forms with the same box checked as you need. Long-term transactions reported on Forms) 1009-B showing basis was reported to the IRS Se Note above) D ) Long-term transactions reported on Forms 1000 B showing basis wasn't reported to the IRS Long-term transactions not reported to you on Form 1090-B a Datorer and see in the marw Date ) M are 100 XY ay Mode r atruction 2 Totals. Add the amounts in columns id. . . and subtract negative amount Enter each total here and include on your Schedule line ab Box D above is checklin B ox above is checked. or line 10 Bex Fabove is checked Notect you checked Box D above but the basis reported to the IRS was incorrect, enter in column the basis as reported to the IRS, and enter an adjustment in column to correct the basis. See Column in the separate instructions for how to figure the amount of the adjustment. Form 8949 2016 Note: This problem is for the 2018 tax year. Beth R. Jordan lives at 2322 Skyview Road, Mesa, AZ 85201. She is a tax accountant with Mesa Manufacturing Company, 1203 Western Avenue, Mesa, AZ 85201 (employer identification number 11-1111111). She also writes computer software programs for tax practitioners and has a part-time tax practice. Beth is single and has no dependents. Beth's birthday is July 4, 1972, and her Social Security number is 123-45-6785. She wants to contribute $3 to the Presidential Election Campaign Fund. The following information is shown on Beth's Wage and Tax Statement (Form W-2) for 2018. Line Description Wages, tips, other compensation Federal income tax withheld Social Security wages Social Security tax withheld Medicare wages and tips Medicare tax withheld State State wages, tips, etc. State income tax withheld Amount $65.000.00 10,500.00 65,000.00 4,030.00 65,000.00 942.50 Arizona 65,000.00 1,954.00 17 During the year, Beth received interest of $1,300 from Arizona Federal Savings and Loan and $400 from Arizona State Bank. Each financial institution reported the interest income on a Form 1099-INT. She received qualified dividends of $800.from Blue Corporation, $750 from Green Corporation, and $650 from Orange Corporation has comparation.copotted Bell payments on a Form 1099-DIV. Beth received a $1,100 income tax refund from the state of Arizona on April 29, 2018. On her 2017 Federal income tax return, she reported total itemized deductions of $8,200, which included $2,200 of state income tax withheld by her employer. Fees earned from her part-time tax practice in 2018 totaled $3,800. She paid $600 to have the tax returns processed by a computerized tax return service. On February 8, 2018, Beth bought 500 shares of Gray Corporation common stock for $17.60 a share. On September 12, 2018, Beth sold the stock for $14 a share. Beth bought a used sport utility vehicle for $6,000 on June 5, 2018. She purchased the vehicle from her brother-in-law, who was unemployed and was in need of cash. On November 2, 2018, she sold the vehicle to a friend for $6,500. On January 2, 2018, Beth acquired 100 shares of Blue Corporation common stock for $30 a share. She sold the stock on December 19, 2018, for $55 a share. Both stock transactions were reported to Beth on Form 1099-B; basis was not reported to the IRS. During the year, Beth records revenues of $16,000 from the sale of a software program she developed. Beth incurred the following expenses in connection with her software development business. Cost of personal computer Cost of printer Furniture Supplies Fee paid to computer consultant $7,000 2,000 3,000 3,500 Beth elected to expense the maximum portion of the cost of the computer, printer, and furniture allowed under the provisions of $ 179. These items were placed in service on January 15, 2018, and used 100% in her business. Although her employer suggested that Beth attend a convention on current developments in corporate taxation, Beth was not reimbursed for the travel expenses of $1,420 she incurred in attending the convention. The $1,420 included $200 for the cost of meals. During the year, Beth paid $300 for prescription medicines and $2,875 for doctor interest to credit card bills and hospital bills. Medical insurance premiums were paid for her by her employer. Beth paid real property taxes of $1,766 on her home. Interest on her home mortgage (Valley National Bank) was $3,845, and interest to credit card companies was $320. Beth contributed $2,080 to various qualifying charities during the year. Professional dues and subscriptions totaled $350. Beth paid estimated taxes of $1,000. Required: Compute the net tax payable or refund due for Beth R. Jordan for 2018. You will need Form 1040, (and its Schedules 1, 4, 5, B, C, D, and SE) and Forms 4562 and 8949 and the Qualified Dividends and Capital Gain Tax Worksheet. Make realistic assumptions about any missing data. . If an amount box does not require an entry or the answer is zero, enter"0". . Enter all amounts as positive numbers, unless instructed otherwise. It may be necessary to complete the tax schedules before completing Form 1040. When computing the tax liability, do not round your immediate calculations. If required round your final answers to the nearest dollar. Use the 2018 Tax Rate Schedule provided. Do not use the Tax Tables. -8949 Sales and Other Dispositions of Capital Assets 2018 Os to www.in.gulform for tions and the West Information fe with your Bahadure to let your transactions fornes 1. 2. 3 . 4 and 10 of Schedule D o ctor 12A yearlicata nila Before you check Box A b bwsee whether you received any Form 1090-8 subote statement from your broker. A substitute statement w ave the same as For 1009- ther will show whether your basis usually your c010 was reported to the IRS by your broker and may even for you in DOK Part 1 Short-Term. Transactions involving capital assets you held 1 year or less are generally short-term (see instructions). For long-term transactions, see page 2 Note: You may aggregate all short-term transactions reported on Forms) 1099-B showing basis was reported to the IRS and for which no adjustments or codes are required. Enter the totals directly on Schedule D line Ta you aren't required to report these transactions on Form 8949 (see instructions) You must check Box AB, or below. Check only one box. more than one box applies for your short-term transactions complete a separate Form 8049. page 1, for each applicable box. If you have more short-term tractions than wil in on this page for one or more of the boxes, complete as many forms with the same box checked as you need (A Short-term transactions reported on Form ) 1009-B showing basis was reported to the IRS Note above) B) Short-term transactions reported on Forms 1099-B showing basis wasn't reported to the IRS (C) Short term transactions not reported to you on For 1099-8 yo Contraherba Descron 100 property XYZCO) Mesh 2 Totals. Add the amount inclus d a n be negative amounts Enter each other and include on your Schedule D. line 1b Box A above is checked. line 21 Box B above is checked, or line 3 Box Cabove is checked Note: If you checked Box A above but the basis reported to the IRS was incorrect, enter in column the basis as reported to the IRS, and enter an adjustment in column to correct the basis. See Columns in the separate instructions for how to figure the amount of the adjustment For Paperwork Reduction Act Notice, see your tax return instructions Cat No. 377842 For 8949 2015 12A 2 Before you check for Fawwe water you received any Form 1090-8 or substitute amants from your brokar. A substitute w e the same informational Form 1038 her wishow whether your b l y your was reported to the IRS by your B rand may even you bow to check Par Long-Term Transactions involving capital assets you hold more than 1 year are generally long-term (see instructions For short-term transactions, see page 1. Note: You may aggregate all long-term transactions reported on Forms) 1099-B showing basis was reported to the IRS and for which no adjustments or codes are required. Enter the totals directly on Schedule D line Bas you aren't required to report these transactions on Form 8949 (en instructions You must check Box D, E, F below. Check only one bo more than one bon e for your long-term transactions, complete r e Form 1940. page 2. for each problebox you have more long-term transactions than will it on this page for one or more of the boxes, complete as many forms with the same box checked as you need. Long-term transactions reported on Forms) 1009-B showing basis was reported to the IRS Se Note above) D ) Long-term transactions reported on Forms 1000 B showing basis wasn't reported to the IRS Long-term transactions not reported to you on Form 1090-B a Datorer and see in the marw Date ) M are 100 XY ay Mode r atruction 2 Totals. Add the amounts in columns id. . . and subtract negative amount Enter each total here and include on your Schedule line ab Box D above is checklin B ox above is checked. or line 10 Bex Fabove is checked Notect you checked Box D above but the basis reported to the IRS was incorrect, enter in column the basis as reported to the IRS, and enter an adjustment in column to correct the basis. See Column in the separate instructions for how to figure the amount of the adjustment. Form 8949 2016

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started