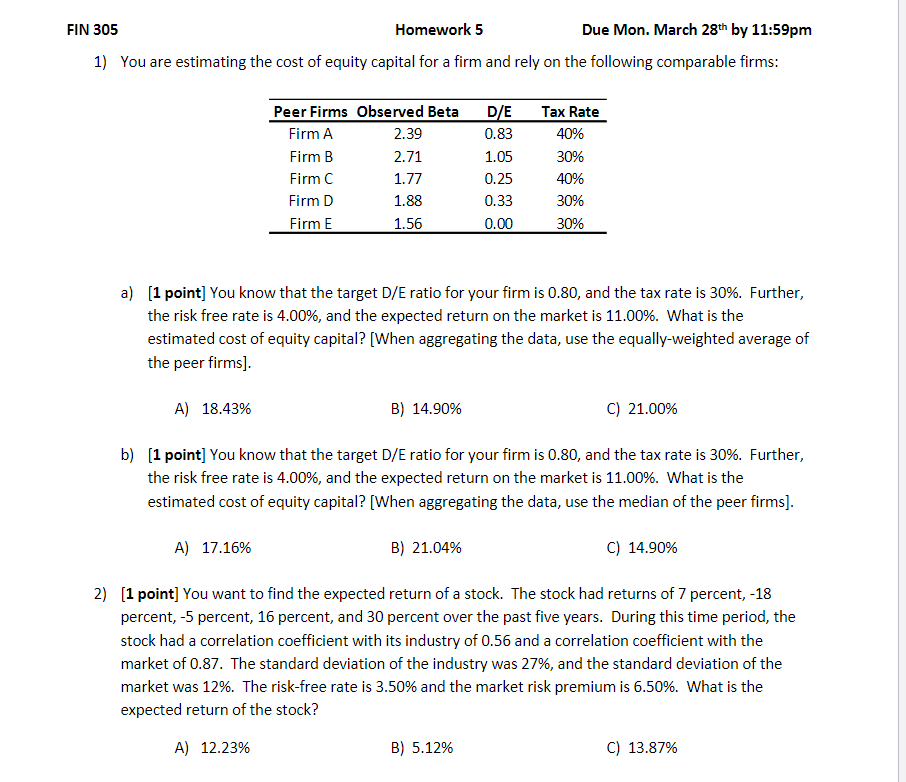

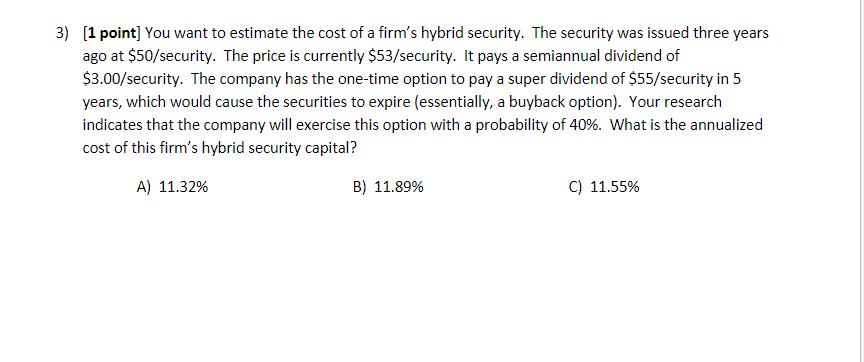

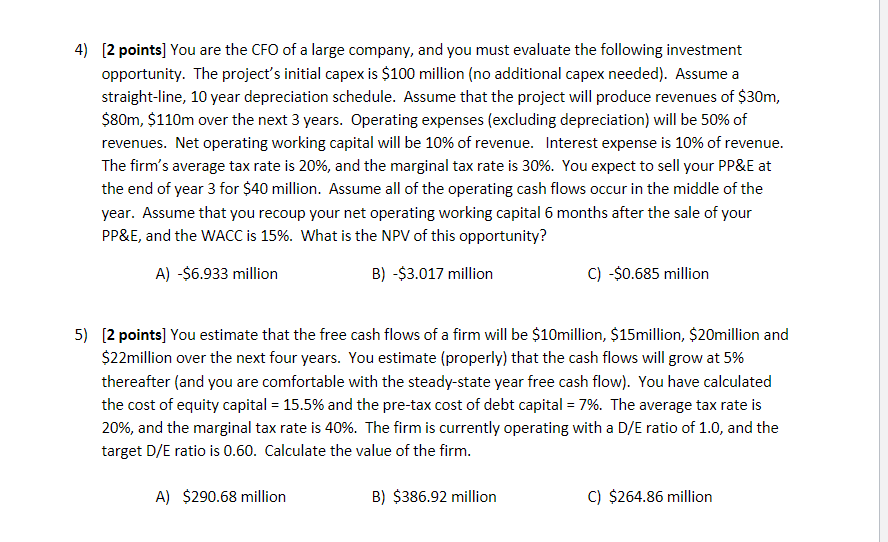

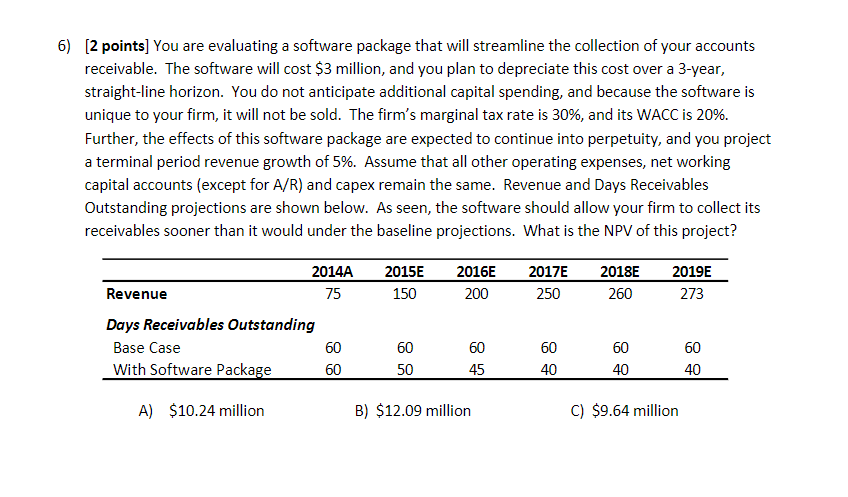

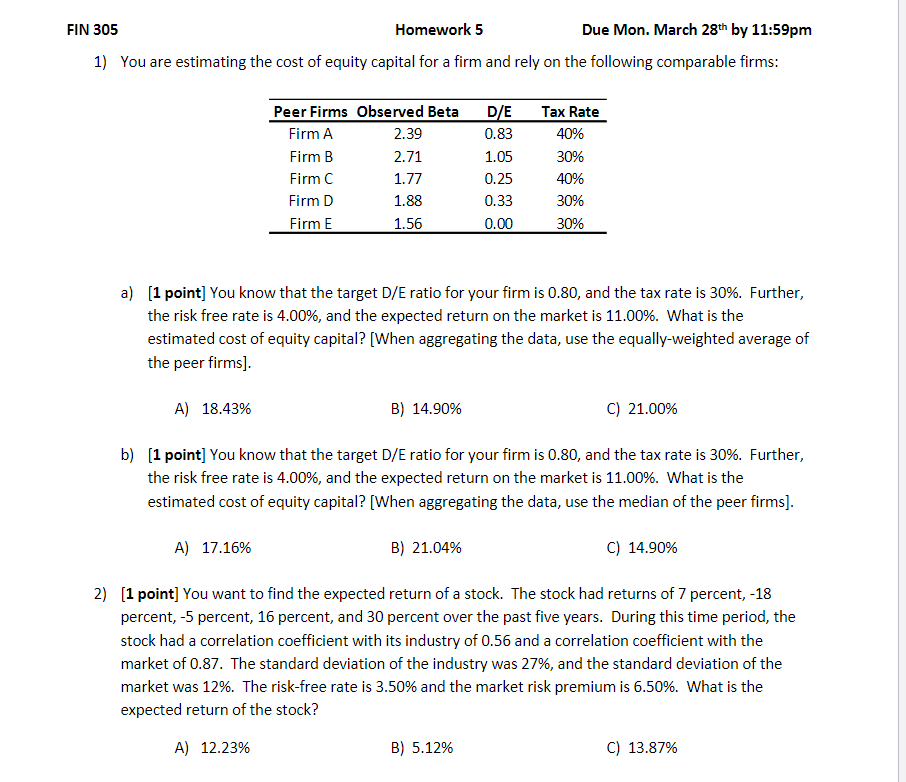

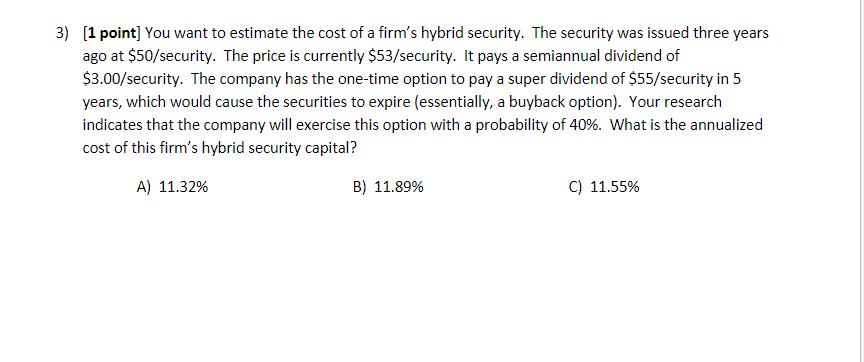

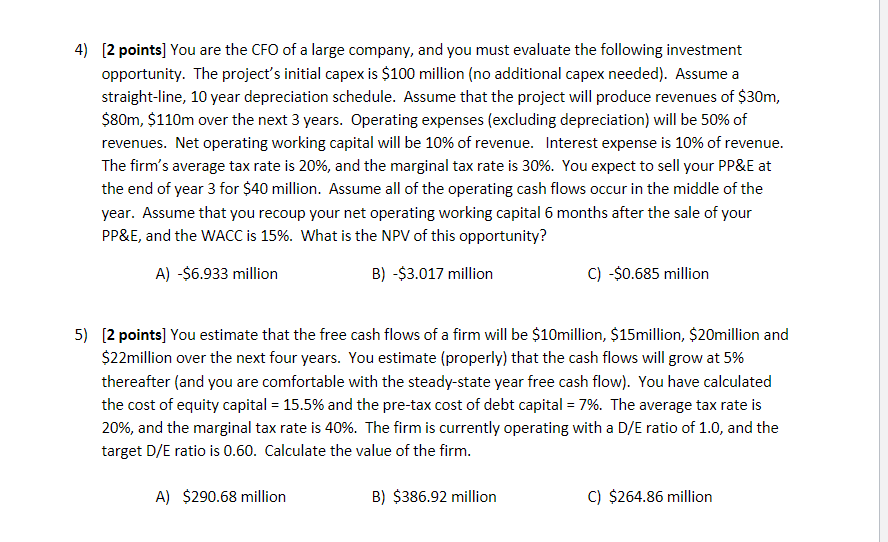

FIN 305 Homework 5 Due Mon. March 28th by 11:59pm 1) You are estimating the cost of equity capital for a firm and rely on the following comparable firms: Peer Firms Observed Beta Firm A 2.39 Firm B 2.71 Firm C 1.77 Firm D 1.88 Firm E 1.56 DE 0.83 1.05 0.25 0.33 0.00 Tax Rate 40% 30% 40% 30% 30% a) [1 point] You know that the target D/E ratio for your firm is 0.80, and the tax rate is 30%. Further, the risk free rate is 4.00%, and the expected return on the market is 11.00%. What is the estimated cost of equity capital? [When aggregating the data, use the equally-weighted average of the peer firms]. A) 18.43% B) 14.90% C) 21.00% b) [1 point] You know that the target D/E ratio for your firm is 0.80, and the tax rate is 30%. Further, the risk free rate is 4.00%, and the expected return on the market is 11.00%. What is the estimated cost of equity capital? [When aggregating the data, use the median of the peer firms). A) 17.16% B) 21.04% C) 14.90% 2) [1 point] You want to find the expected return of a stock. The stock had returns of 7 percent, -18 percent, -5 percent, 16 percent, and 30 percent over the past five years. During this time period, the stock had a correlation coefficient with its industry of 0.56 and a correlation coefficient with the market of 0.87. The standard deviation of the industry was 27%, and the standard deviation of the market was 12%. The risk-free rate is 3.50% and the market risk premium is 6.50%. What is the expected return of the stock? A) 12.23% B) 5.12% C) 13.87% 3) [1 point] You want to estimate the cost of a firm's hybrid security. The security was issued three years ago at $50/security. The price is currently $53/security. It pays a semiannual dividend of $3.00/security. The company has the one-time option to pay a super dividend of $55/security in 5 years, which would cause the securities to expire (essentially, a buyback option). Your research indicates that the company will exercise this option with a probability of 40%. What is the annualized cost of this firm's hybrid security capital? A) 11.32% B) 11.89% C) 11.55% 4) (2 points] You are the CFO of a large company, and you must evaluate the following investment opportunity. The project's initial capex is $100 million (no additional capex needed). Assume a straight-line, 10 year depreciation schedule. Assume that the project will produce revenues of $30m, $80m, $110m over the next 3 years. Operating expenses (excluding depreciation) will be 50% of revenues. Net operating working capital will be 10% of revenue. Interest expense is 10% of revenue. The firm's average tax rate is 20%, and the marginal tax rate is 30%. You expect to sell your PP&E at the end of year 3 for $40 million. Assume all of the operating cash flows occur in the middle of the year. Assume that you recoup your net operating working capital 6 months after the sale of your PP&E, and the WACC is 15%. What is the NPV of this opportunity? A) -$6.933 million B) $3.017 million C) $0.685 million 5) (2 points] You estimate that the free cash flows of a firm will be $10million, $15million, $20million and $22million over the next four years. You estimate (properly) that the cash flows will grow at 5% thereafter (and you are comfortable with the steady-state year free cash flow). You have calculated the cost of equity capital = 15.5% and the pre-tax cost of debt capital = 7%. The average tax rate is 20%, and the marginal tax rate is 40%. The firm is currently operating with a D/E ratio of 1.0, and the target D/E ratio is 0.60. Calculate the value of the firm. A) $290.68 million B) $386.92 million C) $264.86 million 6) (2 points] You are evaluating a software package that will streamline the collection of your accounts receivable. The software will cost $3 million, and you plan to depreciate this cost over a 3-year, straight-line horizon. You do not anticipate additional capital spending, and because the software is unique to your firm, it will not be sold. The firm's marginal tax rate is 30%, and its WACC is 20%. Further, the effects of this software package are expected to continue into perpetuity, and you project a terminal period revenue growth of 5%. Assume that all other operating expenses, net working capital accounts (except for A/R) and capex remain the same. Revenue and Days Receivables Outstanding projections are shown below. As seen, the software should allow your firm to collect its receivables sooner than it would under the baseline projections. What is the NPV of this project? 2015E 150 2016E 200 2017E 250 2018E 260 2019E 273 2014A Revenue 75 Days Receivables Outstanding Base Case 60 With Software Package 60 60 50 60 45 60 40 60 40 60 40 A) $10.24 million B) $12.09 million C) $9.64 million FIN 305 Homework 5 Due Mon. March 28th by 11:59pm 1) You are estimating the cost of equity capital for a firm and rely on the following comparable firms: Peer Firms Observed Beta Firm A 2.39 Firm B 2.71 Firm C 1.77 Firm D 1.88 Firm E 1.56 DE 0.83 1.05 0.25 0.33 0.00 Tax Rate 40% 30% 40% 30% 30% a) [1 point] You know that the target D/E ratio for your firm is 0.80, and the tax rate is 30%. Further, the risk free rate is 4.00%, and the expected return on the market is 11.00%. What is the estimated cost of equity capital? [When aggregating the data, use the equally-weighted average of the peer firms]. A) 18.43% B) 14.90% C) 21.00% b) [1 point] You know that the target D/E ratio for your firm is 0.80, and the tax rate is 30%. Further, the risk free rate is 4.00%, and the expected return on the market is 11.00%. What is the estimated cost of equity capital? [When aggregating the data, use the median of the peer firms). A) 17.16% B) 21.04% C) 14.90% 2) [1 point] You want to find the expected return of a stock. The stock had returns of 7 percent, -18 percent, -5 percent, 16 percent, and 30 percent over the past five years. During this time period, the stock had a correlation coefficient with its industry of 0.56 and a correlation coefficient with the market of 0.87. The standard deviation of the industry was 27%, and the standard deviation of the market was 12%. The risk-free rate is 3.50% and the market risk premium is 6.50%. What is the expected return of the stock? A) 12.23% B) 5.12% C) 13.87% 3) [1 point] You want to estimate the cost of a firm's hybrid security. The security was issued three years ago at $50/security. The price is currently $53/security. It pays a semiannual dividend of $3.00/security. The company has the one-time option to pay a super dividend of $55/security in 5 years, which would cause the securities to expire (essentially, a buyback option). Your research indicates that the company will exercise this option with a probability of 40%. What is the annualized cost of this firm's hybrid security capital? A) 11.32% B) 11.89% C) 11.55% 4) (2 points] You are the CFO of a large company, and you must evaluate the following investment opportunity. The project's initial capex is $100 million (no additional capex needed). Assume a straight-line, 10 year depreciation schedule. Assume that the project will produce revenues of $30m, $80m, $110m over the next 3 years. Operating expenses (excluding depreciation) will be 50% of revenues. Net operating working capital will be 10% of revenue. Interest expense is 10% of revenue. The firm's average tax rate is 20%, and the marginal tax rate is 30%. You expect to sell your PP&E at the end of year 3 for $40 million. Assume all of the operating cash flows occur in the middle of the year. Assume that you recoup your net operating working capital 6 months after the sale of your PP&E, and the WACC is 15%. What is the NPV of this opportunity? A) -$6.933 million B) $3.017 million C) $0.685 million 5) (2 points] You estimate that the free cash flows of a firm will be $10million, $15million, $20million and $22million over the next four years. You estimate (properly) that the cash flows will grow at 5% thereafter (and you are comfortable with the steady-state year free cash flow). You have calculated the cost of equity capital = 15.5% and the pre-tax cost of debt capital = 7%. The average tax rate is 20%, and the marginal tax rate is 40%. The firm is currently operating with a D/E ratio of 1.0, and the target D/E ratio is 0.60. Calculate the value of the firm. A) $290.68 million B) $386.92 million C) $264.86 million 6) (2 points] You are evaluating a software package that will streamline the collection of your accounts receivable. The software will cost $3 million, and you plan to depreciate this cost over a 3-year, straight-line horizon. You do not anticipate additional capital spending, and because the software is unique to your firm, it will not be sold. The firm's marginal tax rate is 30%, and its WACC is 20%. Further, the effects of this software package are expected to continue into perpetuity, and you project a terminal period revenue growth of 5%. Assume that all other operating expenses, net working capital accounts (except for A/R) and capex remain the same. Revenue and Days Receivables Outstanding projections are shown below. As seen, the software should allow your firm to collect its receivables sooner than it would under the baseline projections. What is the NPV of this project? 2015E 150 2016E 200 2017E 250 2018E 260 2019E 273 2014A Revenue 75 Days Receivables Outstanding Base Case 60 With Software Package 60 60 50 60 45 60 40 60 40 60 40 A) $10.24 million B) $12.09 million C) $9.64 million