Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FIN 6 0 4 : Global Financial Markets and Institutions Problem Set: Lesson 2 Suppose there are n uncorrelated assets in the market. You, a

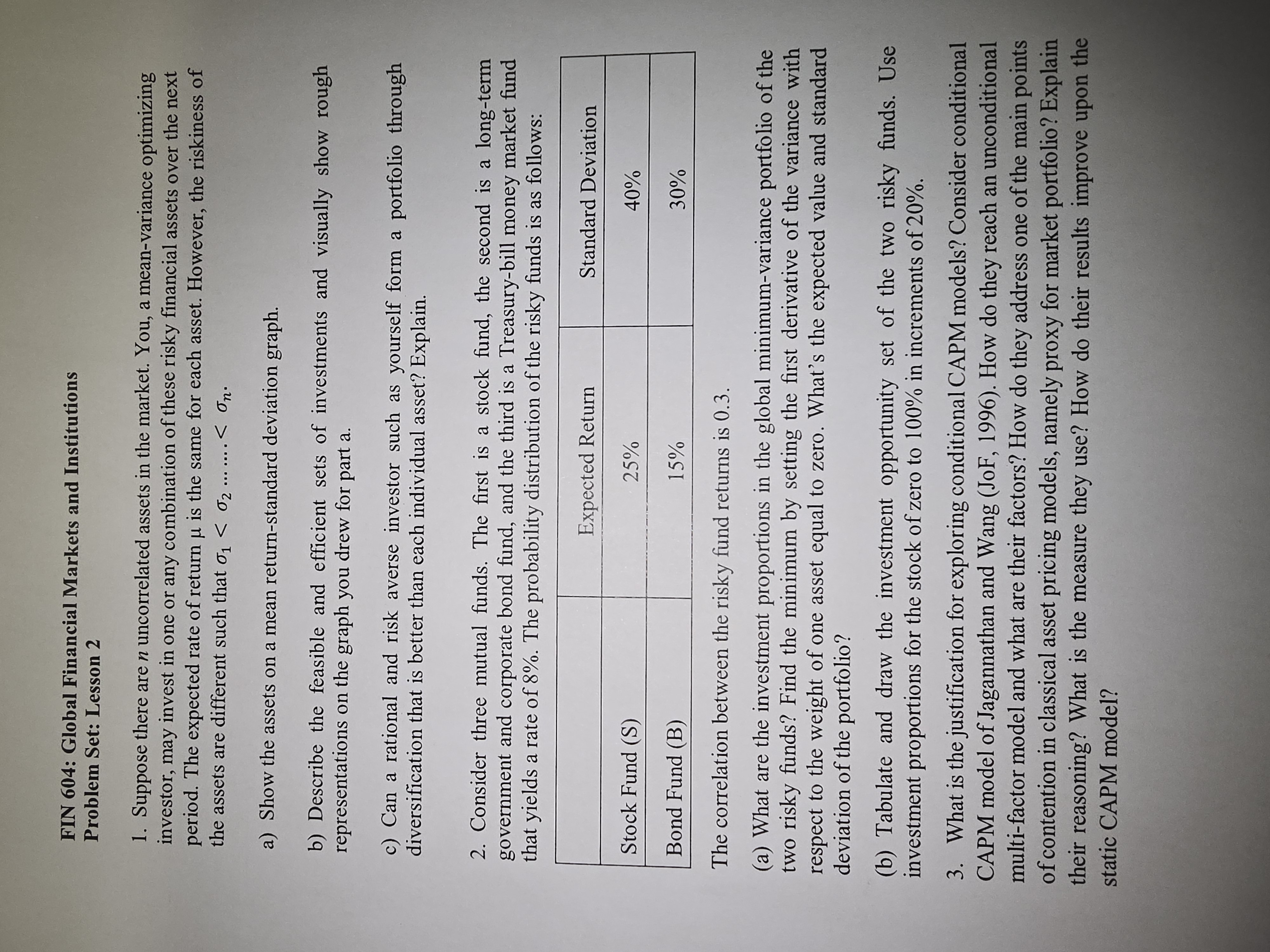

FIN : Global Financial Markets and Institutions

Problem Set: Lesson

Suppose there are uncorrelated assets in the market. You, a meanvariance optimizing

investor, may invest in one or any combination of these risky financial assets over the next

period. The expected rate of return is the same for each asset. However, the riskiness of

the assets are different such that dotsdots

a Show the assets on a mean returnstandard deviation graph.

b Describe the feasible and efficient sets of investments and visually show rough

representations on the graph you drew for part a

c Can a rational and risk averse investor such as yourself form a portfolio through

diversification that is better than each individual asset? Explain.

Consider three mutual funds. The first is a stock fund, the second is a longterm

government and corporate bond fund, and the third is a Treasurybill money market fund

that yields a rate of The probability distribution of the risky funds is as follows:

The correlation between the risky fund returns is

a What are the investment proportions in the global minimumvariance portfolio of the

two risky funds? Find the minimum by setting the first derivative of the variance with

respect to the weight of one asset equal to zero. What's the expected value and standard

deviation of the portfolio?

b Tabulate and draw the investment opportunity set of the two risky funds. Use

investment proportions for the stock of zero to in increments of

What is the justification for exploring conditional CAPM models? Consider conditional

CAPM model of Jagannathan and Wang JoF How do they reach an unconditional

multifactor model and what are their factors? How do they address one of the main points

of contention in classical asset pricing models, namely proxy for market portfolio? Explain

their reasoning? What is the measure they use? How do their results improve upon the

static CAPM model?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started