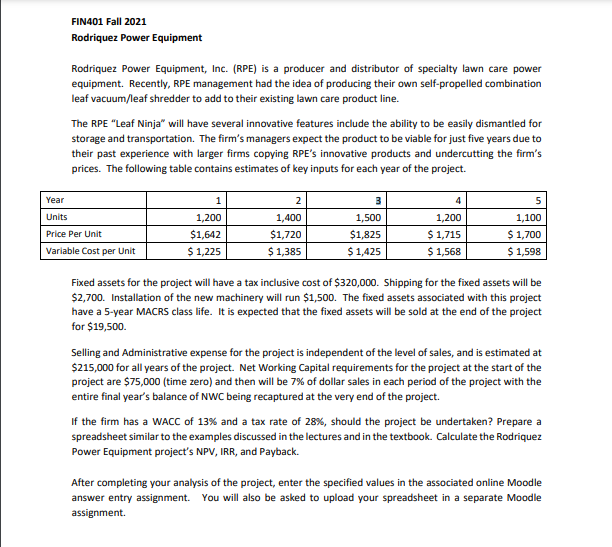

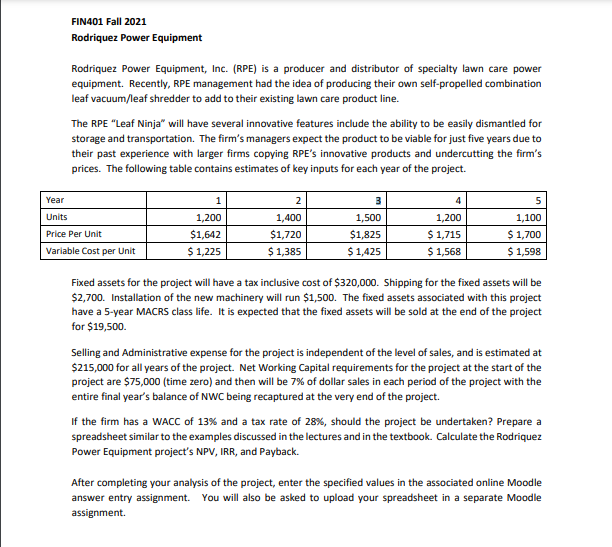

FIN401 Fall 2021 Rodriquez Power Equipment Rodriquez Power Equipment, Inc. (RPE) is a producer and distributor of specialty lawn care power equipment. Recently, RPE management had the idea of producing their own self-propelled combination leaf vacuum/leaf shredder to add to their existing lawn care product line. The RPE "Leaf Ninja" will have several innovative features include the ability to be easily dismantled for storage and transportation. The firm's managers expect the product to be viable for just five years due to their past experience with larger firms copying RPE's innovative products and undercutting the firm's prices. The following table contains estimates of key inputs for each year of the project. Year 1 4 5 Units 2 1,400 $1,720 $ 1,385 1,200 $1,642 $ 1,225 3 1,500 $1,825 $ 1,425 Price Per Unit Variable Cost per Unit 1,200 $ 1,715 $ 1,568 1,100 $ 1,700 $ 1,598 Fixed assets for the project will have a tax inclusive cost of $320,000. Shipping for the fixed assets will be $2,700. Installation of the new machinery will run $1,500. The fixed assets associated with this project have a 5-year MACRS class life. It is expected that the fixed assets will be sold at the end of the project for $19,500. Selling and Administrative expense for the project is independent of the level of sales, and is estimated at $215,000 for all years of the project. Net Working Capital requirements for the project at the start of the project are $75,000 (time zero) and then will be 7% of dollar sales in each period of the project with the entire final year's balance of NWC being recaptured at the very end of the project. If the firm has a WACC of 13% and a tax rate of 28%, should the project be undertaken? Prepare a spreadsheet similar to the examples discussed in the lectures and in the textbook. Calculate the Rodriquez Power Equipment project's NPV, IRR, and Payback. After completing your analysis of the project, enter the specified values in the associated online Moodle answer entry assignment. You will also be asked to upload your spreadsheet in a separate Moodle assignment. FIN401 Fall 2021 Rodriquez Power Equipment Rodriquez Power Equipment, Inc. (RPE) is a producer and distributor of specialty lawn care power equipment. Recently, RPE management had the idea of producing their own self-propelled combination leaf vacuum/leaf shredder to add to their existing lawn care product line. The RPE "Leaf Ninja" will have several innovative features include the ability to be easily dismantled for storage and transportation. The firm's managers expect the product to be viable for just five years due to their past experience with larger firms copying RPE's innovative products and undercutting the firm's prices. The following table contains estimates of key inputs for each year of the project. Year 1 4 5 Units 2 1,400 $1,720 $ 1,385 1,200 $1,642 $ 1,225 3 1,500 $1,825 $ 1,425 Price Per Unit Variable Cost per Unit 1,200 $ 1,715 $ 1,568 1,100 $ 1,700 $ 1,598 Fixed assets for the project will have a tax inclusive cost of $320,000. Shipping for the fixed assets will be $2,700. Installation of the new machinery will run $1,500. The fixed assets associated with this project have a 5-year MACRS class life. It is expected that the fixed assets will be sold at the end of the project for $19,500. Selling and Administrative expense for the project is independent of the level of sales, and is estimated at $215,000 for all years of the project. Net Working Capital requirements for the project at the start of the project are $75,000 (time zero) and then will be 7% of dollar sales in each period of the project with the entire final year's balance of NWC being recaptured at the very end of the project. If the firm has a WACC of 13% and a tax rate of 28%, should the project be undertaken? Prepare a spreadsheet similar to the examples discussed in the lectures and in the textbook. Calculate the Rodriquez Power Equipment project's NPV, IRR, and Payback. After completing your analysis of the project, enter the specified values in the associated online Moodle answer entry assignment. You will also be asked to upload your spreadsheet in a separate Moodle assignment