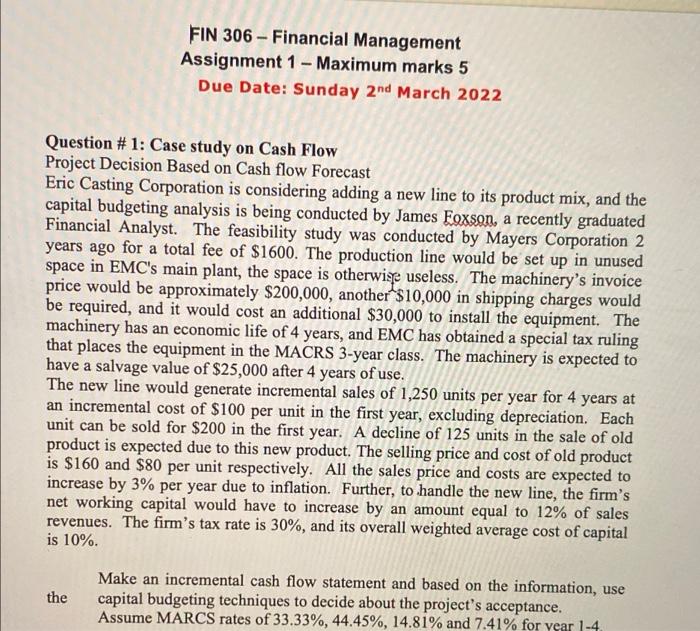

FIN 306 - Financial Management Assignment 1 - Maximum marks 5 Due Date: Sunday 2nd March 2022 - Question #1: Case study on Cash Flow Project Decision Based on Cash flow Forecast Eric Casting Corporation is considering adding a new line to its product mix, and the capital budgeting analysis is being conducted by James Foxson, a recently graduated Financial Analyst. The feasibility study was conducted by Mayers Corporation 2 years ago for a total fee of $1600. The production line would be set up in unused space in EMC's main plant, the space is otherwise useless. The machinery's invoice price would be approximately $200,000, another $10,000 in shipping charges would be required, and it would cost an additional $30,000 to install the equipment. The machinery has an economic life of 4 years, and EMC has obtained a special tax ruling that places the equipment in the MACRS 3-year class. The machinery is expected to have a salvage value of $25,000 after 4 years of use. The new line would generate incremental sales of 1,250 units per year for 4 years at an incremental cost of $100 per unit in the first year, excluding depreciation. Each unit can be sold for $200 in the first year. A decline of 125 units in the sale of old product is expected due to this new product. The selling price and cost of old product is $160 and $80 per unit respectively. All the sales price and costs are expected to increase by 3% per year due to inflation. Further, to handle the new line, the firm's net working capital would have to increase by an amount equal to 12% of sales revenues. The firm's tax rate is 30%, and its overall weighted average cost of capital is 10% the Make an incremental cash flow statement and based on the information, use capital budgeting techniques to decide about the project's acceptance. Assume MARCS rates of 33.33%, 44.45%, 14.81% and 7.41% for year 1-4 FIN 306 - Financial Management Assignment 1 - Maximum marks 5 Due Date: Sunday 2nd March 2022 - Question #1: Case study on Cash Flow Project Decision Based on Cash flow Forecast Eric Casting Corporation is considering adding a new line to its product mix, and the capital budgeting analysis is being conducted by James Foxson, a recently graduated Financial Analyst. The feasibility study was conducted by Mayers Corporation 2 years ago for a total fee of $1600. The production line would be set up in unused space in EMC's main plant, the space is otherwise useless. The machinery's invoice price would be approximately $200,000, another $10,000 in shipping charges would be required, and it would cost an additional $30,000 to install the equipment. The machinery has an economic life of 4 years, and EMC has obtained a special tax ruling that places the equipment in the MACRS 3-year class. The machinery is expected to have a salvage value of $25,000 after 4 years of use. The new line would generate incremental sales of 1,250 units per year for 4 years at an incremental cost of $100 per unit in the first year, excluding depreciation. Each unit can be sold for $200 in the first year. A decline of 125 units in the sale of old product is expected due to this new product. The selling price and cost of old product is $160 and $80 per unit respectively. All the sales price and costs are expected to increase by 3% per year due to inflation. Further, to handle the new line, the firm's net working capital would have to increase by an amount equal to 12% of sales revenues. The firm's tax rate is 30%, and its overall weighted average cost of capital is 10% the Make an incremental cash flow statement and based on the information, use capital budgeting techniques to decide about the project's acceptance. Assume MARCS rates of 33.33%, 44.45%, 14.81% and 7.41% for year 1-4