Answered step by step

Verified Expert Solution

Question

1 Approved Answer

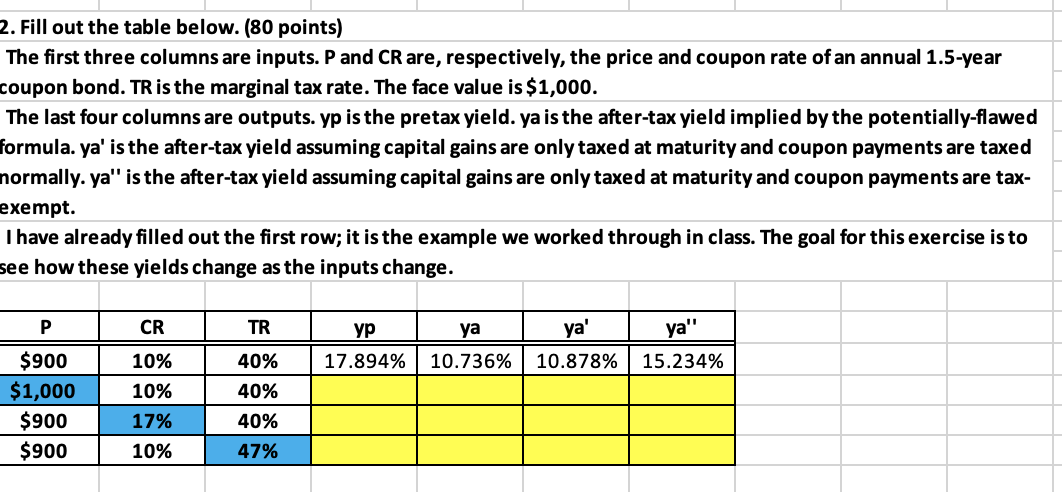

Fill out the table below. ( 8 0 points ) The first three columns are inputs. P and C R are, respectively, the price and

Fill out the table below. points

The first three columns are inputs. and are, respectively, the price and coupon rate of an annual year

coupon bond. TR is the marginal tax rate. The face value is $

The last four columns are outputs. yp is the pretax yield. ya is the aftertax yield implied by the potentiallyflawed

formula. ya is the aftertax yield assuming capital gains are only taxed at maturity and coupon payments are taxed

normally. ya is the aftertax yield assuming capital gains are only taxed at maturity and coupon payments are tax

exempt.

I have already filled out the first row; it is the example we worked through in class. The goal for this exercise is to

see how these yields change as the inputs change.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started