Answered step by step

Verified Expert Solution

Question

1 Approved Answer

fill the letters Companies X and Y have been offered the following borrowing rates per annum on a $5 million 10-year loan Company X seeks

fill the letters

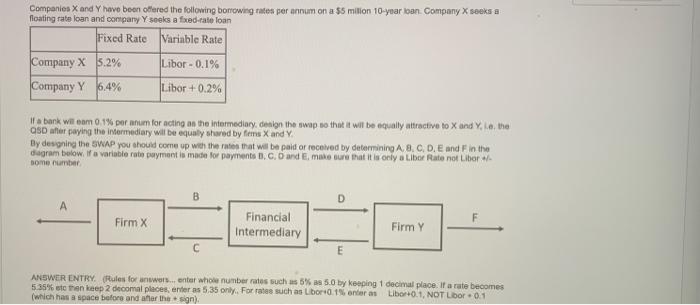

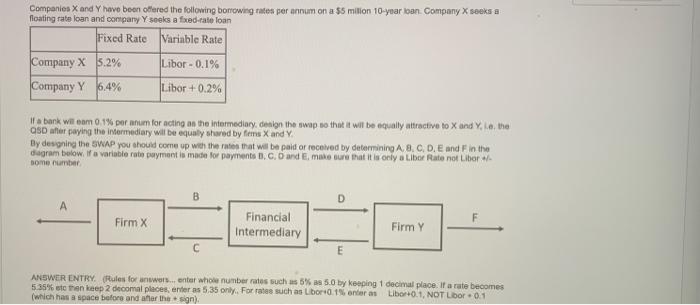

Companies X and Y have been offered the following borrowing rates per annum on a $5 million 10-year loan Company X seeks a floating rate loan and company Y seeks a fixed-rate loan Fixed Rate Variable Rate Company X 5.2% Company Y 6.4% Libor-0.1% If a bank will eam 0.1% per anum for acting as the intermediary, design the swap so that it will be equally attractive to X and Y, L.e. the QSD after paying the intermediary will be equally shared by firms X and Y. A Libor +0.2% By designing the SWAP you should come up with the rates that will be paid or received by determining A, B, C, D, E and F in the diagram below. If a variable rate payment is made for payments B. C. O and E, make sure that it is only a Libor Rate not Libor +/- some number Firm X B C Financial Intermediary E ANSWER ENTRY (Rules for answers... enter whole number rates such as 5% as 5.0 by keeping 1 5.35% etc then keep 2 decomal places, enter as 5.35 only, For rates such as Libor+0.1% enter as (which has a space before and after the sign). Firm Y F decimal place. If a rate becomes Libor+0.1, NOT Libor 0.1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started