Question

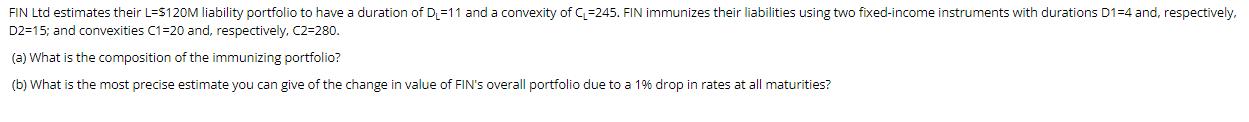

FIN Ltd estimates their L=$120M liability portfolio to have a duration of D-11 and a convexity of C=245. FIN immunizes their liabilities using two

FIN Ltd estimates their L=$120M liability portfolio to have a duration of D-11 and a convexity of C=245. FIN immunizes their liabilities using two fixed-income instruments with durations D1-4 and, respectively, D2-15; and convexities C1=20 and, respectively, C2=280. (a) What is the composition of the immunizing portfolio? (b) What is the most precise estimate you can give of the change in value of FIN's overall portfolio due to a 1% drop in rates at all maturities?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

SOLUTION a The composition of the immunizing portfolio is not explicitly given in the information provided However we can infer that one of the fixedincome instruments has a duration of D115 and a con...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fixed Income Analysis

Authors: Barbara S. Petitt

5th Edition

1119850541, 978-1119850540

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App