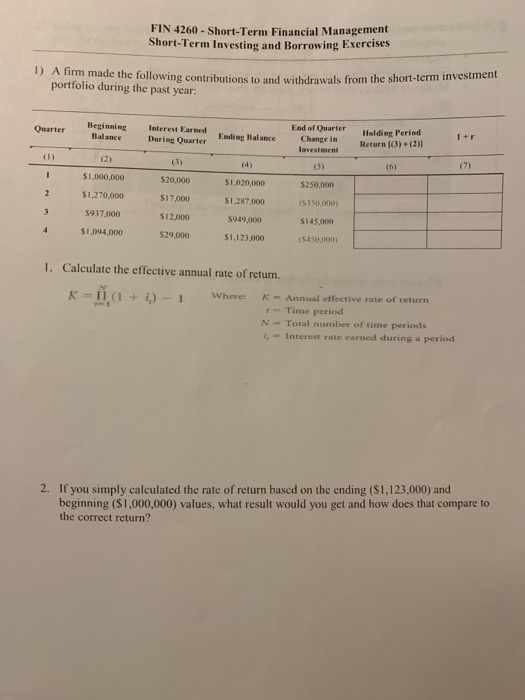

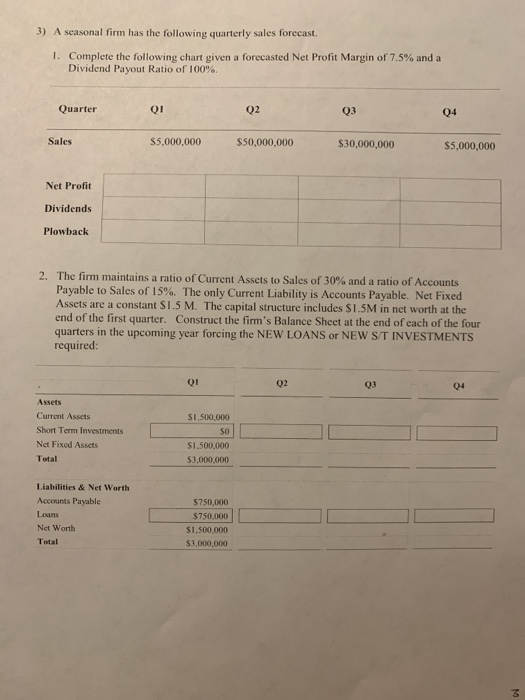

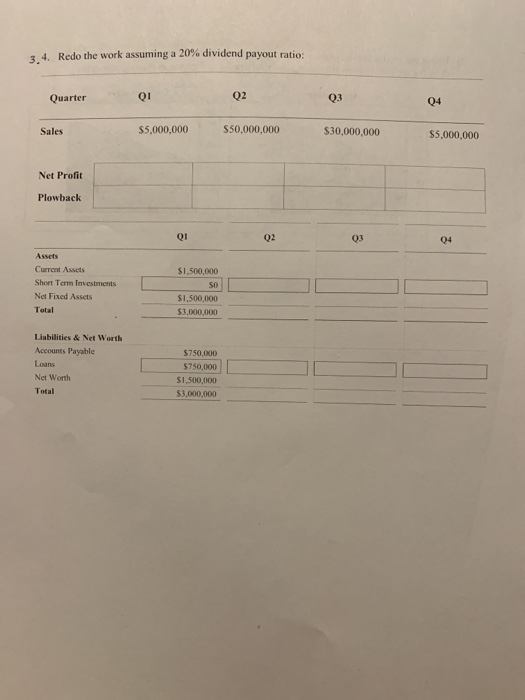

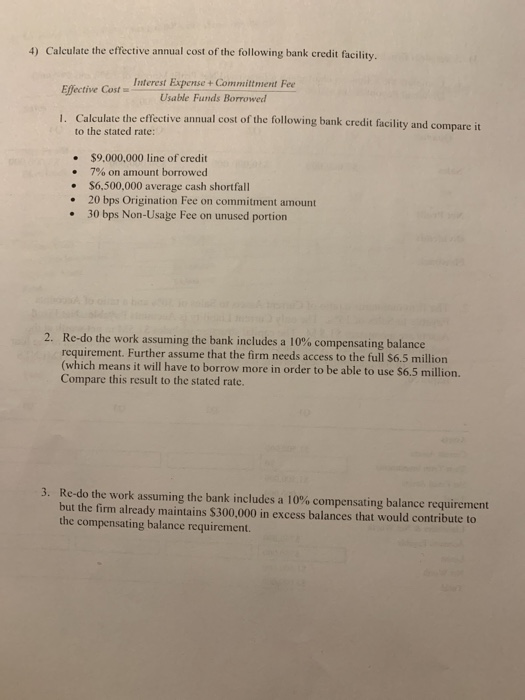

FIN 4260 - Short-Term Financial Management Short-Term Investing and Borrowing Exercises 1) A firm made the following contributions to and withdrawals from the short-term portfolio during the past year: Quarter Beginning Balance Interest Earned During Quarter Ending Balance End of Quarter Change in lavestment Helding Period Return (3) + (2) 1+r (5) $1,000,000 SI 020 000 $250,000 1530 000 $1,270,000 5937,000 $1.094.000 $20,000 $17,000 $12,000 $29,000 S1.287.000 $949,000 $1,123,000 $145.000 15150,000 1. Calculate the effective annual rate of return. K = (1 + i) - 1 1-Time period N- Total number of time periods Interest rate earned during a period 2. If you simply calculated the rate of return based on the ending (S1,123,000) and beginning ($1,000,000) values, what result would you get and how does that compare to the correct return? 3) A seasonal firm has the following quarterly sales forecast. 1. Complete the following chart given a forecasted Net Profit Margin of 7.5% and a Dividend Payout Ratio of 100% Quarter Q1 02 Q3 Sales $5,000,000 $50,000,000 $30,000,000 $5,000,000 Net Profit Dividends Plowback 2. The firm maintains a ratio of Current Assets to Sales of 30% and a ratio of Accounts Payable to Sales of 15%. The only Current Liability is Accounts Payable. Net Fixed Assets are a constant S1.5 M. The capital structure includes $1.5M in net worth at the end of the first quarter. Construct the firm's Balance Sheet at the end of each of the four quarters in the upcoming year forcing the NEW LOANS or NEW SIT INVESTMENTS required: $1,500,000 Assets Current Assets Short Term Investments Net Fixed Assets Total S1,500,000 $3.000.00 Liabilities & Net Worth Accounts Payable Loans Net Worth Total $750.000 $750.000 $1.500.000 53 000 000 34. Redo the work assuming a 20% dividend payout ratio: Quarter 01 02 03 04 Sales $5,000,000 $50,000,000 $30,000,000 $5,000,000 Net Profit Plowback Aucts Current Assets Short Term Investments Net Fixed Assets Total $1,500,000 SO $1.500.000 $1.000.000 Liabilities & Net Worth Accounts Payable $750,000 $750,000 SI 500,000 51.000.000 Net Worth 4) Calculate the effective annual cost of the following bank credit facility. Interest Expense + Commitment Fee Effective Cost = Usable Funds Borrowed 1. Calculate the effective annual cost of the following bank credit facility and compare it to the stated rate: $9,000,000 line of credit 7% on amount borrowed $6,500,000 average cash shortfall 20 bps Origination Fee on commitment amount 30 bps Non-Usage Fee on unused portion 2. Re-do the work assuming the bank includes a 10% compensating balance requirement. Further assume that the firm needs access to the full $6.5 million (which means it will have to borrow more in order to be able to use $6.5 million. Compare this result to the stated rate. 3. Re-do the work assuming the bank includes a 10% compensating balance requirement but the firm already maintains $300,000 in excess balances that would contribute to the compensating balance requirement