Answered step by step

Verified Expert Solution

Question

1 Approved Answer

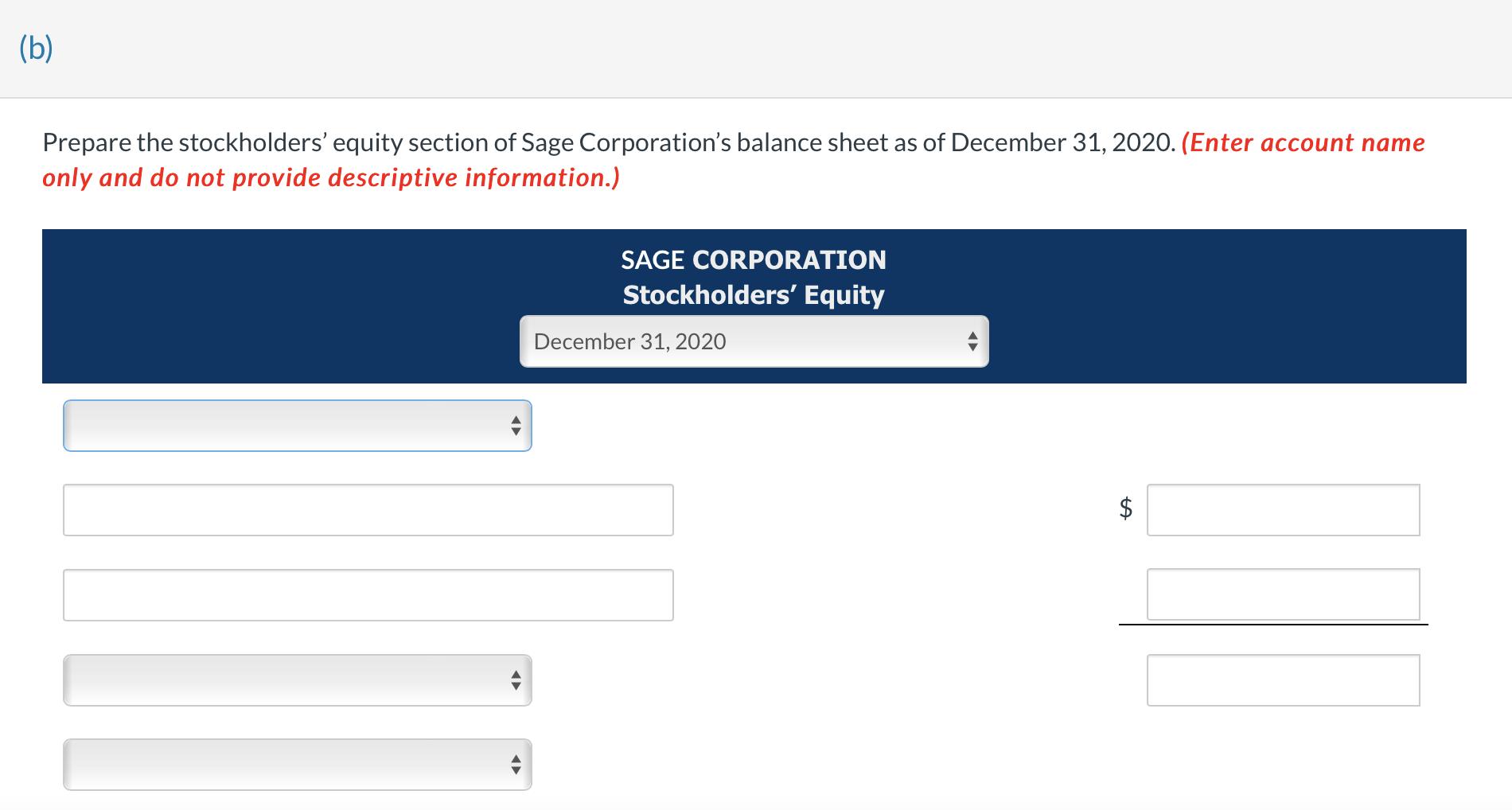

Fill up the blanks on the below portion for part B prepare the stockholders' equity section of Sage Corporation's balance sheet as December 31,2020 On

Fill up the blanks on the below portion for part B prepare the stockholders' equity section of Sage Corporation's balance sheet as December 31,2020

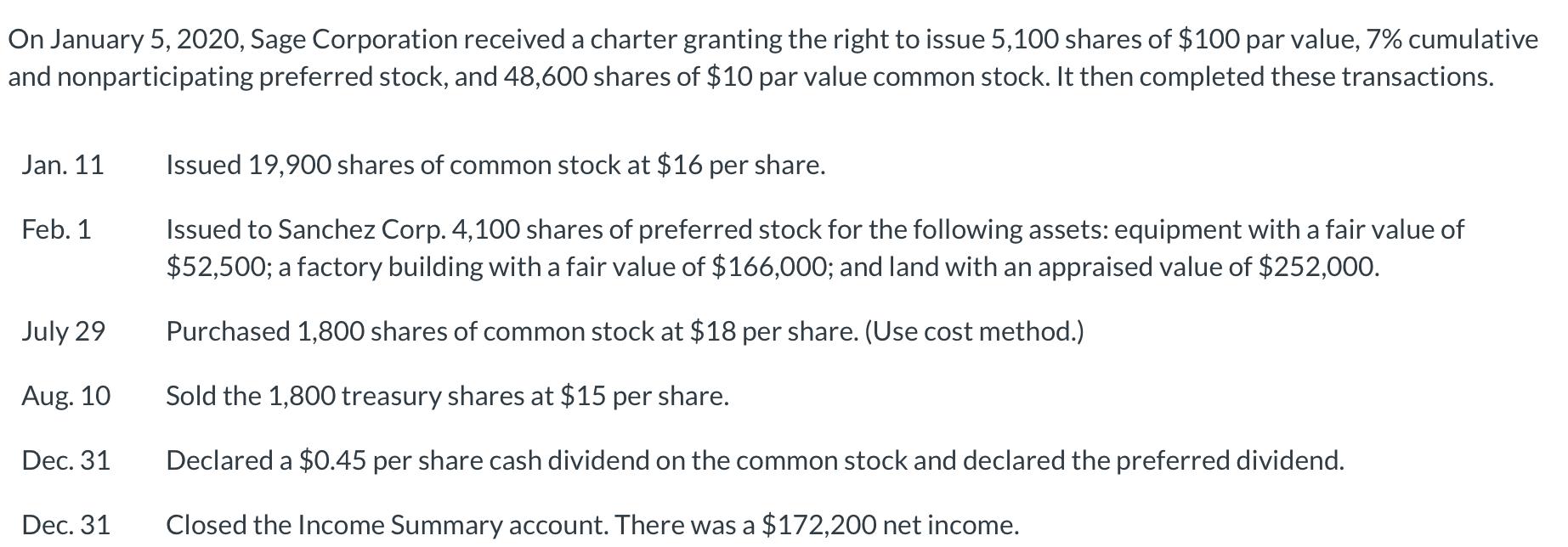

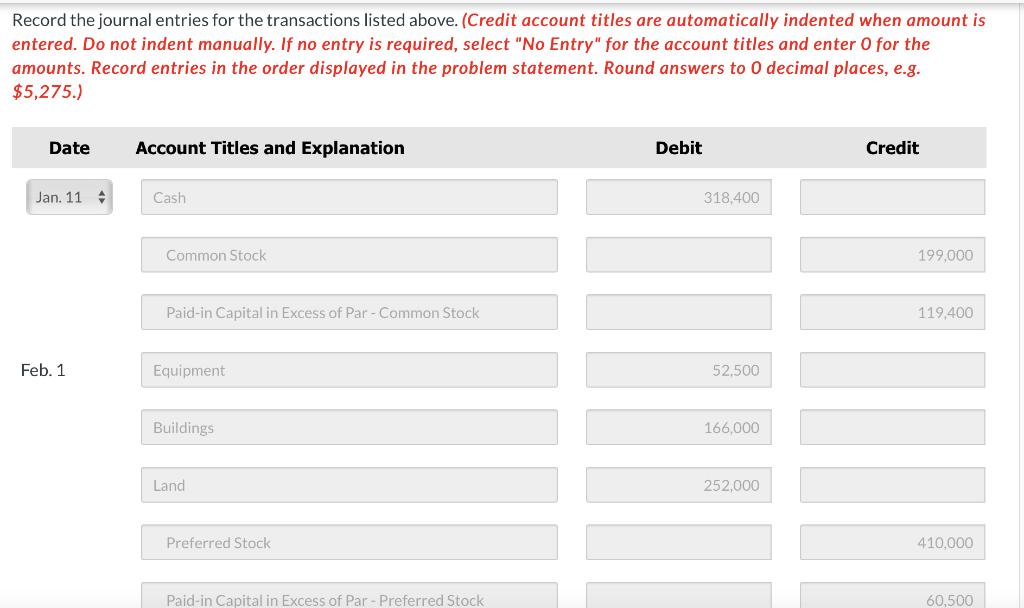

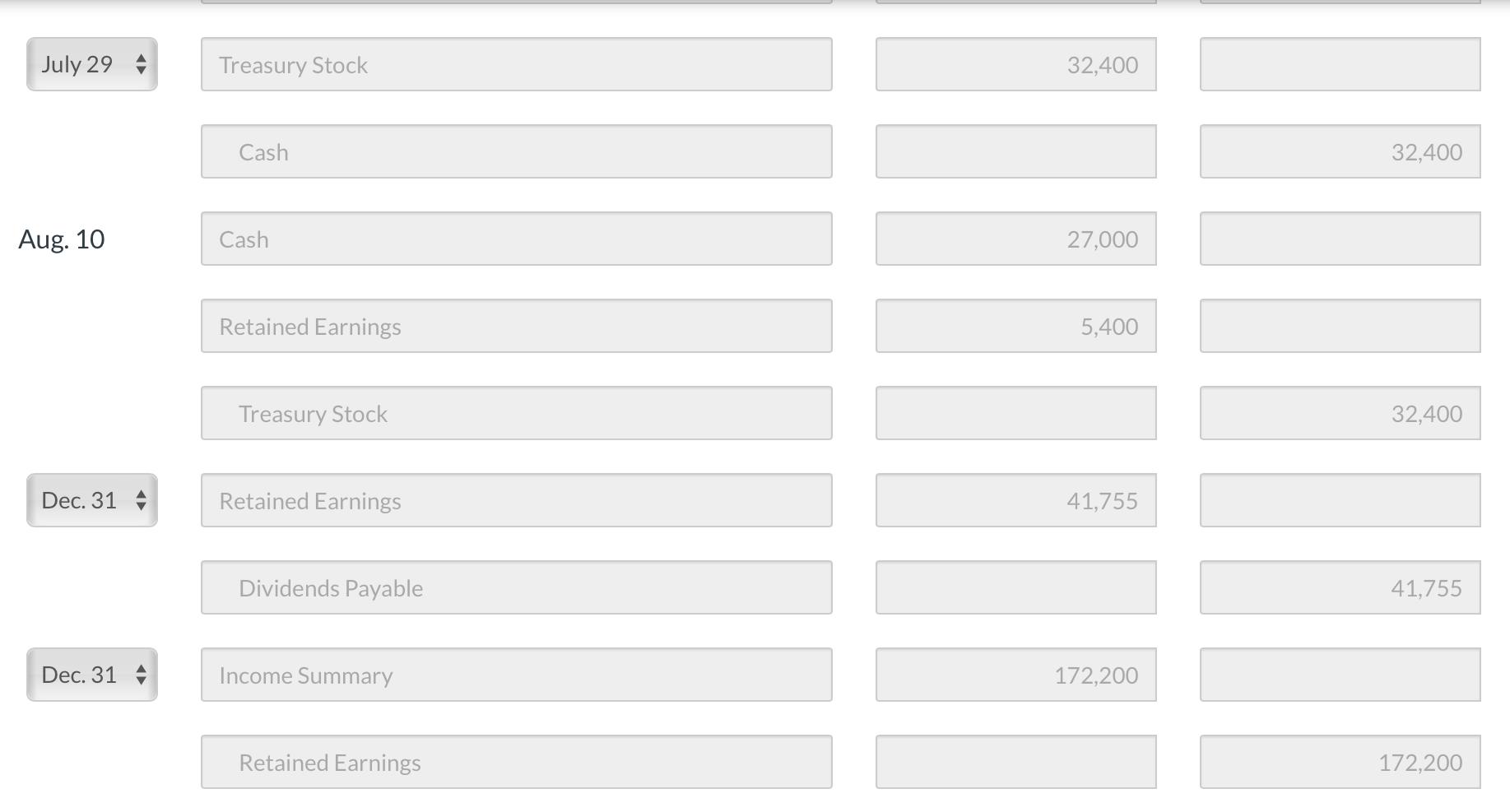

On January 5, 2020, Sage Corporation received a charter granting the right to issue 5,100 shares of $100 par value, 7% cumulative and nonparticipating preferred stock, and 48,600 shares of $10 par value common stock. It then completed these transactions. Jan. 11 Feb. 1 July 29 Aug. 10 Dec. 31 Dec. 31 Issued 19,900 shares of common stock at $16 per share. Issued to Sanchez Corp. 4,100 shares of preferred stock for the following assets: equipment with a fair value of $52,500; a factory building with a fair value of $166,000; and land with an appraised value of $252,000. Purchased 1,800 shares of common stock at $18 per share. (Use cost method.) Sold the 1,800 treasury shares at $15 per share. Declared a $0.45 per share cash dividend on the common stock and declared the preferred dividend. Closed the Income Summary account. There was a $172,200 net income.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer The answer is as follows Ans a Ans b Outstanding issued preferred shares 6000 2000 8000 share...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started