Answered step by step

Verified Expert Solution

Question

1 Approved Answer

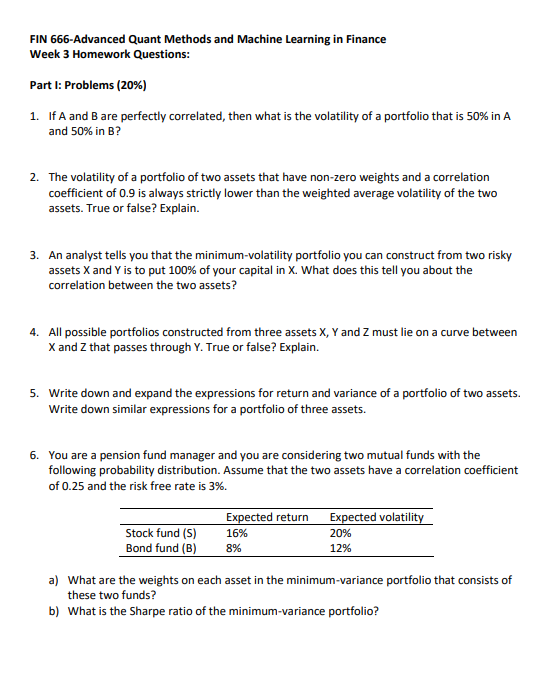

FIN 6 6 6 - Advanced Quant Methods and Machine Learning in Finance Week 3 Homework Questions: Part I: Problems ( 2 0 % )

FIN Advanced Quant Methods and Machine Learning in Finance

Week Homework Questions:

Part I: Problems

If A and are perfectly correlated, then what is the volatility of a portfolio that is in

and in

The volatility of a portfolio of two assets that have nonzero weights and a correlation

coefficient of is always strictly lower than the weighted average volatility of the two

assets. True or false? Explain.

An analyst tells you that the minimumvolatility portfolio you can construct from two risky

assets and is to put of your capital in What does this tell you about the

correlation between the two assets?

All possible portfolios constructed from three assets and must lie on a curve between

and that passes through True or false? Explain.

Write down and expand the expressions for return and variance of a portfolio of two assets.

Write down similar expressions for a portfolio of three assets.

You are a pension fund manager and you are considering two mutual funds with the

following probability distribution. Assume that the two assets have a correlation coefficient

of and the risk free rate is

a What are the weights on each asset in the minimumvariance portfolio that consists of

these two funds?

b What is the Sharpe ratio of the minimumvariance portfolio?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started