fin.1

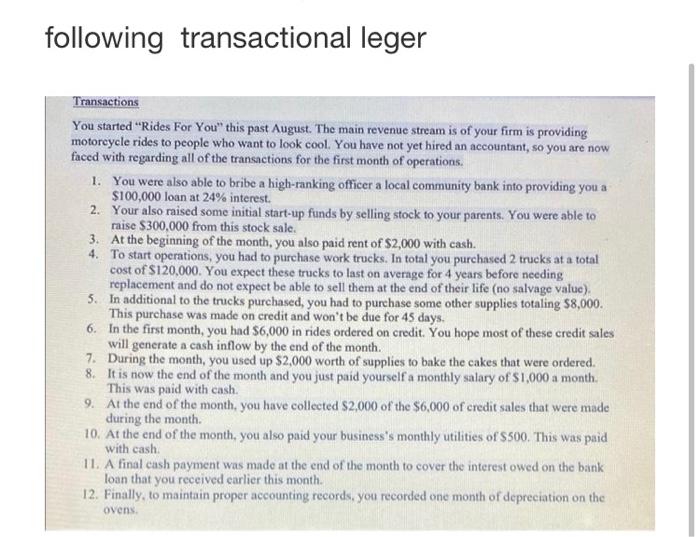

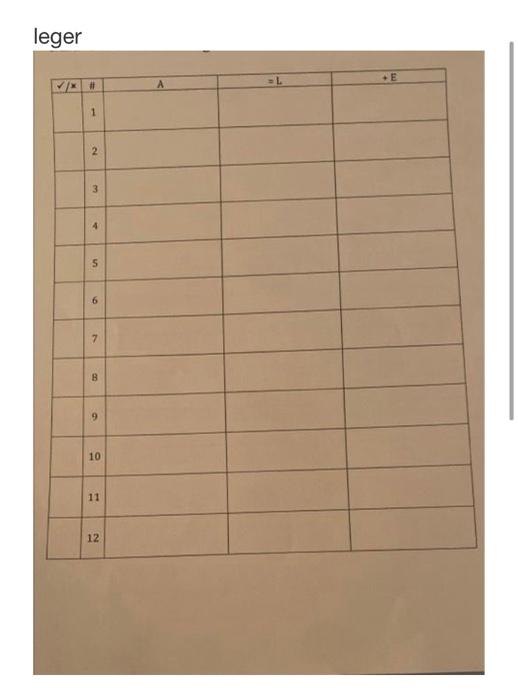

For this assignment, you will need to record the transactions for a firm in the basic accounting equation (A=L+E). Make sure to label each account accurately, record the amount of the transaction (with the appropriate positiveegative sign), and place each transaction in the appropriate blank. This assignment is worth a total of 25 points with each transaction being worth 2 points. One point will be rewarded for following instructions correctly. following transactional leger Transactions You started "Rides For You" this past August. The main revenue stream is of your firm is providing motorcycle rides to people who want to look cool. You have not yet hired an accountant, so you are now faced with regarding all of the transactions for the first month of operations. 1. You were also able to bribe a high-ranking officer a local community bank into providing you a $100,000 loan at 24% interest. 2. Your also raised some initial start-up funds by selling stock to your parents. You were able to raise $300,000 from this stock sale. 3. At the beginning of the month, you also paid rent of $2,000 with cash. 4. To start operations, you had to purchase work trucks. In total you purchased 2 trucks at a total cost of $120,000. You expect these trucks to last on average for 4 years before needing replacement and do not expect be able to sell them at the end of their life (no salvage value). 5. In additional to the trucks purchased, you had to purchase some other supplies totaling $8,000. This purchase was made on credit and won't be due for 45 days. 6. In the first month, you had $6,000 in rides ordered on credit. You hope most of these credit sales will generate a cash inflow by the end of the month. 7. During the month, you used up $2,000 worth of supplies to bake the cakes that were ordered. 8. It is now the end of the month and you just paid yourself a monthly salary of $1,000 a month. This was paid with cash. 9. At the end of the month, you have collected $2,000 of the $6,000 of credit sales that were made during the month. 10. At the end of the month, you also paid your business's monthly utilities of 5500 . This was paid with cash. 11. A final cash payment was made at the end of the month to cover the interest owed on the bank loan that you received carlier this month. 12. Finally, to maintain proper accounting records, you recorded one month of depreciation on the ovens. leger