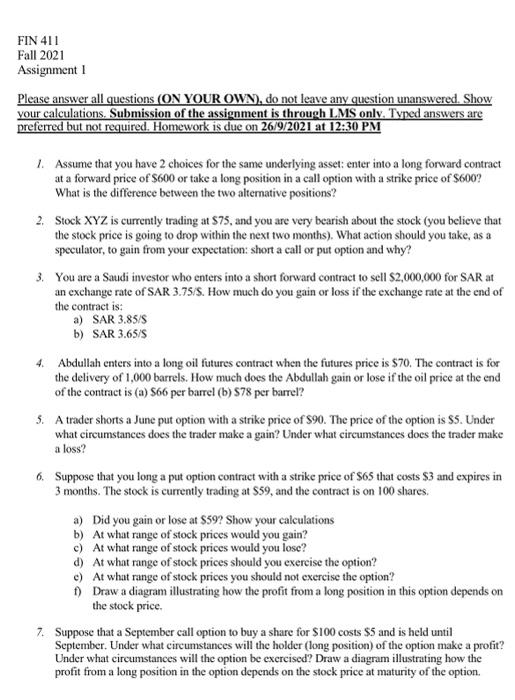

FIN 411 Fall 2021 Assignment1 Please answer all questions (ON YOUR OWN), do not leave any question unanswered. Show your calculations. Submission of the assignment is through LMS only. Typed answers are preferred but not required. Homework is due on 26/9/2021 at 12:30 PM 1. Assume that you have 2 choices for the same underlying asset: enter into a long forward contract at a forward price of $600 or take a long position in a call option with a strike price of $600? What is the difference between the two alternative positions? 2. Stock XYZ is currently trading at S75, and you are very bearish about the stock (you believe that the stock price is going to drop within the next two months). What action should you take, as a speculator, to gain from your expectation: short a call or put option and why? 3. You are a Saudi investor who enters into a short forward contract to sell S2,000,000 for SAR at an exchange rate of SAR 3.75/5. How much do you gain or loss if the exchange rate at the end of the contract is: a) SAR 3.85/5 b) SAR 3.65/8 4. Abdullah enters into a long oil futures contract when the futures price is $70. The contract is for the delivery of 1,000 barrels. How much does the Abdullah gain or lose if the oil price at the end of the contract is (a) 566 per barrel (b) S78 per barrel? 5. A trader shorts a June put option with a strike price of $90. The price of the option is $5. Under what circumstances does the trader make a gain? Under what circumstances does the trader make a loss? 6. Suppose that you long a put option contract with a strike price of $65 that costs $3 and expires in 3 months. The stock is currently trading at $59, and the contract is on 100 shares. a) Did you gain or lose at $597 Show your calculations b) At what range of stock prices would you gain? c) At what range of stock prices would you lose? d) At what range of stock prices should you exercise the option? c) At what range of stock prices you should not exercise the option? f) Draw a diagram illustrating how the profit from a long position in this option depends on the stock price 7. Suppose that a September call option to buy a share for $100 costs $5 and is held until September. Under what circumstances will the holder (long position) of the option make a profit? Under what circumstances will the option be exercised? Draw a diagram illustrating how the profit from a long position in the option depends on the stock price at maturity of the option. FIN 411 Fall 2021 Assignment1 Please answer all questions (ON YOUR OWN), do not leave any question unanswered. Show your calculations. Submission of the assignment is through LMS only. Typed answers are preferred but not required. Homework is due on 26/9/2021 at 12:30 PM 1. Assume that you have 2 choices for the same underlying asset: enter into a long forward contract at a forward price of $600 or take a long position in a call option with a strike price of $600? What is the difference between the two alternative positions? 2. Stock XYZ is currently trading at S75, and you are very bearish about the stock (you believe that the stock price is going to drop within the next two months). What action should you take, as a speculator, to gain from your expectation: short a call or put option and why? 3. You are a Saudi investor who enters into a short forward contract to sell S2,000,000 for SAR at an exchange rate of SAR 3.75/5. How much do you gain or loss if the exchange rate at the end of the contract is: a) SAR 3.85/5 b) SAR 3.65/8 4. Abdullah enters into a long oil futures contract when the futures price is $70. The contract is for the delivery of 1,000 barrels. How much does the Abdullah gain or lose if the oil price at the end of the contract is (a) 566 per barrel (b) S78 per barrel? 5. A trader shorts a June put option with a strike price of $90. The price of the option is $5. Under what circumstances does the trader make a gain? Under what circumstances does the trader make a loss? 6. Suppose that you long a put option contract with a strike price of $65 that costs $3 and expires in 3 months. The stock is currently trading at $59, and the contract is on 100 shares. a) Did you gain or lose at $597 Show your calculations b) At what range of stock prices would you gain? c) At what range of stock prices would you lose? d) At what range of stock prices should you exercise the option? c) At what range of stock prices you should not exercise the option? f) Draw a diagram illustrating how the profit from a long position in this option depends on the stock price 7. Suppose that a September call option to buy a share for $100 costs $5 and is held until September. Under what circumstances will the holder (long position) of the option make a profit? Under what circumstances will the option be exercised? Draw a diagram illustrating how the profit from a long position in the option depends on the stock price at maturity of the option