Answered step by step

Verified Expert Solution

Question

1 Approved Answer

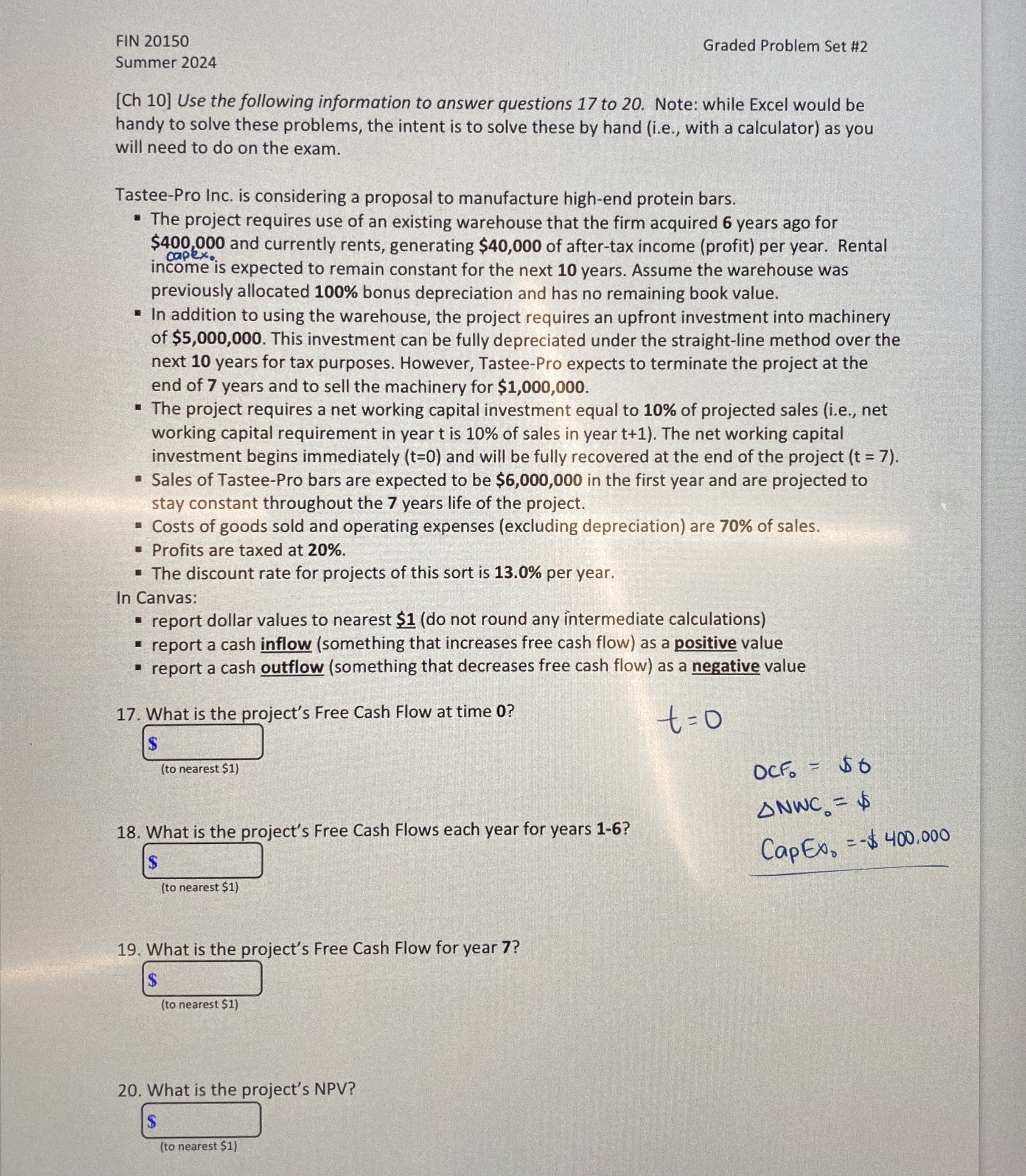

FIN 2 0 1 5 0 Graded Problem Set # 2 Summer 2 0 2 4 [ Ch 1 0 ] Use the following information

FIN

Graded Problem Set #

Summer

Ch Use the following information to answer questions to Note: while Excel would be handy to solve these problems, the intent is to solve these by hand ie with a calculator as you will need to do on the exam.

TasteePro Inc. is considering a proposal to manufacture highend protein bars.

The project requires use of an existing warehouse that the firm acquired years ago for $ and currently rents, generating $ of aftertax income profit per year. Rental income is expected to remain constant for the next years. Assume the warehouse was previously allocated bonus depreciation and has no remaining book value.

In addition to using the warehouse, the project requires an upfront investment into machinery of $ This investment can be fully depreciated under the straightline method over the next years for tax purposes. However, TasteePro expects to terminate the project at the end of years and to sell the machinery for $

The project requires a net working capital investment equal to of projected sales ie net working capital requirement in year is of sales in year The net working capital investment begins immediately and will be fully recovered at the end of the project

Sales of TasteePro bars are expected to be $ in the first year and are projected to stay constant throughout the years life of the project.

Costs of goods sold and operating expenses excluding depreciation are of sales.

Profits are taxed at

The discount rate for projects of this sort is per year.

In Canvas:

report dollar values to nearest $do not round any intermediate calculations

report a cash inflow something that increases free cash flow as a positive value

report a cash outflow something that decreases free cash flow as a negative value

What is the project's Free Cash Flow at time

to nearest $

What is the project's Free Cash Flows each year for years

$

$

CapEx $

to nearest $

What is the project's Free Cash Flow for year

to nearest $

What is the project's NPV

to nearest $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started