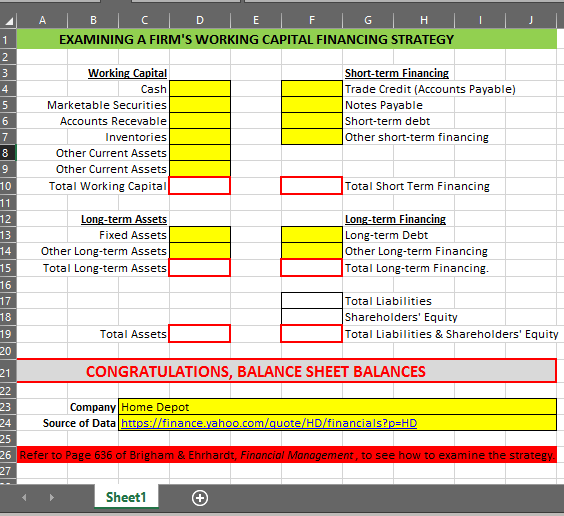

Fill out the working capital analysis for Home Depot (adequacy of amounts of working capital, cash conversion cycle, and financing strategy). Remember, working capital is

- Fill out the working capital analysis for Home Depot (adequacy of amounts of working capital, cash conversion cycle, and financing strategy). Remember, working capital is current assets and is not to be confused with net working capital, which is current assets minus current liabilities. Please don't forget to analyze the results you received using these two models.

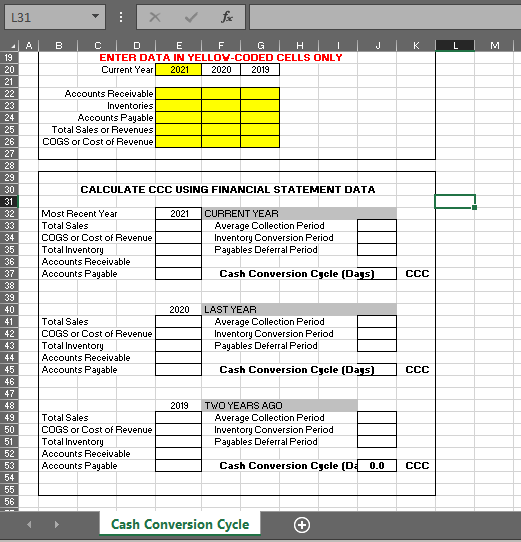

L31 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 A B C D E F G H ENTER DATA IN YELLOV-CODED CELLS ONLY Current Year 2021 2020 2019 Accounts Receivable Inventories Accounts Payable Total Sales or Revenues COGS or Cost of Revenue Most Recent Year Total Sales COGS or Cost of Revenue Total Inventory CALCULATE CCC USING FINANCIAL STATEMENT DATA Accounts Receivable Accounts Payable Total Sales COGS or Cost of Revenue Total Inventory Accounts Receivable Accounts Payable Total Sales COGS or Cost of Revenue Total Inventory Accounts Receivable Accounts Payable fxx 2021 CURRENT YEAR 2020 2019 J Average Collection Period Inventory Conversion Period Payables Deferral Period Cash Conversion Cycle (Days) LAST YEAR Average Collection Period Inventory Conversion Period Payables Deferral Period Cash Conversion Cycle (Days) TWO YEARS AGO Average Collection Period Inventory Conversion Period Payables Deferral Period Cash Conversion Cycle (Da 0.0 Cash Conversion Cycle + K CCC CCC CCC L

Step by Step Solution

There are 3 Steps involved in it

Step: 1

It seems that you have a worksheet with financial data for different years and you would like to calculate the Cash Conversion Cycle CCC using this data The Cash Conversion Cycle measures the time it ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started