Question

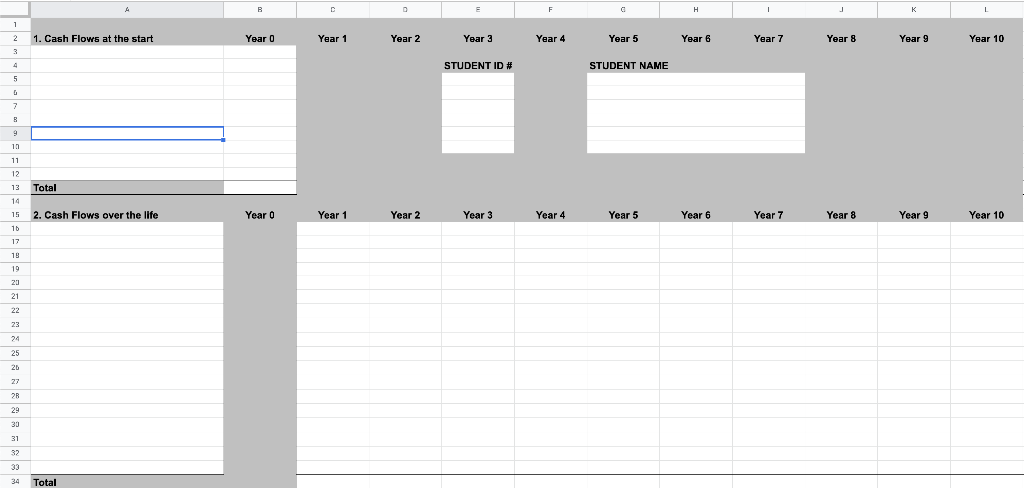

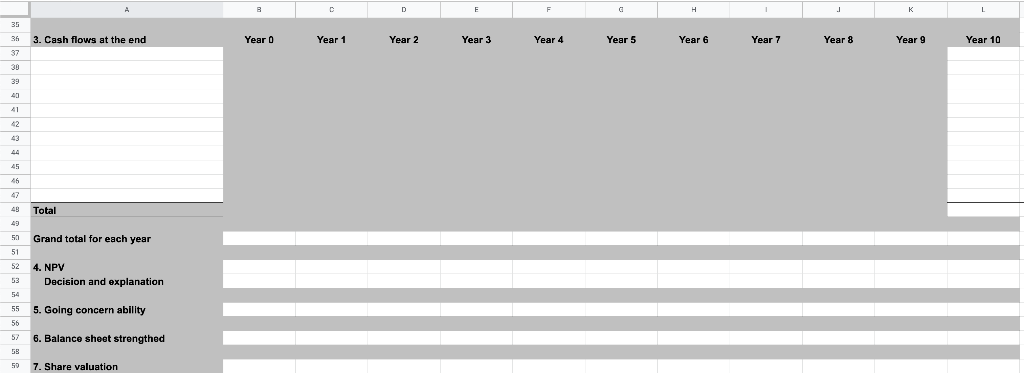

Fill the excel sheet below followed by question 1-17 Questions 1. Orbital Corporation Limited (hereafter known as Orbital) ordinary shares are listed on the Australian

Fill the excel sheet below followed by question 1-17

Questions

1. Orbital Corporation Limited (hereafter known as Orbital) ordinary shares are listed on the Australian Securities Exchange (ASX). Orbitals ASX announcement on 19 December 2022 (Announcement) updated the market on its development opportunities. Orbital plans to build on the business opportunities in the Unmanned Aerial Vehicle (UAV) market by constructing a second manufacturing facility in Balcatta, Western Australia. Orbital has already incurred $60,000 of costs for preliminary engineering designs of the proposed new factory. Furthermore, the capital expenditure associated with the construction of the new factory, the purchase of the necessary machinery, and the annual operating expenses are all significant amounts of money. Therefore, before Orbital commits to building the new factory a financial analysis is needed to determine if it will contribute to the goal of creating wealth for its shareholders.

2. The capital cost of the factory is expected to be $900,000. The new factory requires the purchase and installation of plant and equipment at a cost of $240,000. Orbital has $780,000 cash and it plans to use $300,000 of this amount to pay for the factory which will reduce its capital cost to just $600,000. Orbital must engage an external patent lawyer at a cost of $35,000 to protect its intellectual property relating to the innovative technology that will be used in the new factory.

3. Orbital plans to construct the new factory in the year 2023 and for capital budgeting purposes the first year of cash flow will be in 2024. Cash sales in 2024 are anticipated to be $860,000 and management forecasts that a sales growth rate of 3% p.a. for each of the next ten years is achievable due to increased demand from its customers. The Announcement states that Orbital is forecasting revenue for FY23 of a minimum of $20 million.

4. Annual variable cash costs at the new factory are expected to be 45% of each years cash sales. Annual fixed operating costs are forecast to be $126,000. Orbitals depreciation expense for 2022 was $85,562.

5. Although Orbitals head office incurs annual costs of $332,000 regardless of the size of the business, for cost accounting purposes they allocate overheads across each business unit. It is therefore proposed that if the new Balcatta factory goes ahead it will be allocated $53,000 of head office costs.

6. Starting in 2024, employees at the new Balcatta factory will receive annual training at a cost of $75,000. Training is not classified as a part of annual operating costs.

7. Orbital will borrow $800,000 today to partly fund the new factory. The ten-year interest-only loan has annual interest repayments of $32,000 (assuming a 4% p.a. rate). Orbitals accountant confirms that interest payments are classified as a business expense and are therefore tax deductible.

8. Orbital will perform the financial analysis of the Balcatta factory over a ten-year period. The Australian Taxation Office (ATO) confirms that for tax purposes the Balcatta factory has a twenty-year life, the plant and equipment have a six-year tax life, and that business expenses are tax deductible in the same year that the expense is incurred. In Orbitals experience, plant and equipment can be operated effectively for ten years before requiring replacement. Orbitals management accountant depreciates all assets over an operational five-year life.

9. According to the Announcement, throughout 2022 Orbital has been exploring a relationship with its customers to better understand their requirements. Expenses already incurred in this process amount to $85,000. There is debate amongst management about

whether this tax-deductible expense should be included in the financial analysis of the new Balcatta factory as a cash outflow in the year 2023 to ensure it is not wasted.

10. Orbitals total marketing expense for 2023 and 2024 is already budgeted at $180,000. To promote the new factorys UAVs, Orbital will approve a further $35,000 of marketing in 2023 only. Because this increased marketing expense will reduce Orbitals net profit in 2023, managers have suggested that the companys entire $215,000 advertising expense for 2023 be expensed over the new factorys ten-year useful life.

11. The repairs and maintenance expense associated with the existing factory are budgeted at $400,000 for each of the next five years, increasing to $500,000 for the following five years. If the new Balcatta factory is built, then an $86,000 expense (over the life)will be incurred in five years time for repairs and maintenance of the building and equipment.

12. The new Balcatta factory will be located close to major transportation hubs allowing substantial efficiency benefits in transportation costs. Orbital expects these benefits will translate into increased freight costs across the entire organisation of $66,000 each year compared to $144,000 if the new factory were built in any other location.

13. Orbital implemented a private placement in 2022 to raise $5 million. These funds were used to support a number of new development programs, in addition to other, more pressing, reasons.

14. Orbital assumes that the Balcatta building can be sold for $300,000 in the year 2033. At any point in time the resale value of the plant and equipment is $26,000 representing its scrap value only. Orbital assumes that it will have cash holdings of $1.4 million ten years from today. You note the ATO regulation that all non-current assets be depreciated to zero.

15. The CEOs annual salary in 2023 was $390,000 and is not expected to change whether the new Balcatta factory is approved by the Board of Directors or not.

16. If the Board approve the new factory Orbital anticipates that it will require an additional $95,000 of inventory today compared with the existing amount of $75,000. Accounts payable is expected to remain at $170,000. The accounts receivable balance will increase from the current level of $215,000 to $335,000 if the Balcatta factory proceeds.

17. Orbital has a required rate of return of 9%. Assume the company tax rate will remain at 30%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started