Answered step by step

Verified Expert Solution

Question

1 Approved Answer

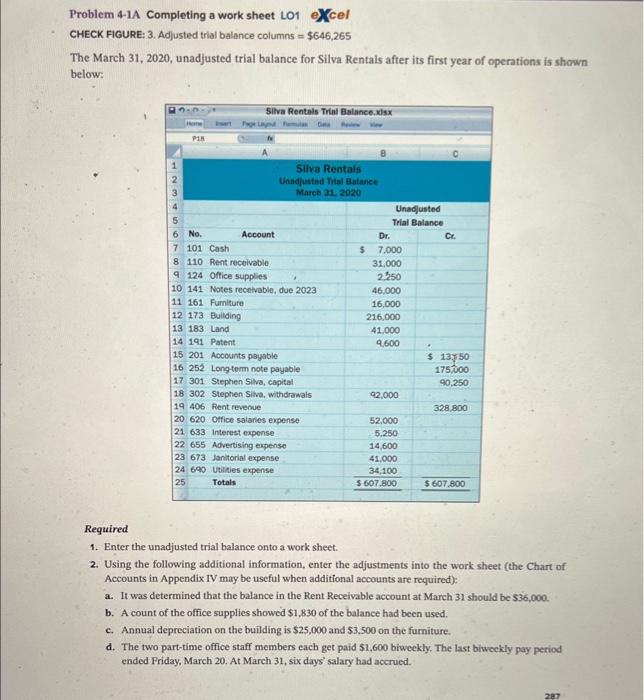

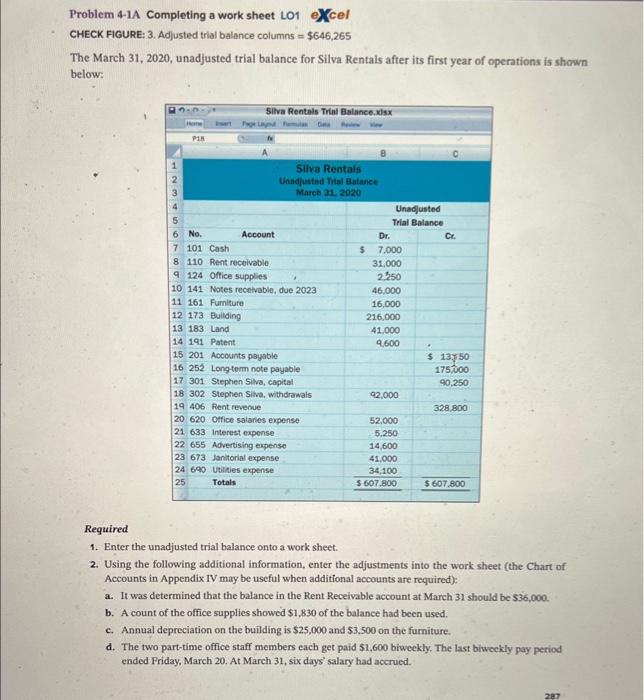

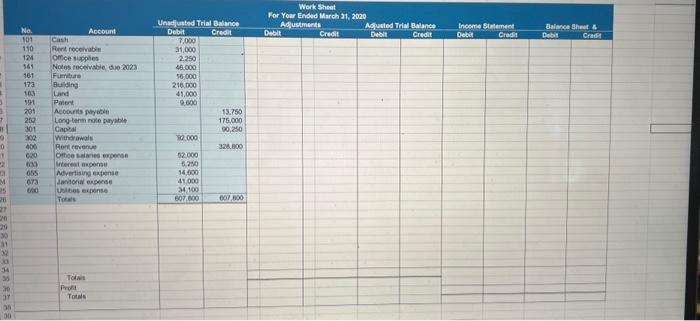

fillied the table pls. i put the picture of the table Problem 4-1A Completing a work sheet LO1 eXcel CHECK FIGURE: 3. Adjusted trial balance

fillied the table pls. i put the picture of the table

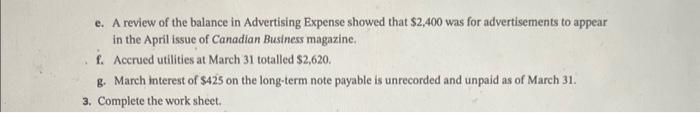

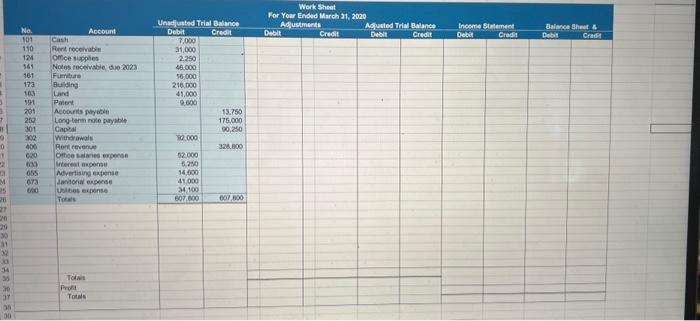

Problem 4-1A Completing a work sheet LO1 eXcel CHECK FIGURE: 3. Adjusted trial balance columns = $646,265 The March 31, 2020, unadjusted trial balance for Silva Rentals after its first year of operations is shown below: UN2 Home P18 Silva Rentals Trial Balance.xlsx fv 6 No. 7 101 Cash 8 110 Rent receivable 9 124 Office supplies 10 141 Notes receivable, due 2023 11 161 Furniture 12 173 Building 13 183 Land Account Silva Rentals Unadjusted Trial Balance March 31, 2020 14 191 Patent 15 201 Accounts payable 16 252 Long term note payable 17 301 Stephen Silva, capital 18 302 Stephen Silva, withdrawals 19 406 Rent revenue 20 620 Office salaries expense 21 633 Interest expense 22 655 Advertising expense 23 673 Janitorial expense 24 690 Utilities expense 25 Totals Unadjusted Trial Balance Dr. $ 7,000 31,000 2,250 46,000 16,000 216,000 41,000 9,600 92,000 52,000 5,250 14,600 41,000 34,100 $ 607,800 Cr. $ 13,50 175,000 90,250 328,800 $ 607,800 Required 1. Enter the unadjusted trial balance onto a work sheet. 2. Using the following additional information, enter the adjustments into the work sheet (the Chart of Accounts in Appendix IV may be useful when additional accounts are required): a. It was determined that the balance in the Rent Receivable account at March 31 should be $36,000. b. A count of the office supplies showed $1,830 of the balance had been used. c. Annual depreciation on the building is $25,000 and $3,500 on the furniture. d. The two part-time office staff members each get paid $1,600 biweekly. The last biweekly pay period ended Friday, March 20. At March 31, six days' salary had accrued. 287 e. A review of the balance in Advertising Expense showed that $2,400 was for advertisements to appear in the April issue of Canadian Business magazine. f. Accrued utilities at March 31 totalled $2,620. g. March interest of $425 on the long-term note payable is unrecorded and unpaid as of March 31. 3. Complete the work sheet. L 5 3 + n! 9 0 1 2 3 M 25 26 27 CM 29 30 31 32 33 RAR ARR 34 35 30 37 35 No. 101 Cash 110 Rent receivable 124 Office supplies 141 161 Furniture 173 Building 103 Land 191 Patent 201 Accounts payable 83888***SE Notes receivable, due 2023 Account 252 Long-term note payable 301 Capital 302 Withdrawals Rent revenue 400 620 Office salaries expense 633 Interest expense 655 Advertising expense 673 Janitorial expense 600 Ubibes expense Totals Totais Profit Totals Unadjusted Trial Balance Debit Credit 7,000 31,000 2.250 46.000 16,000 216,000 41,000 9,000 12,000 52.000 5.250 14,000 41,000 34,100 607.000 13,750 175,000 90,250 328.800 607,800 Work Sheet For Year Ended March 31, 2020 Adjustments Debit Credit Adjusted Trial Balance Debit Credit Income Statement Debit Credit Balance Sheet & Debi Crad

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started