Fill the blanks

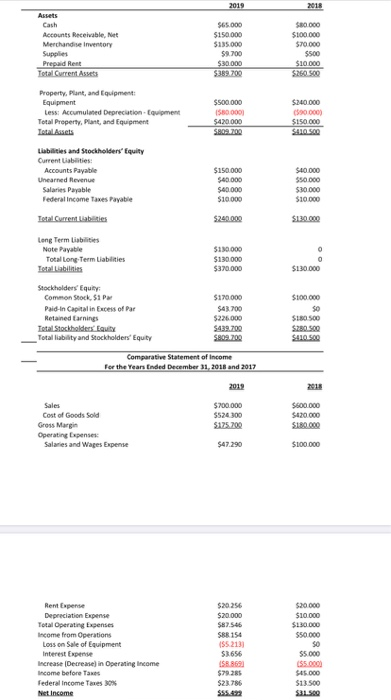

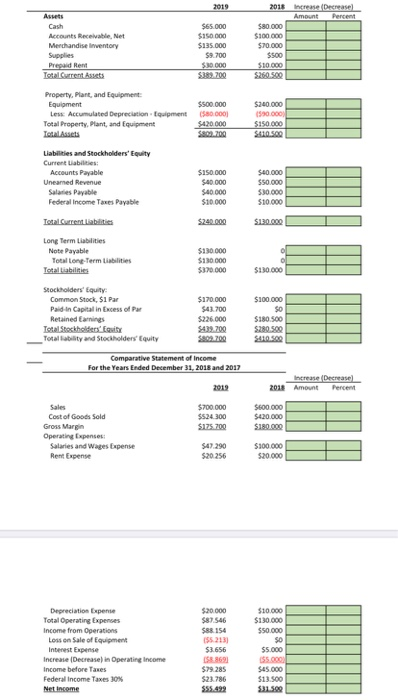

Information: (Assets, Liabilities and Stockholder's Equity, and Comparative Statement Income) year 2018 and 2019

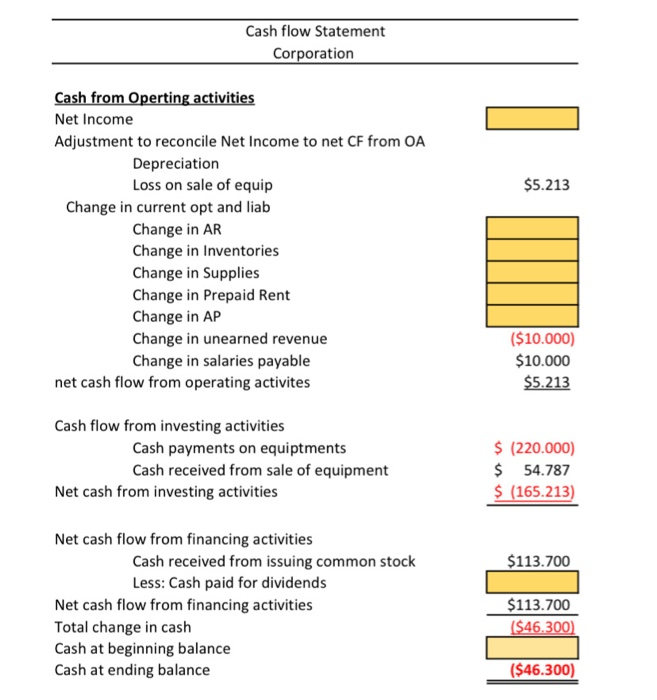

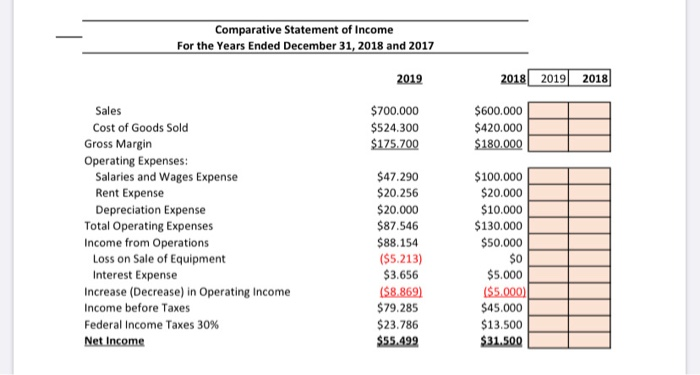

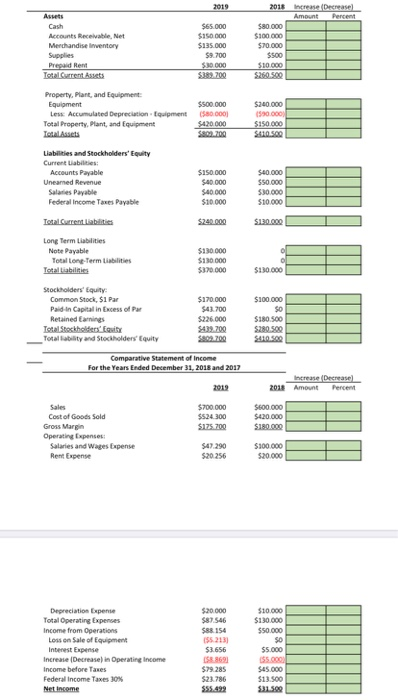

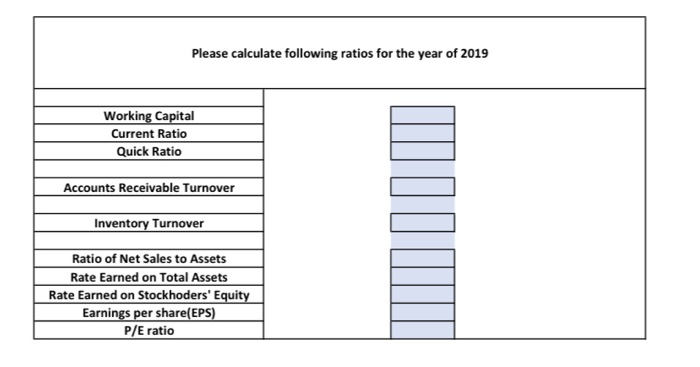

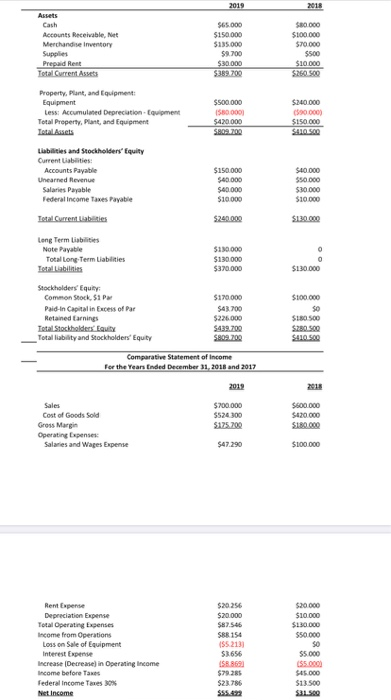

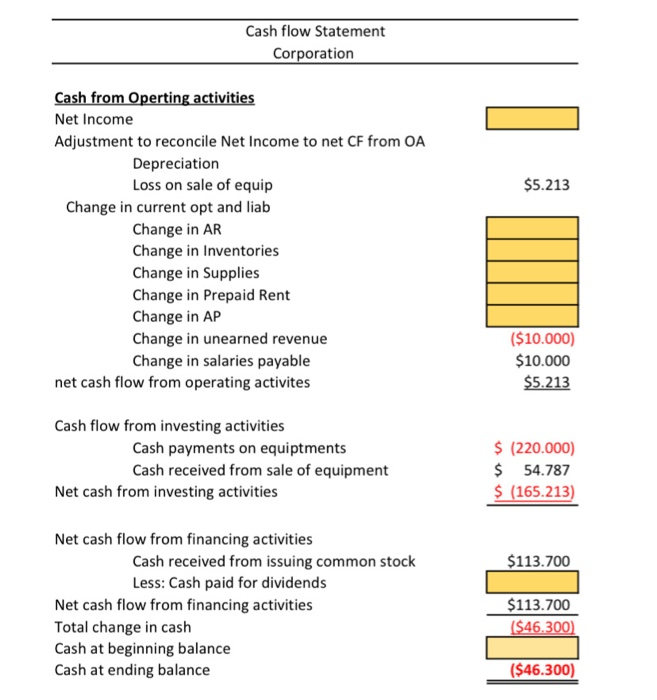

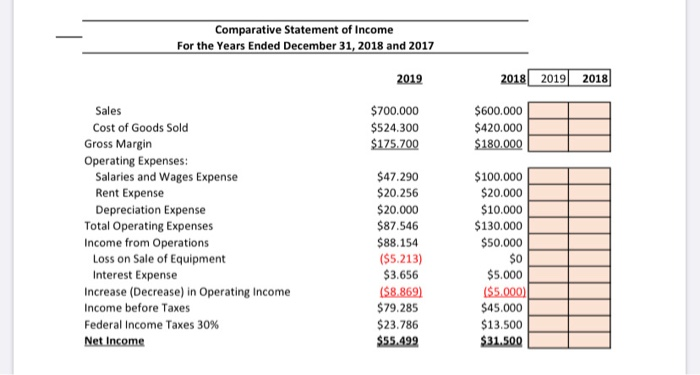

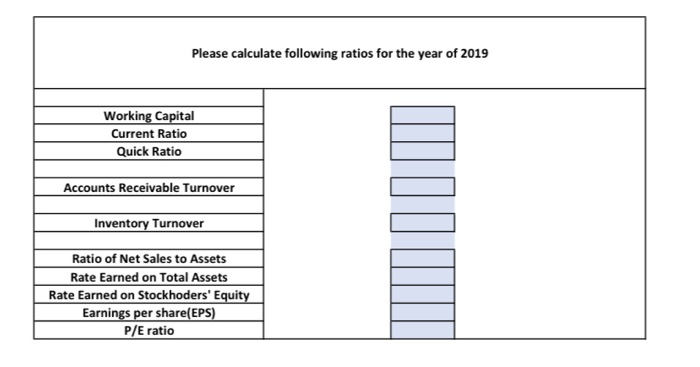

2019 2018 Assets Cash Accounts Receivable, et Merchandise Inventory Supplies Prepaid Rent Total Current Assets $65.000 $150.000 $135.000 59.700 $30.000 $389.700 $100.000 $70.000 $500 $10 000 $260.500 $500.000 1580.000 $420.000 SROD.709 $240.000 (590.000) $150 000 SAIOSCO Property. Plant, and Equipment: Equipment Less: Accumulated Depreciation Equipment Total Property, Plant, and Equipment Total Assets Liabilities and Stockholders' Equity Current Liabilities: Accounts Payable Unearned Revenue Salaries Payable Federal Income Taxes Payable Total Current liabilities $150.000 $40.000 $40.000 $10.000 $40.000 550.000 $30.000 $10.000 $240.000 $130.000 Long Term Liabilities Note Payable Total Long-Term Liabilities Total abilities $110.000 $130.000 $370.000 0 0 $130.000 Stockholders' Equity Common Stock 51 PM $170.000 Paid in Capital in Excess of Par $43.700 Retained Earnings $226.000 Total Stockholders Equity $439.700 Total liability and Stockholders' Equity $800.202 Comparative Statement of Income For the Year Ended December 31, 2018 and 2017 $100.000 $0 $180.500 $280.500 $410.50 2019 Sales Cost of Goods Sold Gross Margin Operating Expenses Salaries and Wages Expense $700.000 $524 300 $175.700 $500.000 S420.000 S180.000 $47.290 $100.000 Rent Expense Depreciation Expense Total Operating Expenses Income from Operations Loss on Sale of Equipment Interest Expense Increase Decrease in Operating income Income before Taxes Federal Income Taxes 30% Net Income $20.256 $20.000 $87.546 S88154 155.213 $3656 158.8691 $79.285 $23786 $20.000 $10.000 $130.000 550.000 50 55.000 155.000 $45.000 $13.500 Cash flow Statement Corporation $5.213 Cash from Operting activities Net Income Adjustment to reconcile Net Income to net CF from OA Depreciation Loss on sale of equip Change in current opt and liab Change in AR Change in Inventories Change in Supplies Change in Prepaid Rent Change in AP Change in unearned revenue Change in salaries payable net cash flow from operating activites ($10.000) $10.000 $5.213 Cash flow from investing activities Cash payments on equipments Cash received from sale of equipment Net cash from investing activities $ (220.000) $ 54.787 $ (165.213) $113.700 Net cash flow from financing activities Cash received from issuing common stock Less: Cash paid for dividends Net cash flow from financing activities Total change in cash Cash at beginning balance Cash at ending balance $113.700 ($46.300) ($46.300) Comparative Statement of Income For the Years Ended December 31, 2018 and 2017 2019 2018 2019 2018) $700.000 $524.300 $175.700 Sales Cost of Goods Sold Gross Margin Operating Expenses: Salaries and Wages Expense Rent Expense Depreciation Expense Total Operating Expenses Income from Operations Loss on Sale of Equipment Interest Expense Increase (Decrease) in Operating Income Income before Taxes Federal Income Taxes 30% Net Income $47.290 $20.256 $20.000 $87.546 $88.154 ($5.213) $3.656 ($8.869) $79.285 $23.786 $55.499 $600.000 $420.000 $180.000 $100.000 $20.000 $10.000 $130.000 $50.000 $0 $5.000 ($5.000) $45.000 $13.500 $31.500 2019 2018 Increase Decrease Amount Percent Assets Cash Accounts Receivable, Net Merchandise ventory Supplies Prepaid Rent Total Current Assets $65.000 $150 000 $135.000 $9.700 $30.000 $389.700 $80.000 $100.000 $70,000 $500 $10.000 $260.500 $240.000 150.000 $150.000 $410.500 Property, Plant, and Equipment: Equipment $500.000 Less Accumulated Depreciation Equipment ($80.000 Total Property, Plant, and Equipment $420.000 Total Assets $800.00 Liabilities and Stockholders' Equity Current Liabilities Accounts Payable $150.000 Uneamed Revenue $40.000 Salaries Payable $40.000 Federal Income Taxes Payable $10.000 $40.000 S50.000 $30.000 $10.000 $240.000 $130.000 Long Term Liabilities Note Payable Total Long-Term Liabilities Total Liabilities $130.000 $130 000 $370.000 $130.000 Stockholders' Equity Common Stock $1 Par $170.000 Paid in Capital in Excess of Par $43.700 Retained Earnings 226.000 Total Stockholders' City S439.200 Total liability and Stockholders Equity SA03.200 Comparative Statement of Income For the Years Ended December 31, 2018 and 2017 $100.000 SO S180.500 $280.500 $410.500 Increase Decrease 2018 Amount Percent $700.000 $524.300 $175.200 $600.000 $420,000 $180.000 Sales Cost of Goods Sold Gross Margin Operating Expenses Salaries and Wages Expense Rent Expense $47.290 $20.256 $100.000 520.000 Depreciation Expense Total Operating Expenses Income from Operations Loss on Sale of Equipment Interest Expense Increase (Decrease) in Operating Income Income before Taxes Federal Income Taxes 30% Net Income $20.000 $87546 $88.154 155.2131 $3.656 $10.000 $130.000 $50.000 50 55.000 55.000 $45.000 $13.500 31.5.09 $79 285 $23.786 $55.499 Please calculate following ratios for the year of 2019 Working Capital Current Ratio Quick Ratio Accounts Receivable Turnover Inventory Turnover Ratio of Net Sales to Assets Rate Earned on Total Assets Rate Earned on Stockhoders' Equity Earnings per share(EPS) P/E ratio