Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fill out using 1040 only His tax rate is $907.50 + 15% of the amount over $9,075. His tax rate is $907.50 + 15% of

Fill out using 1040 only

His tax rate is $907.50 + 15% of the amount over $9,075.

His tax rate is $907.50 + 15% of the amount over $9,075.

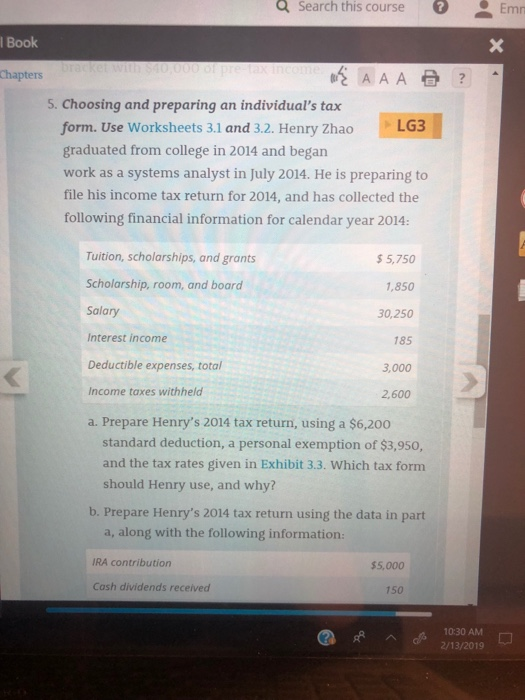

Search this course Emm l Book Chapters 5. choosing and preparing an indtividual's tax form. Use Worksheets 3.1 and 3.2. Henry Zhao graduated from college in 2014 and began work as a systems analyst in July 2014. He is preparing to file his income tax return for 2014, and has collected the following financial information for calendar year 2014 Tuition, scholarships, and grants Scholarship, room, and board Salary Interest income Deductible expenses, total Income taxes withheld a. Prepare Henry's 2014 tax return, using a $6,200 5,750 1,850 30,250 185 3,000 2,600 standard deduction, a personal exemption of $3,950, and the tax rates given in Exhibit 3.3. Which tax form should Henry use, and why? b. Prepare Henry's 2014 tax return using the data in part a, along with the following information IRA contribution $5,000 Cash dividends received 150 10:30 AM 2/13/2019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started