FILL SCHEDULE A FOR ME PLSSSS

Tax problem 2

Please complete the 2020 federal income tax return for Bob and Melissa Quinn. Ignore the requirement to attach the forms W2 to the front page of the Form 1040. If required information is missing, use reasonable assumptions to fill in the gaps.

Bob (age 43) and Melissa (age 53) Quinn are married and live in Lexington Kentucky. The Quinns have two children: Jared, age 15 and Alese, Age 12. The Quinns would like to file a joint tax return for the year.

The following information relates to the Quinns tax year:

- Bobs Social Security number is 987-45-1235. His DOB is 10/14/77

- Melissas Social Security number is 494-37-4893. Her DOB is 4/28/67

- Jareds Social Security number is 412-32-5690. His DOB is 9/22/05

- Aleses Social Security number is 412-32-6940. Her DOB is 6/11/08

- The Quinns mailing address is 95 Hickory Road, Lexington, Kentucky 40502

- Jared and Alese are tax dependents for federal tax purposes

Bob Quinns form W2 provided the following wages and withholding for the year:

| Employer | Gross Wages | Federal Income Tax Withholding | State Income Tax Withholding |

| National Storage | $65,200 | $7,700 | $3,550 |

| Lexington Little League | $4,510 | 0 | 0 |

Melissa Quinns Form W2 provided the following wages and withholding for the year:

| Employer | Gross Wages | Federal Income Tax Withholding | State Income Tax Withholding |

| Jensen Photography | $42,500 | $5,250 | $2,425 |

All applicable and appropriate payroll taxes were withheld by the Quinns respective employers. All the Quinn family was covered by minimum essential health insurance during each month in 2020. The insurance was provided by Bobs primary employer, National Storage.

The Quinns also received the following during the year:

| Interest Income from First Kentucky Bank | $200 |

| Interest Income from City of Lexington, KY Bond | $550 |

| Interest Income from US Treasury Bond | $800 |

| Interest Income from Nevada State School Board Bond | $250 |

| Workers Compensation payments to Bob | $4,350 |

| Disability payments received by Bob due to injury National Storage paid 100% of the premiums on the policy and included the premium payments in Bobs taxable wages | $3,500 |

Melissa received the following payments due to a lawsuit she filed for damages sustained in a car accident:

- Medical Expenses for Physical injuries $3,000

- Emotional Distress (from having been physically injured) $11,000

- Punitive Damages $ 9,000

Total $23,000

Eight years ago, Melissa purchased an annuity contract for $88,000. She received her first annuity payment on January 1, 2020. The annuity will pay Melissa $15,000 per year for ten years (beginning this year). The $15,000 payment was reported to Melissa on form 1099-R for the current year (box 4 contained an entry of 7 on the form).

The Quinns did not own, control or manage any foreign bank accounts nor were they grantors or beneficiaries of a foreign trust during the year.

The Quinns paid or incurred the following expenses during the year:

| Dentist/Orthodontist (unreimbursed by insurance) | $10,500 |

| Doctor Fees (unreimbursed by insurance) | $ 4,075 |

| Prescriptions (unreimbursed by insurance) | $ 980 |

| KY state tax payments made on 4/15/20 for the 2019 tax return liability | $ 1,425 |

| KY state income taxes withheld during 2020 | $ 5,975 |

| Real Property taxes on residence | $ 3,900 |

| Vehicle registration fee based upon age of vehicle | $ 1,350 |

| Mortgage interest on principle residence | $19,500 |

| Interest paid on borrowed money to purchase the City of Lexington, KY municipal bond | $ 400 |

| Interest paid on borrowed money to purchase US Treasury Bonds | $ 250 |

| Contribution to the Red Cross | $ 2,000 |

| Contribution to Senator Rick Hartleys Re-Election Campaign | $ 3,500 |

| Contribution to First Baptist Church of Kentucky | $ 6,000 |

| Fee paid to Jones & Company, CPA for tax preparation | $ 200 |

In addition, Bob drove 6,750 miles commuting to work and Melissa drove 8,230 miles commuting to work. The Quinns have represented to you that they maintained careful logs to support their respective mileage.

The Quinns drove 465 miles in total to receive medical treatment at a hospital in April.

The Quinns both wanted to contribute to the Presidential Election Campaign Fund. The Quinns would like to receive a refund (if any) of any tax they may have overpaid for the year. Their preferred method of receiving the refund is by check.

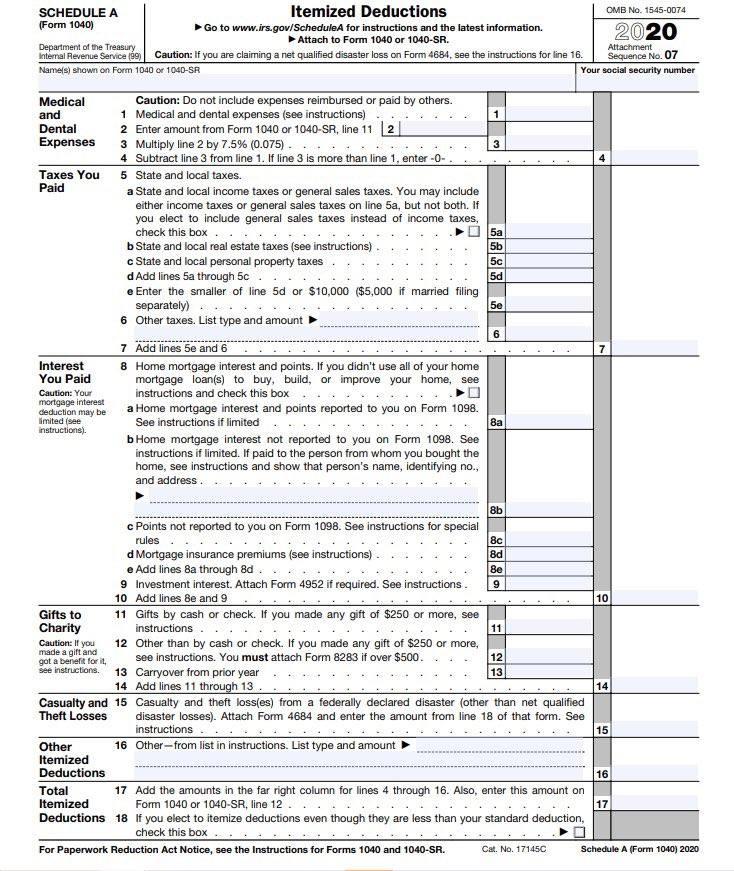

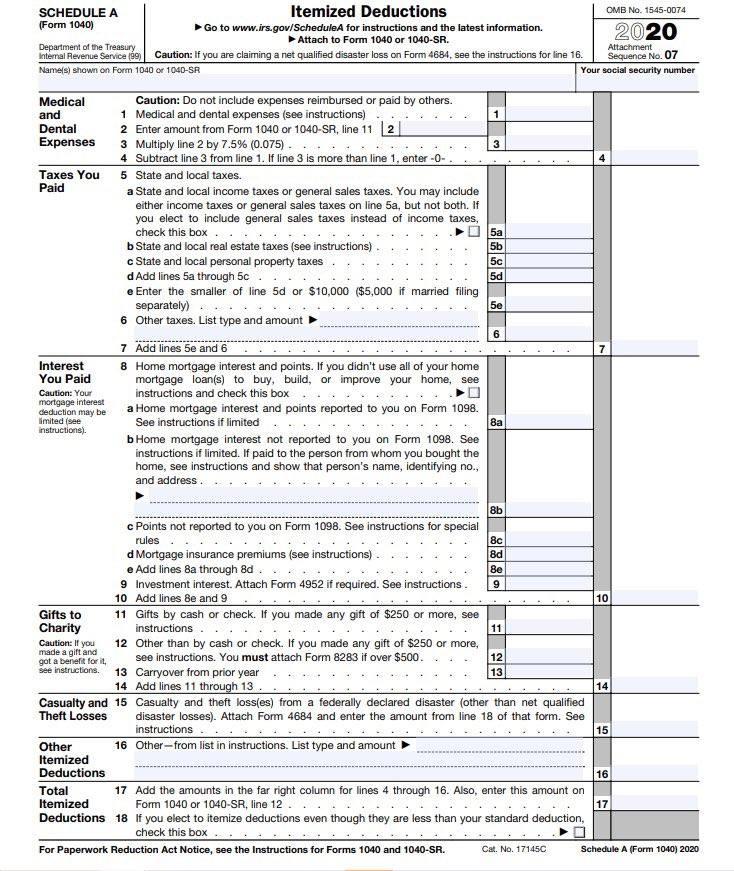

SCHEDULE A Itemized Deductions OMB No 1545-0074 (Form 1040) Go to www.irs.gov/ScheduleA for instructions and the latest information. 2020 Department of the Treasury Attach to Form 1040 or 1040-SR. Attachment Internal Revenue Service (80) Caution: If you are claiming a net qualified disaster loss on Form 4684, see the instructions for line 16 Sequence No. 07 Names) shown on Form 1040 or 1040-SR Your social security number 5a 5b 5c 5d Medical Caution: Do not include expenses reimbursed or paid by others. and 1 Medical and dental expenses (see instructions) Dental 2 Enter amount from Form 1040 or 1040-SR, line 11 |2| Expenses 3 Multiply line 2 by 7.5% (0.075) 4 Subtract line 3 from line 1. If line 3 is more than line 1, enter-O- Taxes You 5 State and local taxes. Paid a State and local income taxes or general sales taxes. You may include either income taxes or general sales taxes on line 5a, but not both. If you elect to include general sales taxes instead of income taxes, check this box b State and local real estate taxes (see instructions) c State and local personal property taxes d Add lines 5a through 5c e Enter the smaller of line 5d or $10,000 ($5,000 if married filing separately) 6 Other taxes. List type and amount 7 Add lines 5e and 6 Interest 8 Home mortgage interest and points. If you didn't use all of your home You Paid mortgage loan(s) to buy, build, or improve your home, see instructions and check this box mortgage interest a Home mortgage interest and points reported to you on Form 1098. See instructions if limited instructions) b Home mortgage interest not reported to you on Form 1098. See instructions if limited. If paid to the person from whom you bought the home, see instructions and show that person's name, identifying no., and address 5e 6 7 Caution: Your deduction may be limited (see 8 8b 8d 8e 10 Caution: If you 12 13 Points not reported to you on Form 1098. See instructions for special rules 8c d Mortgage insurance premiums (see instructions) e Add lines 8a through 8d. 9 Investment interest. Attach Form 4952 if required. See instructions. 9 10 Add lines 8e and 9 Gifts to 11 Gifts by cash or check. If you made any gift of $250 or more, see Charity instructions 11 12 Other than by cash or check you made any gift of $250 or more, made a gift and got a benefit for it. see instructions. You must attach Form 8283 if over $500. see instructions. 13 Carryover from prior year 14 Add lines 11 through 13 . Casualty and 15 Casualty and theft loss(es) from a federally declared disaster (other than net qualified Theft Losses disaster losses). Attach Form 4684 and enter the amount from line 18 of that form. See instructions 15 Other 16 Other from list in instructions. List type and amount Itemized Deductions Total 17 Add the amounts in the far right column for lines 4 through 16. Also, enter this amount on Itemized Form 1040 or 1040-SR, line 12 Deductions 18 If you elect to itemize deductions even though they are less than your standard deduction, check this box For Paperwork Reduction Act Notice, see the Instructions for Forms 1040 and 1040-SR. Cat. No. 171450 Schedule A (Form 1040) 2020 14 16 17 SCHEDULE A Itemized Deductions OMB No 1545-0074 (Form 1040) Go to www.irs.gov/ScheduleA for instructions and the latest information. 2020 Department of the Treasury Attach to Form 1040 or 1040-SR. Attachment Internal Revenue Service (80) Caution: If you are claiming a net qualified disaster loss on Form 4684, see the instructions for line 16 Sequence No. 07 Names) shown on Form 1040 or 1040-SR Your social security number 5a 5b 5c 5d Medical Caution: Do not include expenses reimbursed or paid by others. and 1 Medical and dental expenses (see instructions) Dental 2 Enter amount from Form 1040 or 1040-SR, line 11 |2| Expenses 3 Multiply line 2 by 7.5% (0.075) 4 Subtract line 3 from line 1. If line 3 is more than line 1, enter-O- Taxes You 5 State and local taxes. Paid a State and local income taxes or general sales taxes. You may include either income taxes or general sales taxes on line 5a, but not both. If you elect to include general sales taxes instead of income taxes, check this box b State and local real estate taxes (see instructions) c State and local personal property taxes d Add lines 5a through 5c e Enter the smaller of line 5d or $10,000 ($5,000 if married filing separately) 6 Other taxes. List type and amount 7 Add lines 5e and 6 Interest 8 Home mortgage interest and points. If you didn't use all of your home You Paid mortgage loan(s) to buy, build, or improve your home, see instructions and check this box mortgage interest a Home mortgage interest and points reported to you on Form 1098. See instructions if limited instructions) b Home mortgage interest not reported to you on Form 1098. See instructions if limited. If paid to the person from whom you bought the home, see instructions and show that person's name, identifying no., and address 5e 6 7 Caution: Your deduction may be limited (see 8 8b 8d 8e 10 Caution: If you 12 13 Points not reported to you on Form 1098. See instructions for special rules 8c d Mortgage insurance premiums (see instructions) e Add lines 8a through 8d. 9 Investment interest. Attach Form 4952 if required. See instructions. 9 10 Add lines 8e and 9 Gifts to 11 Gifts by cash or check. If you made any gift of $250 or more, see Charity instructions 11 12 Other than by cash or check you made any gift of $250 or more, made a gift and got a benefit for it. see instructions. You must attach Form 8283 if over $500. see instructions. 13 Carryover from prior year 14 Add lines 11 through 13 . Casualty and 15 Casualty and theft loss(es) from a federally declared disaster (other than net qualified Theft Losses disaster losses). Attach Form 4684 and enter the amount from line 18 of that form. See instructions 15 Other 16 Other from list in instructions. List type and amount Itemized Deductions Total 17 Add the amounts in the far right column for lines 4 through 16. Also, enter this amount on Itemized Form 1040 or 1040-SR, line 12 Deductions 18 If you elect to itemize deductions even though they are less than your standard deduction, check this box For Paperwork Reduction Act Notice, see the Instructions for Forms 1040 and 1040-SR. Cat. No. 171450 Schedule A (Form 1040) 2020 14 16 17