Question

Fill out the rest of the table. Note that you are calculating the effective tax rates, so you need to use the following formula to

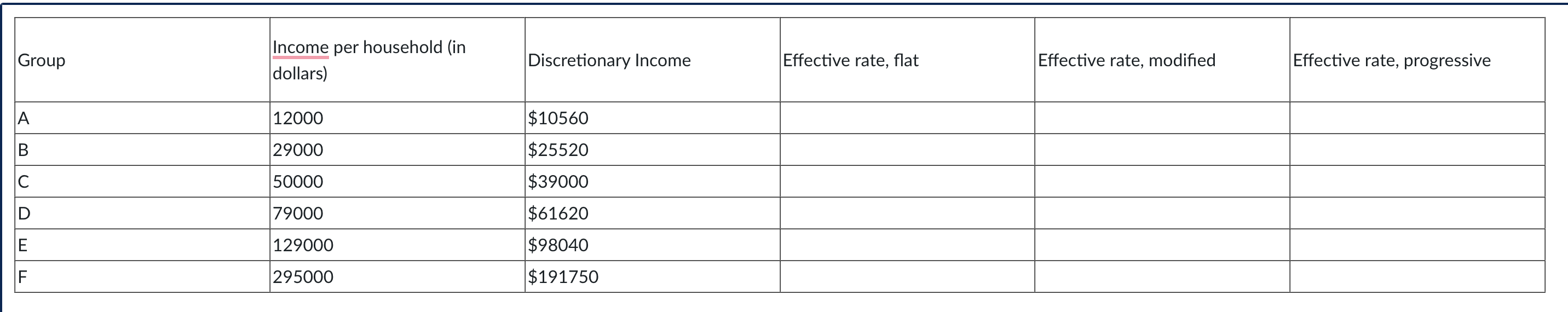

Fill out the rest of the table.

Note that you are calculating the effective tax rates, so you need to use the following formula to calculate the effective rate:

the amount the household pays in taxes in that plan discretionary income

In other words, to calculate the effective rate for each plan, make a fraction where the numerator is the amount they pay in taxes in that plan and the denominator is the discretionary income for the group. Do this out on a calculator (numerator divided by denominator). You can leave that as a decimal or convert it to a percentage by moving the decimal point two places to the right.

For example, let's say that for group E, I think the discretionary income is $59000. For the flat tax, group E pays 15157.50 in taxes. So I would do:

15157.50 59000 = .26 or 26%.

Then for the modified effective tax rate you would take the modified flat tax paid by group E and divide by 59000.

\begin{tabular}{|l|l|l|l|l|} \hline Group & Incomeperhousehold(indollars) & Discretionary Income & Effective rate, flat & Effective rate, modified \\ \hline A & 12000 & $10560 & & \\ \hline B & 29000 & $25520 & & \\ \hline C & 50000 & $39000 & & \\ \hline D & 79000 & $61620 & & \\ \hline E & 129000 & $98040 & & \\ \hline F & 295000 & $191750 & & \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started