Answered step by step

Verified Expert Solution

Question

1 Approved Answer

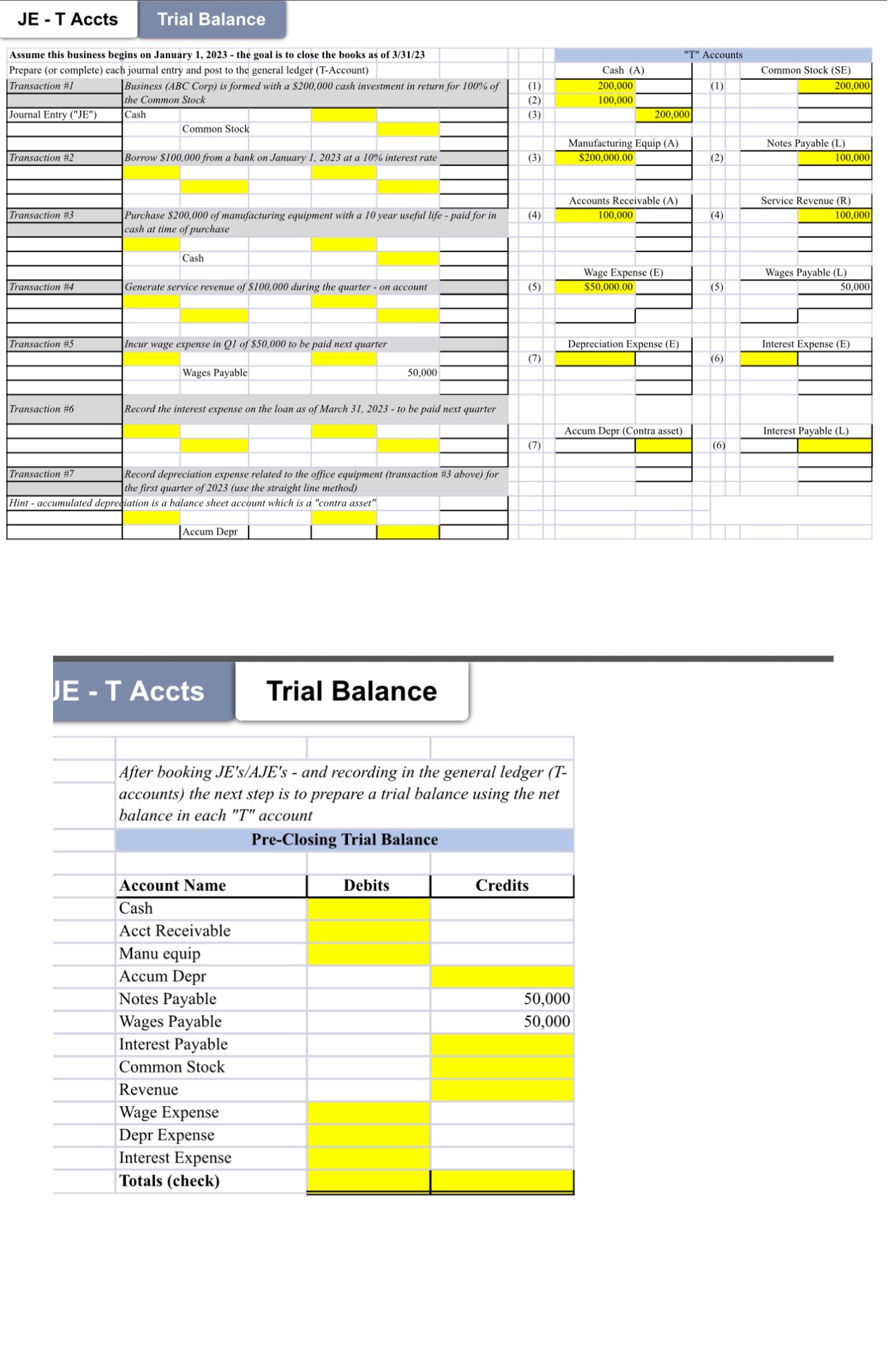

Fill these out. Make sure when u get to the trial balance the numbers are the same when totaled. Also explain how you got transaction

Fill these out. Make sure when u get to the trial balance the numbers are the same when totaled. Also explain how you got transaction number 6 and 7 numbers.

Trial Balance Assume this business begins on January 1, 2023 - the goal is to close the books as of 3/31/23 Prepare (or complete) each journal entry and post to the general ledger (T-Account) Transaction #1 JET Accts Journal Entry ("JE") Transaction #2 Transaction #3 Transaction #4 Transaction #5 Transaction #6 Transaction #7 Business (ABC Corp) is formed with a $200,000 cash investment in return for 100% of the Common Stock Cash Common Stock Borrow $100,000 from a bank on January 1, 2023 at a 10% interest rate Purchase $200,000 of manufacturing equipment with a 10 year useful life - paid for in cash at time of purchase Cash Generate service revenue of $100,000 during the quarter - on account Incur wage expense in Q1 of $50,000 to be paid next quarter Wages Payable Record the interest expense on the loan as of March 31, 2023- to be paid next quarter Record depreciation expense related to the office equipment (transaction #3 above) for the first quarter of 2023 (use the straight line method) Hint - accumulated depreciation is a balance sheet account which is a "contra asset" Accum Depr JE - T Accts Account Name Cash Acct Receivable Manu equip Accum Depr Notes Payable 50,000 Wages Payable Interest Payable Common Stock Revenue Wage Expense Depr Expense Interest Expense Totals (check) Trial Balance Debits (1) (2) (3) (3) (4) (5) (7) (7) After booking JE's/AJE's - and recording in the general ledger (T- accounts) the next step is to prepare a trial balance using the net balance in each "T" account Pre-Closing Trial Balance Credits Cash (A) 200,000 100,000 Manufacturing Equip (A) $200,000.00 Accounts Receivable (A) 50,000 50,000 200,000 100,000 Depreciation Expense (E) Wage Expense (E) $50,000.00 Accum Depr (Contra asset) "T" Accounts (1) (2) (4) (5) (6) (6) Common Stock (SE) 200,000 Notes Payable (L) 100,000 Service Revenue (R) 100,000 Wages Payable (L) 50,000 Interest Expense (E) Interest Payable (L)

Step by Step Solution

★★★★★

3.55 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Explanation for transaction number 6 and 7 numbers Transaction 6 Depreciation Expense The depreciation expense related to the office equipment is recorded using the straightline method The straightlin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started