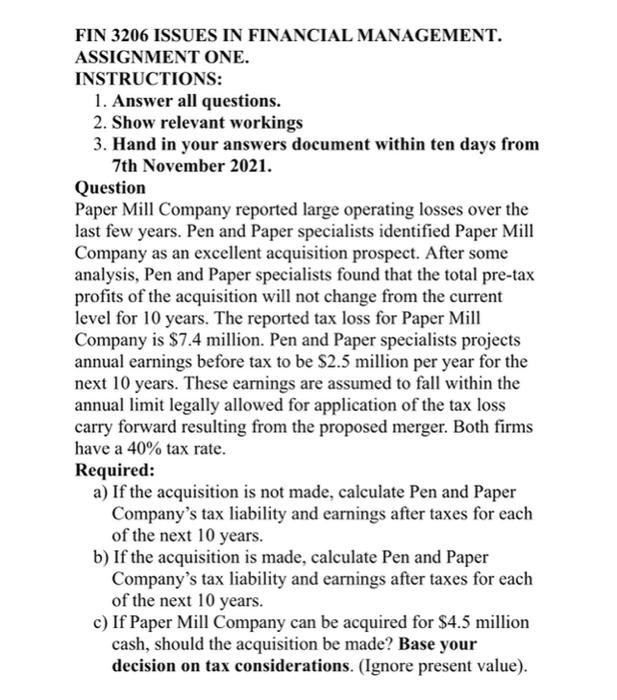

FIN 3206 ISSUES IN FINANCIAL MANAGEMENT. ASSIGNMENT ONE. INSTRUCTIONS: 1. Answer all questions. 2. Show relevant workings 3. Hand in your answers document within ten days from 7th November 2021. Question Paper Mill Company reported large operating losses over the last few years. Pen and Paper specialists identified Paper Mill Company as an excellent acquisition prospect. After some analysis, Pen and Paper specialists found that the total pre-tax profits of the acquisition will not change from the current level for 10 years. The reported tax loss for Paper Mill Company is $7.4 million. Pen and Paper specialists projects annual earnings before tax to be $2.5 million per year for the next 10 years. These earnings are assumed to fall within the annual limit legally allowed for application of the tax loss carry forward resulting from the proposed merger. Both firms have a 40% tax rate. Required: a) If the acquisition is not made, calculate Pen and Paper Company's tax liability and earnings after taxes for each of the next 10 years. b) If the acquisition is made, calculate Pen and Paper Company's tax liability and earnings after taxes for each of the next 10 years. c) If Paper Mill Company can be acquired for $4.5 million cash, should the acquisition be made? Base your decision on tax considerations. (Ignore present value). FIN 3206 ISSUES IN FINANCIAL MANAGEMENT. ASSIGNMENT ONE. INSTRUCTIONS: 1. Answer all questions. 2. Show relevant workings 3. Hand in your answers document within ten days from 7th November 2021. Question Paper Mill Company reported large operating losses over the last few years. Pen and Paper specialists identified Paper Mill Company as an excellent acquisition prospect. After some analysis, Pen and Paper specialists found that the total pre-tax profits of the acquisition will not change from the current level for 10 years. The reported tax loss for Paper Mill Company is $7.4 million. Pen and Paper specialists projects annual earnings before tax to be $2.5 million per year for the next 10 years. These earnings are assumed to fall within the annual limit legally allowed for application of the tax loss carry forward resulting from the proposed merger. Both firms have a 40% tax rate. Required: a) If the acquisition is not made, calculate Pen and Paper Company's tax liability and earnings after taxes for each of the next 10 years. b) If the acquisition is made, calculate Pen and Paper Company's tax liability and earnings after taxes for each of the next 10 years. c) If Paper Mill Company can be acquired for $4.5 million cash, should the acquisition be made? Base your decision on tax considerations. (Ignore present value)