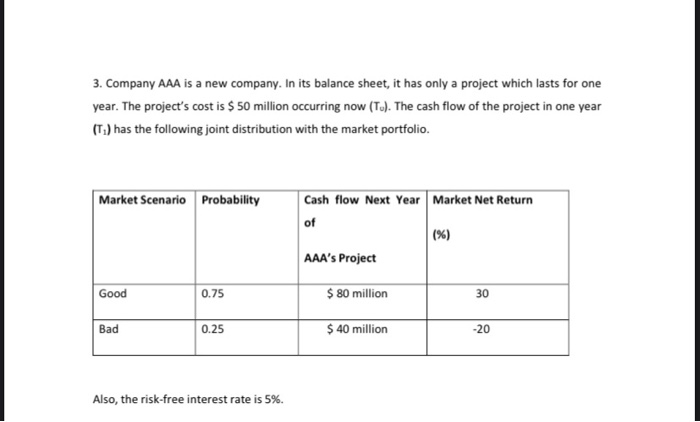

FINA 2311: Case studies in corporate finance Assignment 2 1. In a two-date (date 0 and 1) binomial model with perfect market assumption, Company AA has existing projects that generate a cash flow worth $ 100 million at date I if the up state occurs and S50 million if the down state occurs. Assume no taxes, a risk-free rate of 0, and risk-neutral probabilities of 50% attached to each of the two states. AA currently has debt maturing at date 1 with a face value of $ 60 million. It has 1 million shares outstanding Suppose Company AA unexpectedly announces that it will issue additional debt, with the same seniority as existing debt and a face value $ 10 million. The company will use the entire proceeds to repurchase back some of the outstanding shares. Just after the announcement, what will be the share price of AA? How many outstanding shares will be repurchased back? 2. Ms White owns 50,000 shares of the common stock of IBM Corporation with a market value of $2 per share, or $100, 000 overall. The company is currently financed as follows: Book Value Common Stock $2,000,000 (8 million shares) Short-term loans $2,000,000 IBM now announces that it is replacing Si million of short-term debt with an issue of common stock. What can Ms White do to make her position same as before in terms of return-risk trade-off)? (Ignore taxes) 3. Company AAA is a new company. In its balance sheet, it has only a project which lasts for one year. The project's cost is $ 50 million occurring now (T.). The cash flow of the project in one year (T.) has the following joint distribution with the market portfolio. Market Scenario Probability Cash flow Next Year Market Net Return (%) AAA's Project Good 0.75 $ 80 million 30 Bad $ 40 million 220 Also, the risk-free interest rate is 5%. Suppose there are no corporate tax or other frictions. Do questions 5)-7) 5) Suppose the company finances the project entirely by its internal capital. What is the (net) expected return of equity, re? 6) Suppose the company issues one-year zero-coupon corporate bonds with face value F= 21 and the remaining funding from the internal capital to finance the project. What is the cash flow at T for the debtholders and for the equityholder, respectively? What are the market value of debt and the market value of equity at To? What are the (net) expected return of debt (ro) and the (net) expected return of equity (re)? Give the MM2 equation. 7) Suppose the company issues one-year zero-coupon corporate bonds with face value F= 50 and the remaining funding from the internal capital to finance the project. What is the cash flow at T for the debtholders and for the equityholder, respectively? What are the market value of debt and the market value of equity at T.? What are the (net) expected return of debt (ro) and the (net) expected return of equity (re)? Give the MM2 equation FINA 2311: Case studies in corporate finance Assignment 2 1. In a two-date (date 0 and 1) binomial model with perfect market assumption, Company AA has existing projects that generate a cash flow worth $ 100 million at date I if the up state occurs and S50 million if the down state occurs. Assume no taxes, a risk-free rate of 0, and risk-neutral probabilities of 50% attached to each of the two states. AA currently has debt maturing at date 1 with a face value of $ 60 million. It has 1 million shares outstanding Suppose Company AA unexpectedly announces that it will issue additional debt, with the same seniority as existing debt and a face value $ 10 million. The company will use the entire proceeds to repurchase back some of the outstanding shares. Just after the announcement, what will be the share price of AA? How many outstanding shares will be repurchased back? 2. Ms White owns 50,000 shares of the common stock of IBM Corporation with a market value of $2 per share, or $100, 000 overall. The company is currently financed as follows: Book Value Common Stock $2,000,000 (8 million shares) Short-term loans $2,000,000 IBM now announces that it is replacing Si million of short-term debt with an issue of common stock. What can Ms White do to make her position same as before in terms of return-risk trade-off)? (Ignore taxes) 3. Company AAA is a new company. In its balance sheet, it has only a project which lasts for one year. The project's cost is $ 50 million occurring now (T.). The cash flow of the project in one year (T.) has the following joint distribution with the market portfolio. Market Scenario Probability Cash flow Next Year Market Net Return (%) AAA's Project Good 0.75 $ 80 million 30 Bad $ 40 million 220 Also, the risk-free interest rate is 5%. Suppose there are no corporate tax or other frictions. Do questions 5)-7) 5) Suppose the company finances the project entirely by its internal capital. What is the (net) expected return of equity, re? 6) Suppose the company issues one-year zero-coupon corporate bonds with face value F= 21 and the remaining funding from the internal capital to finance the project. What is the cash flow at T for the debtholders and for the equityholder, respectively? What are the market value of debt and the market value of equity at To? What are the (net) expected return of debt (ro) and the (net) expected return of equity (re)? Give the MM2 equation. 7) Suppose the company issues one-year zero-coupon corporate bonds with face value F= 50 and the remaining funding from the internal capital to finance the project. What is the cash flow at T for the debtholders and for the equityholder, respectively? What are the market value of debt and the market value of equity at T.? What are the (net) expected return of debt (ro) and the (net) expected return of equity (re)? Give the MM2 equation