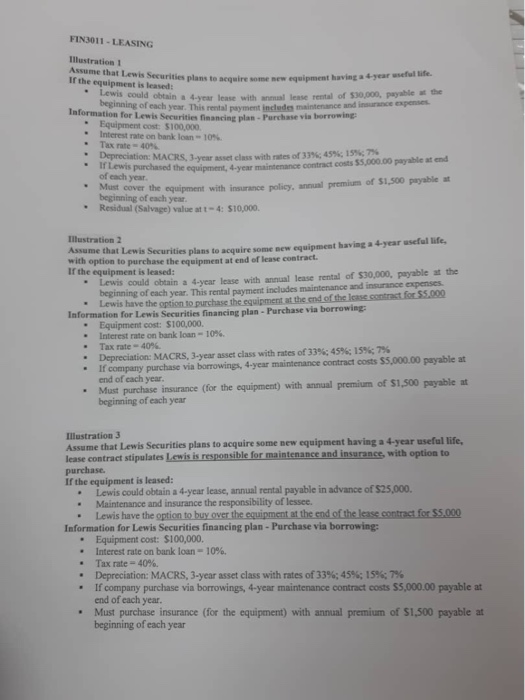

FIN3011 LEASING Illustration 1 Assume that Lewis Securities plans If the equipment is leased: te acquire some new equipment having a 4year wseful life. acq Lewis could obtaina 4-year lease with anenal lease rental of 530,000, payable at the beginning of each year. This rental payment Information for Lewis Securities financing plan- Parchase incledes maintenance and insurance expenses via borrowing Equipment cost: S100,000 Interest rate on bank loan-10%. Tax rate 40% Depreciation: MACRS, 3-year asset class with rates of 3 n; 45%, 15%;756 If Lewis purchased the equipment, 4-year maintenance contract costs 55,000.00 payable at end of each year Must cover the beginning of each year Residual (Salvage) value at t-4: $10,000. equipment with insurance policy, annual premium of $1,500 pryable at * Illustration 2 Assume that with option to purchase the equipment at If the equipment is leased: t Lewis Securities plans to acquire some new equipment having a 4-year aseful life, end of lease contract * Lewis could obtain a 4-year lease with annual lease rental of s30,000, payable at the * Lewis have the option beginning of each year. This rental payment includes maintenance and insurance expenses Information for Lewis Securities financing plan- Purchase via borrowing 10%. Equipment cost: $100,000. Interest rate on bank loan Tax rate-40%. Depreciation: MACRS, 3-year asset class with rates of 33% 45%:15% 7% * If company purchase via borrowings, 4-year maintenance contract costs $5,000.00 payable at . Must purchase insurance (for the equipment) with annual premium of $1,500 payable at . end of each year beginning of each year Illustration 3 Assume that Lewis Securities plans to acquire some new equip lease contract stipulates Lewis is responsible for maintenance and insurancs, with option to purchase If the equipment is leased: Lewis could obtain a 4-year lease, annual rental payable in advance of $25,000. Maintenance and insurance the responsibility of lessee. Information for Lewis Securities financing plan- Purchase via borrowing Equipment cost: $100,000. Interest rate on bank loan-10% Tax rate-40%. Depreciation: MACRS, 3-year asset class with rates of 33%; 45% 15% 7% If company purchase via borrowings, 4-year maintenance contract costs $5,000.00 payable at end of each year. Must purchase insurance (for the equipment) with annual premium of $1,500 payable at beginning of each year . *