Question

FINA5352 Corp. is considering leasing an asset out. Here are the relevant facts: $900,000 Straight line over 6 years to a zero residual value

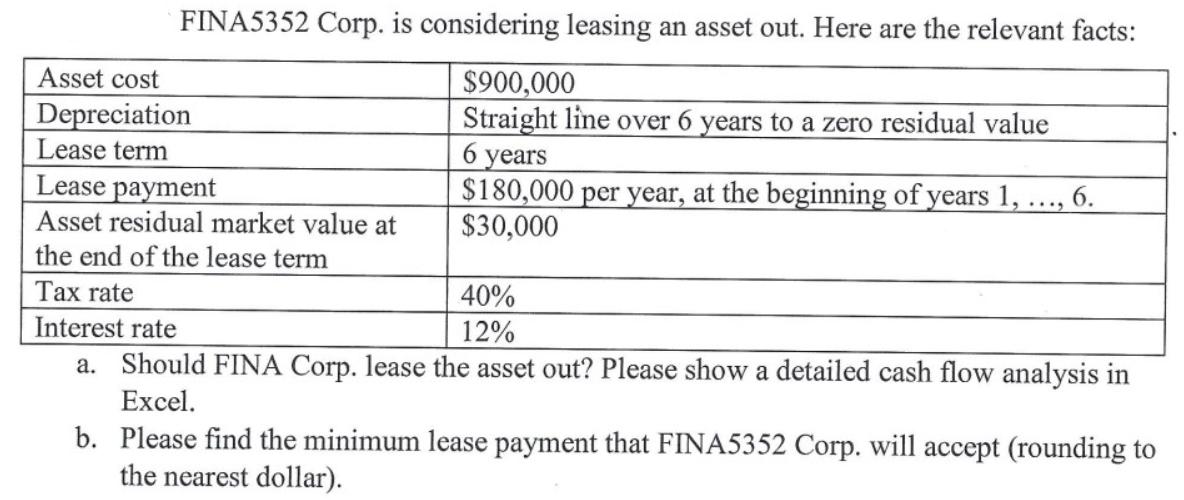

FINA5352 Corp. is considering leasing an asset out. Here are the relevant facts: $900,000 Straight line over 6 years to a zero residual value 6 years $180,000 per year, at the beginning of years 1, ..., 6. $30,000 Asset cost Depreciation Lease term Lease payment Asset residual market value at the end of the lease term Tax rate 40% 12% Interest rate a. Should FINA Corp. lease the asset out? Please show a detailed cash flow analysis in Excel. b. Please find the minimum lease payment that FINA5352 Corp. will accept (rounding to the nearest dollar).

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a To determine whether FINA5352 Corp should lease the asset out we need to compare the present value of cash inflows lease payments and residual value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Modeling

Authors: Simon Benninga

4th Edition

0262027283, 9780262027281

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App