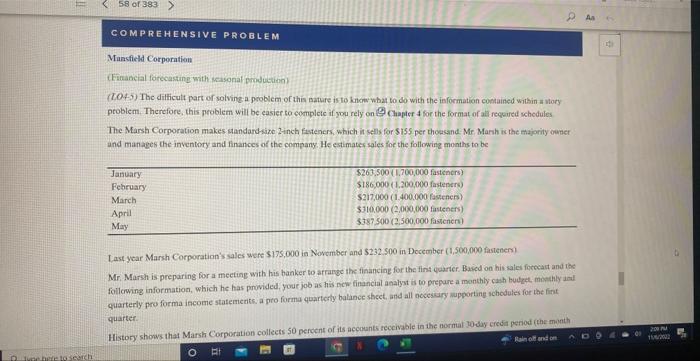

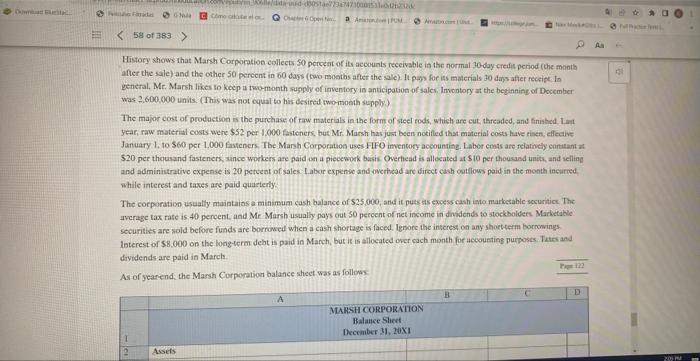

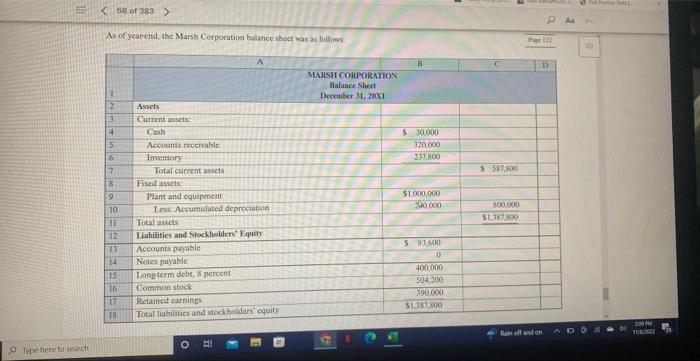

(Fimancial forecasting with keasonaf production) (LO+5) The ditificult part of solving a problem of this dature is to know what to do with the infocmation contained within a story problem. Therefore, this problem will be easief to complete if you rely on (9) Chapter 4 for the format of all regared wehedules The Marsh Corporation makes standard-size 2-inch fasteners, which it sells for \$155 per thoosand- Mr. Marah ic the etajority ouster and manages the inventory and finances of the company. He estimates sales for the following months to be Last year Marsh Corporation's sales were $175,000 in November and $232.500 in December (1,500,000 fastenem) Mr. Marsh is preparing for a meeting with his banker to arragge the financing for the fint quarter. Baicd on his sales foctecact and ribe following information, which he has provided, your job as his new financial analyst is to prepare a monthly cath butget, mosethly and quarterly pro forma income statemexits, a pro forma quarterly balance stacet, and all nocesiary mpporting schedules for the fint quarter. History shows that Marst Corporntion collects 50 percent of its accounts receivable in the normat 30-day credit period (the manth after the sale) and the other 50 pereent in 60 days (two moaths after the sale). It pups for its materials 30 days after receipe in general. Mr. Marsh likes to keep u two-month supply of inventory in anticipation of sales. Inventory at the beginning of Docember was 2.600.000 units. (This was not equal to his desired twomoeth supply) The major cost of production es the purchase of raw materials in the form of steel rods, which are cut, threaded, and fimished. Layt year, raw materal costs were $52 per I,000 fasteners, but Mr. Marsh has just been notified that material costs have eisen, effective January 1, to 560 per 1,000 faveners. The Marsh Corporation uses. HFO imventory accounting. Labor costs are felatively contant at $20 per thousand fasteners, ance workers are paid un a piecewodk basis. Overhead ts allocated at 510 per thousand units, and selling and administrative expense is 20 petcent of sales. Labot expense and overticad are cifect cash oat liows paid in the monte incurred. while interest and taves are paid quarterty. The corporation usaally maintains a minimum cash balance of 525.000, and it puss sts excess cash into marketable securiticc. The average tax rate is 40 percent and Mr Marsh usually pays out 30 percent of net income in dridends to stock holders. Marketahile securittes are sold before funds are borrowed when a cash shortage is faced. Igrote the interess on any shoetterm bornowings. Interest of $8,000 on the long-term debt is paid in Manch, but it is allocated over cach month for accoueting purposes. Twates and dividends are paid in March. As of yearend. the Marsh Corporation balance shect was as follows. As of yeatend, the Marit Corporation tulance sticet was as follion