Answered step by step

Verified Expert Solution

Question

1 Approved Answer

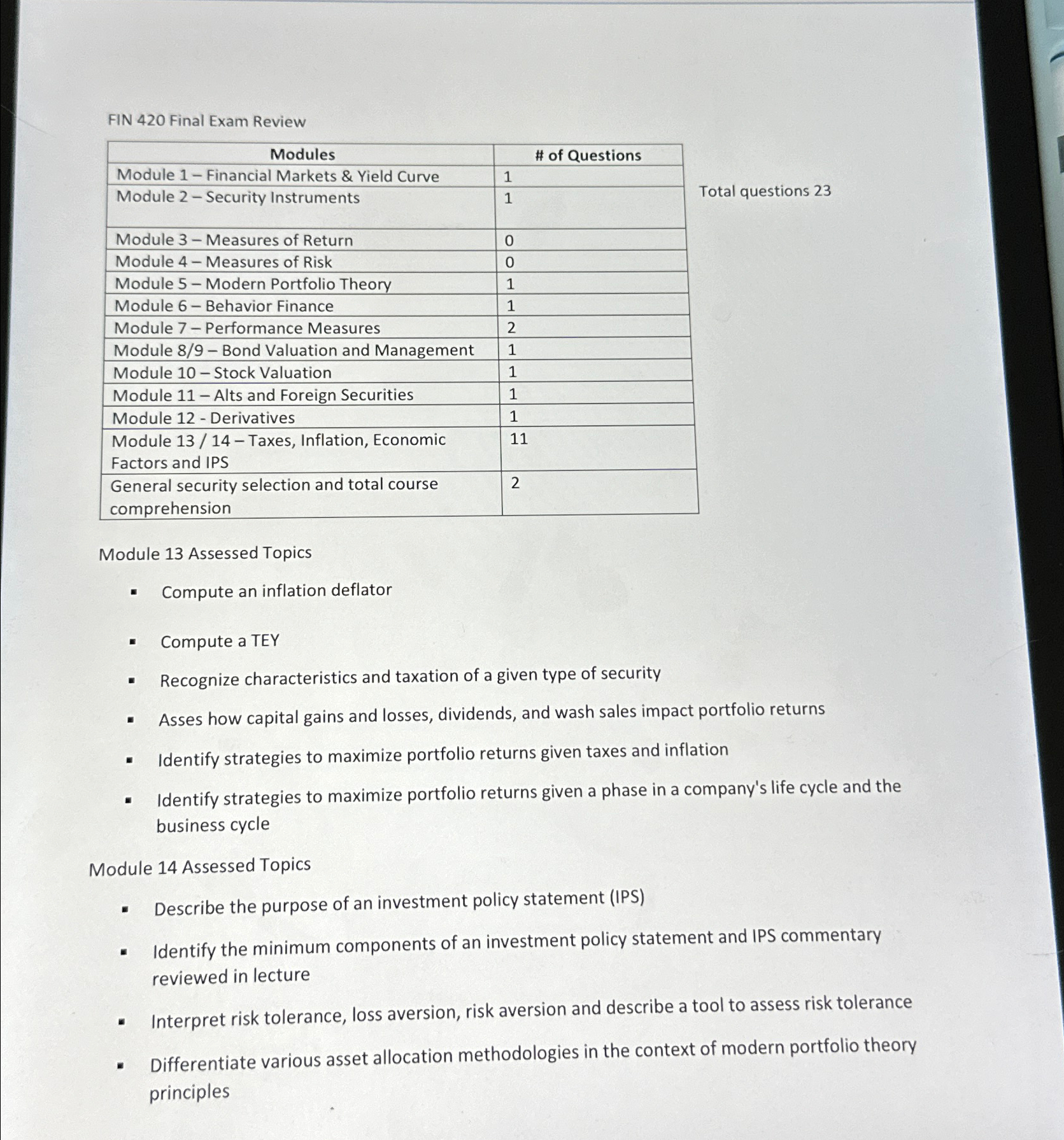

FIN 4 2 0 Final Exam Review table [ [ Modules , # of Questions ] , [ Module 1 - Financial Markets &

FIN Final Exam Review

tableModules# of QuestionsModule Financial Markets & Yield Curve,Module Security Instruments,Module Measures of Return,Module Measures of Risk,Module Modern Portfolio Theory,Module Behavior Finance,Module Performance Measures,Module Bond Valuation and Management,Module Stock Valuation,Module Alts and Foreign Securities,Module Derivatives,tableModule Taxes, Inflation, EconomicFactors and IPStableGeneral security selection and total coursecomprehension

Module Assessed Topics

Compute an inflation deflator

Compute a TEY

Recognize characteristics and taxation of a given type of security

Asses how capital gains and losses, dividends, and wash sales impact portfolio returns

Identify strategies to maximize portfolio returns given taxes and inflation

Identify strategies to maximize portfolio returns given a phase in a company's life cycle and the business cycle

Module Assessed Topics

Describe the purpose of an investment policy statement IPS

Identify the minimum components of an investment policy statement and IPS commentary reviewed in lecture

Interpret risk tolerance, loss aversion, risk aversion and describe a tool to assess risk tolerance

Differentiate various asset allocation methodologies in the context of modern portfolio theory principles

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started