Answered step by step

Verified Expert Solution

Question

1 Approved Answer

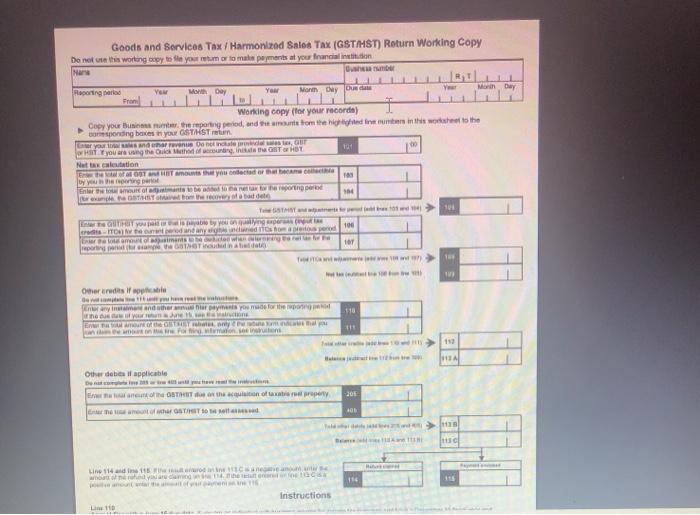

Fill out this Goods and Services Tax / Harmonized Sales Tax (GST/HST) Return Working Copy Do not use this working copy to file your retum

Fill out this

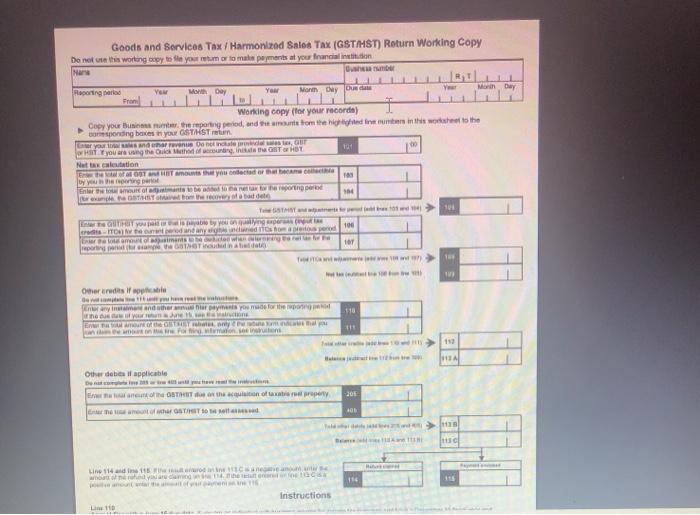

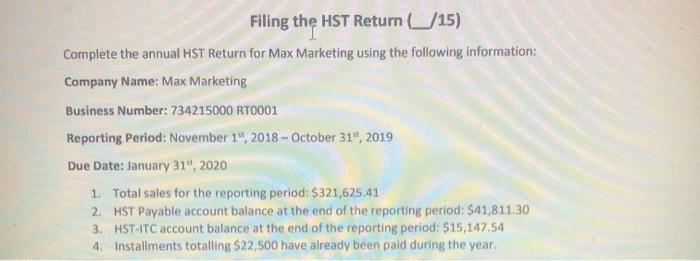

Goods and Services Tax / Harmonized Sales Tax (GST/HST) Return Working Copy Do not use this working copy to file your retum or to make payments at your financial institution Nara Raporting period From Your Month Day Enter your tor sales and char revenus Oo net incate provincial ses tas, GET or HST you are using the Quick Method of accounting, insade the GT or HBT Net tax calculation Enter the total of al GST and HET amounts that you codected or that became collectible by you in the reporting part Your Month Day Oueda Working copy (for your records) Copy your Business number, the reporting period, and the amounts from the highlighted line numbers in this worksheet to the coresponding boxes in your GST/HST return Enter the tote amount of amants to be added to the net tax example the STHST o bom the recovery of a bad dete Enter the lote amount of apsiments be reporting paned the sample the GSTNOT the reporting per Enter the GT you past or that is payable by you on quallying experes putas ITON) for sament period and any engis unclined 110s from a pretous period Line 110 dati 104 TTT des pd (105 104 100 107 Other credits if applicable en you have read the late Enter any Instament and other anmusi har payments you made for the reporting po the dus of your return June 15, auctions Enter that amount of the GTST rebates only be a meas that you and the amout on the tre For ting dermation se instruction Other debits if applicable Enver the tal ameung of the OSTHET doe on the acquisition of taxabis reel property Enter the amount of other GSTST to be sold Ta je 108 and 197) Baumber 11 Tald Line 114 and Ine 115 euro anne 113Ca negavanju, unter Be amoa oferind you are claiming in 114 the tutorial pe Ca (und the wall of your payment 115 121 Instructions 103 110 Bri 201 406 114 F j 1001 Your HU 108 TH 109 113 A 1118 113 C Manin Day 116 Filing the HST Return (15) Complete the annual HST Return for Max Marketing using the following information: Company Name: Max Marketing Business Number: 734215000 RT0001 Reporting Period: November 1 , 2018 - October 31, 2019 Due Date: January 31 , 2020 1. Total sales for the reporting period: $321,625.41 2. HST Payable account balance at the end of the reporting period: $41,811.30 3. HST-ITC account balance at the end of the reporting period: $15,147.54 4. Installments totalling $22,500 have already been paid during the year.

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer To complete the annual HST Return for Max Marketing we need to calculate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started