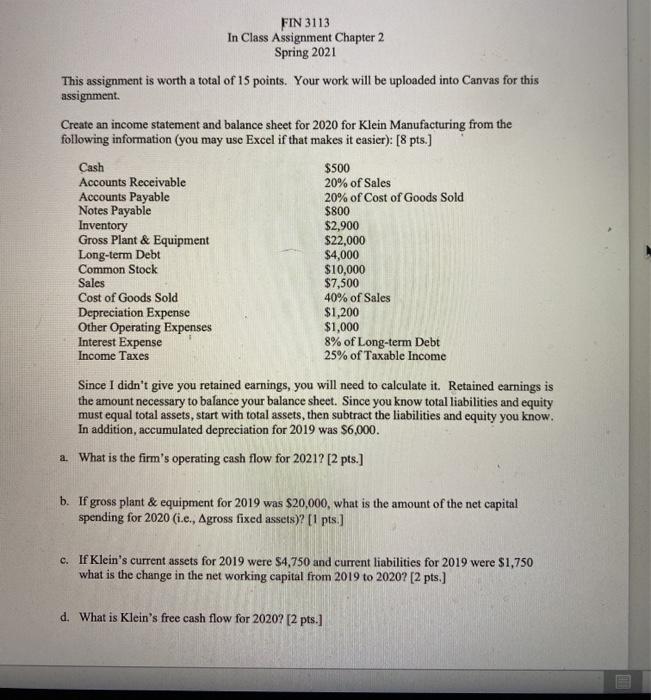

FIN 3113 In Class Assignment Chapter 2 Spring 2021 This assignment is worth a total of 15 points. Your work will be uploaded into Canvas for this assignment. Create an income statement and balance sheet for 2020 for Klein Manufacturing from the following information (you may use Excel if that makes it easier): [8 pts.) Cash $500 Accounts Receivable 20% of Sales Accounts Payable 20% of Cost of Goods Sold Notes Payable $800 Inventory $2,900 Gross Plant & Equipment $22,000 Long-term Debt $4,000 Common Stock $10,000 Sales $7,500 Cost of Goods Sold 40% of Sales Depreciation Expense $1,200 Other Operating Expenses $1,000 Interest Expense 8% of Long-term Debt Income Taxes 25% of Taxable Income Since I didn't give you retained earnings, you will need to calculate it. Retained earnings is the amount necessary to balance your balance sheet. Since you know total liabilities and equity must equal total assets, start with total assets, then subtract the liabilities and equity you know. In addition, accumulated depreciation for 2019 was $6,000. a. What is the firm's operating cash flow for 2021? [2 pts.] b. If gross plant & equipment for 2019 was $20,000, what is the amount of the net capital spending for 2020 (i.e., Agross fixed assets)? [1 pts.] c. If Klein's current assets for 2019 were $4,750 and current liabilities for 2019 were $1,750 what is the change in the net working capital from 2019 to 20207 [2 pts.] d. What is Klein's free cash flow for 2020? (2 pts.] FIN 3113 In Class Assignment Chapter 2 Spring 2021 This assignment is worth a total of 15 points. Your work will be uploaded into Canvas for this assignment. Create an income statement and balance sheet for 2020 for Klein Manufacturing from the following information (you may use Excel if that makes it easier): [8 pts.) Cash $500 Accounts Receivable 20% of Sales Accounts Payable 20% of Cost of Goods Sold Notes Payable $800 Inventory $2,900 Gross Plant & Equipment $22,000 Long-term Debt $4,000 Common Stock $10,000 Sales $7,500 Cost of Goods Sold 40% of Sales Depreciation Expense $1,200 Other Operating Expenses $1,000 Interest Expense 8% of Long-term Debt Income Taxes 25% of Taxable Income Since I didn't give you retained earnings, you will need to calculate it. Retained earnings is the amount necessary to balance your balance sheet. Since you know total liabilities and equity must equal total assets, start with total assets, then subtract the liabilities and equity you know. In addition, accumulated depreciation for 2019 was $6,000. a. What is the firm's operating cash flow for 2021? [2 pts.] b. If gross plant & equipment for 2019 was $20,000, what is the amount of the net capital spending for 2020 (i.e., Agross fixed assets)? [1 pts.] c. If Klein's current assets for 2019 were $4,750 and current liabilities for 2019 were $1,750 what is the change in the net working capital from 2019 to 20207 [2 pts.] d. What is Klein's free cash flow for 2020? (2 pts.]