Final decision with supportive numbers

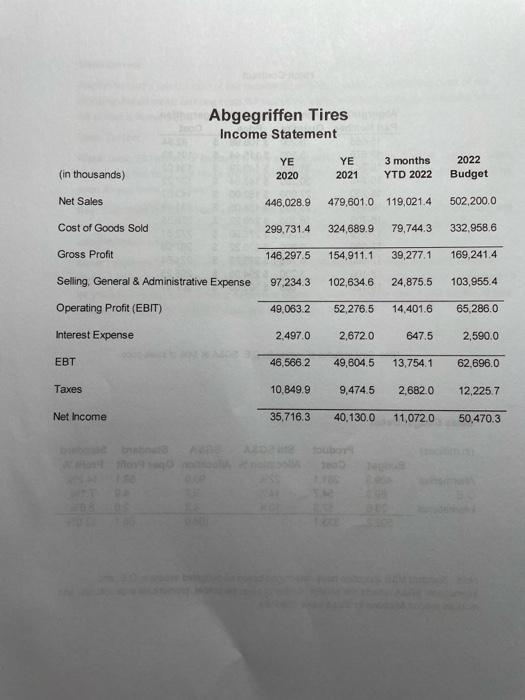

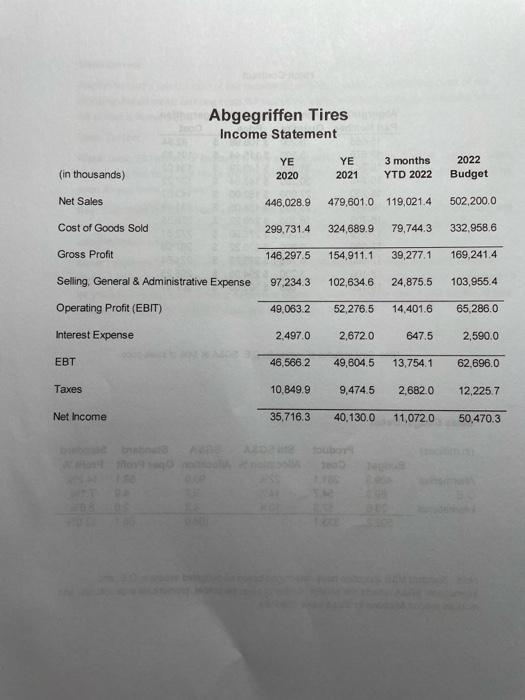

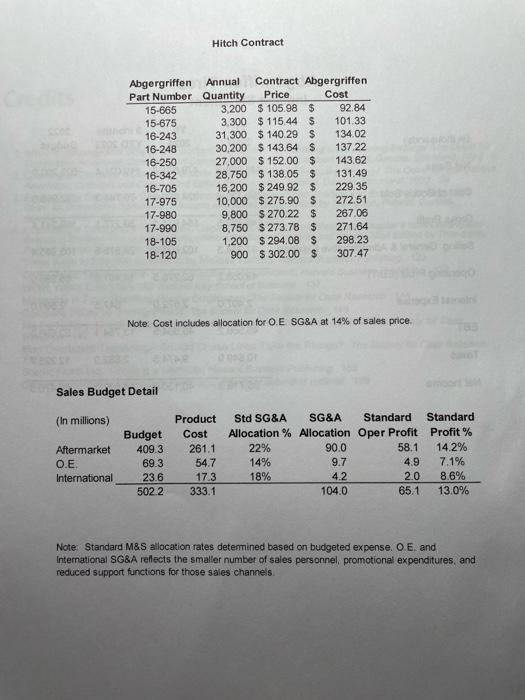

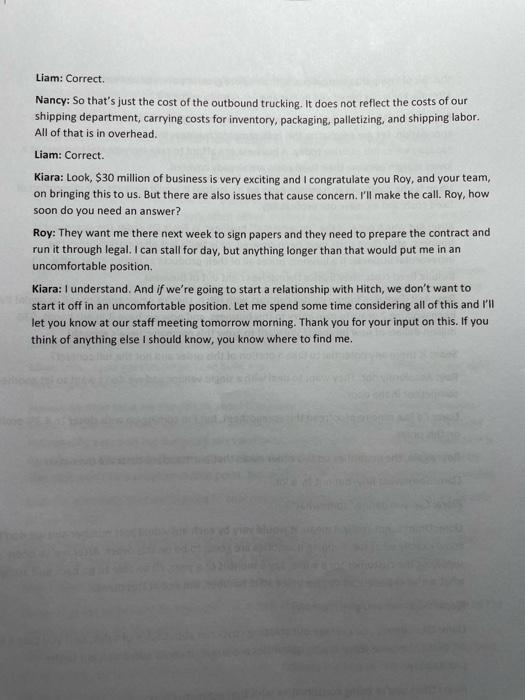

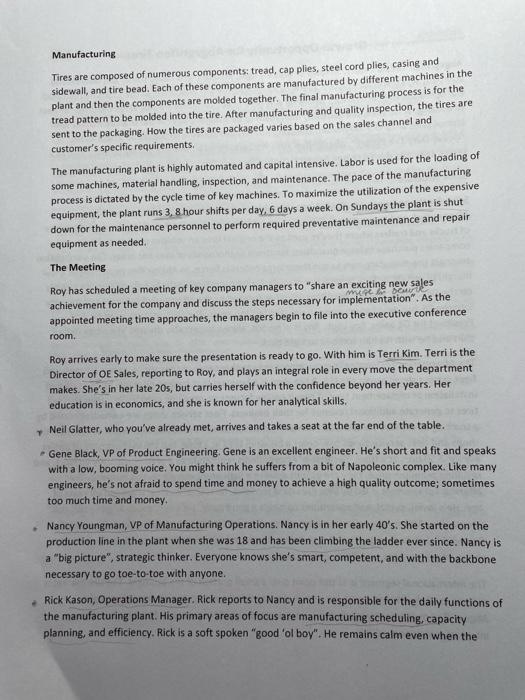

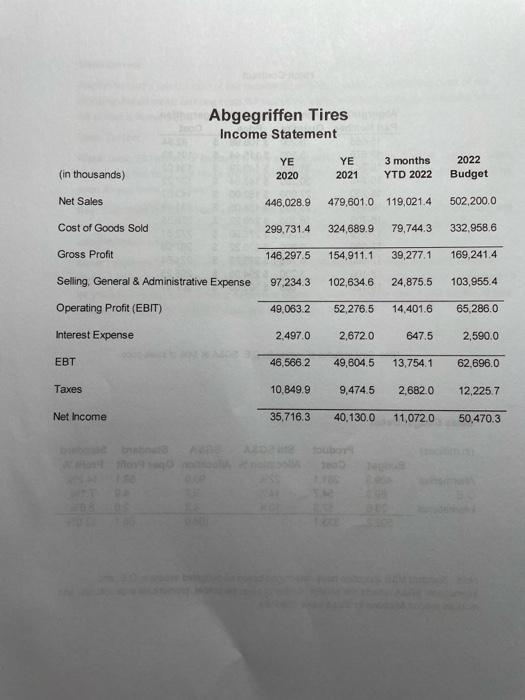

Abgegriffen Tires Income Statement (in thousands) YE 2020 YE 2021 3 months YTD 2022 2022 Budget Net Sales 446,028.9 479,601.0 119,021.4 502,200.0 Cost of Goods Sold 299.731.4 324,689.9 79,744.3 332,958,6 Gross Profit 146.297.5 154.911.1 39,277.1 169,241.4 Seling, General & Administrative Expense 97 2343 102,634.6 24,875.5 103,955.4 Operating Profit (EBIT) 49,0632 52,276.5 14,401.6 65.286.0 Interest Expense 2,497.0 2,672.0 647.5 2,590.0 EBT 46,566.2 49,8045 13,754.1 62,696.0 Taxes 10,849.9 9,474.5 2,682.0 12,225.7 Net Income 35.716.3 40,130.0 11,072.0 50,470.3 bor Hitch Contract Abgergriffen Annual Contract Abgergriffen Part Number Quantity Price Cost 15-665 3,200 $ 105.98 $ 92.84 15-675 3,300 $ 115.44 $ 101.33 16-243 31,300 $ 140.29 $ 134.02 16-248 30,200 $143.64 $ 137 22 16-250 27,000 $152.00 $ 143.62 16-342 28,750 $ 138.05 $ 131.49 16-705 16,200 $ 249.92 $ 229.35 17-975 10,000 $275.90 $ 272.51 17-980 9,800 $ 270.22 $ 267.06 17-990 8.750 $273.78 $ 271.64 18-105 1.200 $294.08 $ 298.23 18-120 900 $302.00 $ 307 47 Note: Cost includes allocation for O.E SG&A at 14% of sales price, Sales Budget Detail (In millions) Aftermarket O.E International Budget 409.3 69.3 23.6 502.2 Product Cost 261.1 54.7 17.3 333.1 Std SG&A SG&A Standard Standard Allocation % Allocation Oper Profit Profit % 22% 90.0 58.1 14.2% 14% 9.7 4.9 7.1% 18% 4.2 2.0 8.6% 104.0 65.1 13.0% Note Standard M&S allocation rates determined based on budgeted expense. O. Eand International SG&A reflects the smaller number of sales personnel, promotional expenditures, and reduced support functions for those sales channels Liam: Correct. Nancy: So that's just the cost of the outbound trucking. It does not reflect the costs of our shipping department, carrying costs for inventory, packaging, palletizing, and shipping labor. All of that is in overhead Liam: Correct. Kiara: Look, $30 million of business is very exciting and I congratulate you Roy, and your team, on bringing this to us. But there are also issues that cause concern. I'll make the call. Roy, how soon do you need an answer? Roy: They want me there next week to sign papers and they need to prepare the contract and run it through legal. I can stall for day, but anything longer than that would put me in an uncomfortable position Kiara: I understand. And if we're going to start a relationship with Hitch, we don't want to start it off in an uncomfortable position. Let me spend some time considering all of this and I'll let you know at our staff meeting tomorrow morning. Thank you for your input on this. If you think of anything else I should know, you know where to find me. the risk of losing that customer and their future growth potential permanently. The aftermarket is our bread and butter and we need to protect it. Roy: This is $30 million dollars of new business! No hedging necessary, it's here, it's not speculation. Let me emphasize this is incremental business that will take advantage of capacity we're not utilizing today. A business can afford to take incremental business at a lower margin because their fixed costs are already covered. Liam: (as he continues to hammer away on his laptop) It would increase our absorption of fixed costs and increase our profitability. Elise: But which order is the "incremental" business. Is Roy's OE order the incremental business, after fixed costs have been covered, or is Neil's last aftermarket order the incremental business. If a business prices all of their products as incremental and don't include fixed costs, they'll price themselves right out of business. Roy: And if we don't jump on this contract with Hitch, they're never going to call us again! I've been working 2 years to gain entry to this business, and now we have it in our hands. $30 million dollars of new business! We want to grow this company, here's growth! Sean: Is there any potential to take a portion of this order and not the full contact? Roy: Absolutely not. They want to deal with a single vendor and we don't want to let another competitor in the door Liam: I'd like time to proofread this spreadsheet, but I'm coming up with closer to 4.3% profit on this order. Roy: Again, the quantities on this order mean that our standard costs are over-stated. Liam: Somewhat Roy, but not by a lot. Kiara: Can you define "somewhat"? Liam: Umm.....not really. I mean, it would vary by each individual part number and we don't know exactly what the shipping quantities are going to be on this order. After we've been supplying the customer for a while, say 6 months or a year, I'll be able to go back and analyze what we've experienced to give you a solid number. But not at this point. Kiara: What can you give me now? Liam: Ok...umm...on average our shipping costs run about 6.5% of sales, so if you take a little off of that because the shipping quantities are larger, it could add a percent to the profitability Roy: I think you're being conservative with that estimate Liam. Neil: Of course you do Roy. (Roy glares at Neil) Nancy: Liam, the 6.5% you're referring to is in Selling Expense? a Sean: Of course, renting warehouse will add cost and building inventory has carrying costs; which will reduce our profitability to some extent. Kiara: What's the profit on this contract? Terri: Well, I haven't had the details long enough to come up with an exact number, but I think it will be around 5% operating profit. Neit: Oof! 5%? That's a third of our normal profit! Roy: Oh come on Neill You know O.E. business is a different animal. You don't get $30 million orders from a single customer very often either. Besides our standard product costs are built around smaller production runs and smaller shipping sizes, so the true profitability is understated for an order of this size. Liam: I'm not sure these quantities will have much of an impact on the size of our production runs, but you're right that the shipping quantities will probably be greater than our assumed order quantities. So, yes, shipping and packaging costs will probably be lower than what's included in the standard costs. Kiara: So Liam, is the 5% profit correct at standard? Liam: Uhh....I just got this detail. I can build a spreadsheet and come up with the answer right here.....give me a few minutes. Nancy: Another issue we should talk about is our overall plant capacity. Of course it varies based on specific product needs, labor, and order timing, but I estimate we're at 93% of our full capacity based on our budgeted sales and sales mix. When the planned plant expansion is completed in 18 months, if construction stays on schedule, our capacity will be bumped by 20% so it won't be a problem at that point. But until then, it's something we need to consider. Neil: I'm optimistic that we're going to beat our sales budget for aftermarket, will we be able to handle that? Rick: I need to plug this order into our capacity planning to give you a solid answer. It also depends on how much you're talking about when you say you'll beat your budget? Neil: I don't like to show my cards until I have to. Let's just say I'm optimistic. Kiara: That vague answer isn't going to cut it Neil. If you had to estimate, and let's pretend I'm saying you must, what would you estimate? Neil: Well...understand that it's only in the 2nd inning, but I'm optimistic we'll be able to beat the budget by up to 6%. The growth "last mile" delivery is going to help us. Elise: "Up to 6%"? You're hedging again Neil Nell: You betiam. It's too early in the year to be confident. And this talk of capacity concerns me! If one of our customers calls to order tires and we don't have the ability to deliver what he wants, he's going to call a competitor. And once we let a competitor in their door, we run proverbial shit is hitting the fan. He practically wrote the book on the company's ERP system and his management of the plant is considered one of the company's competitive advantages. Sean Finney, VP of Finance. He's a solid head of finance but is more comfortable reviewing the trial balance than doing analysis. He's quiet and avoids confrontation Liam Kim, Cost Analyst. Liam reports to Sean Finney. Llam is in late 20s with a background in accounting and finance. His role to maintain the accuracy of the company's product costing system and conduct profitability analysis. He's smart and cocky, Elise Verschelden, VP of International. While this particular sales opportunity has only an indirect impact on her area of responsibility, she is considered a key member of the executive team and is a part of all strategic decisions Finally, you, Kiara Sommit. President of Abgergriffen. Roy: Thanks for coming on such short notice. I've got some exciting news for us. You're all familiar with "Hitch" brand trailers. You can't drive down the highway without seeing their trailers on the road. They are, in fact, the largest flatbed and enclosed trailer manufacturer in the U.S. Well, for the past 4 years they've been purchasing all of their OE tires from the Asian manufacturer, Enatsu. I've been calling on Hitch for the past two years to develop a relationship and hopefully get a crack at this business. This effort has paid off. Due to both production issues and interruptions in international shipping, Enatsu's on-time delivery to Hitch has been...sporadic. Frustrated with Enatsu's performance, Hitch has offered us the contract if we match Enatsu's price. This is $30,000,000 of large volume, new business annually! They're ready for me to fly to St. Louis early next week to sign the contract and we'll start delivering product to them in 60 days. I just received the specifics on the tire sizes and quantities this morning. Terri has crossed their tires requirements to our part numbers and the information is on the table in front of you. This is a real homerun for us! We've been focused on this Hitch business for a couple years and we've finally cracked it. They're a growing company, so this $30 million will only go up in future years. My question, for Nancy and Rick, is do you see any problem with us starting deliveries in 60 days? Nancy: What's the timing on these items....I mean are they spread out evenly over the course of the year? Roy: It's my understanding that it's fairly even over the year, but with some bump in the spring which is their busiest sales season. Neil: That's our busiest season as well. Rick: Well....I'll have to dig into the details, but I'm pretty comfortable that we have capacity on an annual basis to add this production. We may have to build some inventory during the winter and temporarily rent some additional warehouse space to make sure we can cover everyone's needs during the busy spring season, but we can manage that. Manufacturing Tires are composed of numerous components: tread, cap plies, steel cord plies, casing and sidewall, and tire bead. Each of these components are manufactured by different machines in the plant and then the components are molded together. The final manufacturing process is for the tread pattern to be molded into the tire. After manufacturing and quality inspection, the tires are sent to the packaging. How the tires are packaged varies based on the sales channel and customer's specific requirements. The manufacturing plant is highly automated and capital intensive. Labor is used for the loading of some machines, material handling, inspection, and maintenance. The pace of the manufacturing process is dictated by the cycle time of key machines. To maximize the utilization of the expensive equipment, the plant runs 3,8 hour shifts per day, 6 days a week. On Sundays the plant is shut down for the maintenance personnel to perform required preventative maintenance and repair equipment as needed. The Meeting Roy has scheduled a meeting of key company managers to "share an exciting new sales DOMU achievement for the company and discuss the steps necessary for implementation". As the appointed meeting time approaches, the managers begin to file into the executive conference room. Roy arrives early to make sure the presentation is ready to go. With him is Terri Kim. Terri is the Director of OE Sales, reporting to Roy, and plays an integral role in every move the department makes. She's in her late 20s, but carries herself with the confidence beyond her years. Her education is in economics, and she is known for her analytical skills. Neil Glatter, who you've already met, arrives and takes a seat at the far end of the table. - Gene Black, VP of Product Engineering, Gene is an excellent engineer. He's short and fit and speaks with a low, booming voice. You might think he suffers from a bit of Napoleonic complex. Like many engineers, he's not afraid to spend time and money to achieve a high quality outcome; sometimes too much time and money, Nancy Youngman, VP of Manufacturing Operations. Nancy is in her early 40's. She started on the production line in the plant when she was 18 and has been climbing the ladder ever since. Nancy is a "big picture", strategic thinker. Everyone knows she's smart, competent, and with the backbone necessary to go toe-to-toe with anyone. Rick Kason, Operations Manager. Rick reports to Nancy and is responsible for the daily functions of the manufacturing plant. His primary areas of focus are manufacturing scheduling, capacity planning, and efficiency. Rick is a soft spoken "good ol boy". He remains calm even when the Growth Opportunity for Abgegriffen Tires Abgegriffen Tires is a manufacturer of tires for light, medium, and heavy trucks and trailers. The company was started in the late 1940s by J.A. Abgegriffen in Wisconsin. In the 1950s he relocated the operation to South Dakota where he was able to acquire some surplus WWII buildings for next to nothing. Since then, the company has grown to be a major player in the U.S. tire market with annual sales around $500 million. The company has developed a strong brand image as the "Heavy-Duty Tire People". Abgegriffen Tires are considered a premium quality product and, as a result, they are able to charge a premium price for their tires. Sales Structure Sales for the company are divided into three broad segments: Original Equipment (OE), Aftermarket, and International. The CE segment includes tires sold directly to the manufacturers of trucks and trailers where they're used as the original tires on vehicles produced. These companies purchase in large quantities, hundreds or thousands of tires per order. The competition amongst tire manufacturers to win these large orders is fierce, so Abgegriffen must price at a low margin to win OE orders. Several tire manufacturing companies focus heavily or even exclusively on the OE market. Historically Abgegriffen has focused on the aftermarket business and its entry into the OE business has occurred in only the last ten years. The OE sales unit is led by Vice President for OE Sales, Roy Laut. Roy is in his 50s, always impeccably dressed in a white oxford shirt and tie with his hair combed straight back. The Aftermarket segment sells replacement tires to thousands of tires shops, repair garages, and fleet service shops across the U.S. A tire shop is a business that focuses primarily on the sale and installation of replacement tires. A repair garage focuses on repairing vehicles, but they also sell tires to generate additional revenue for their business. Fleet service shops are owned/operated by a trucking or delivery company to maintain exclusively their fleet of vehicles. A few of the large tire shops and fleet service shops may order a hundred tires at a time, but the vast majority of orders are for 2-50 tires at a time. Because of Abgegriffen's reputation as a premium quality product, and resulting premium price, they are able to achieve a high profit margin on this business. The aftermarket segment is led by Vice President for Sales, Neal Glatter. Neal is around 60 years of age. He's jovial, casual, and sometimes commits a good gaffe. He's very much a "glass-half-full" personality. Aftermarket sales are divided into 4 regions in the U.S., each led by a Director of Regional Sales. Each region has 3-5 company employed salespeople that call directly on the tire shops, repair garages, and fleet service shops. The International segment is at this point only a small portion of the business. The tire market is mature in all developed countries with major manufacturers scattered across the globe. Abgegriffen only recently started to invest personnel and resources to focus on developing international opportunities Abgegriffen Tires Income Statement (in thousands) YE 2020 YE 2021 3 months YTD 2022 2022 Budget Net Sales 446,028.9 479,601.0 119,021.4 502,200.0 Cost of Goods Sold 299.731.4 324,689.9 79,744.3 332,958,6 Gross Profit 146.297.5 154.911.1 39,277.1 169,241.4 Seling, General & Administrative Expense 97 2343 102,634.6 24,875.5 103,955.4 Operating Profit (EBIT) 49,0632 52,276.5 14,401.6 65.286.0 Interest Expense 2,497.0 2,672.0 647.5 2,590.0 EBT 46,566.2 49,8045 13,754.1 62,696.0 Taxes 10,849.9 9,474.5 2,682.0 12,225.7 Net Income 35.716.3 40,130.0 11,072.0 50,470.3 bor Hitch Contract Abgergriffen Annual Contract Abgergriffen Part Number Quantity Price Cost 15-665 3,200 $ 105.98 $ 92.84 15-675 3,300 $ 115.44 $ 101.33 16-243 31,300 $ 140.29 $ 134.02 16-248 30,200 $143.64 $ 137 22 16-250 27,000 $152.00 $ 143.62 16-342 28,750 $ 138.05 $ 131.49 16-705 16,200 $ 249.92 $ 229.35 17-975 10,000 $275.90 $ 272.51 17-980 9,800 $ 270.22 $ 267.06 17-990 8.750 $273.78 $ 271.64 18-105 1.200 $294.08 $ 298.23 18-120 900 $302.00 $ 307 47 Note: Cost includes allocation for O.E SG&A at 14% of sales price, Sales Budget Detail (In millions) Aftermarket O.E International Budget 409.3 69.3 23.6 502.2 Product Cost 261.1 54.7 17.3 333.1 Std SG&A SG&A Standard Standard Allocation % Allocation Oper Profit Profit % 22% 90.0 58.1 14.2% 14% 9.7 4.9 7.1% 18% 4.2 2.0 8.6% 104.0 65.1 13.0% Note Standard M&S allocation rates determined based on budgeted expense. O. Eand International SG&A reflects the smaller number of sales personnel, promotional expenditures, and reduced support functions for those sales channels Liam: Correct. Nancy: So that's just the cost of the outbound trucking. It does not reflect the costs of our shipping department, carrying costs for inventory, packaging, palletizing, and shipping labor. All of that is in overhead Liam: Correct. Kiara: Look, $30 million of business is very exciting and I congratulate you Roy, and your team, on bringing this to us. But there are also issues that cause concern. I'll make the call. Roy, how soon do you need an answer? Roy: They want me there next week to sign papers and they need to prepare the contract and run it through legal. I can stall for day, but anything longer than that would put me in an uncomfortable position Kiara: I understand. And if we're going to start a relationship with Hitch, we don't want to start it off in an uncomfortable position. Let me spend some time considering all of this and I'll let you know at our staff meeting tomorrow morning. Thank you for your input on this. If you think of anything else I should know, you know where to find me. the risk of losing that customer and their future growth potential permanently. The aftermarket is our bread and butter and we need to protect it. Roy: This is $30 million dollars of new business! No hedging necessary, it's here, it's not speculation. Let me emphasize this is incremental business that will take advantage of capacity we're not utilizing today. A business can afford to take incremental business at a lower margin because their fixed costs are already covered. Liam: (as he continues to hammer away on his laptop) It would increase our absorption of fixed costs and increase our profitability. Elise: But which order is the "incremental" business. Is Roy's OE order the incremental business, after fixed costs have been covered, or is Neil's last aftermarket order the incremental business. If a business prices all of their products as incremental and don't include fixed costs, they'll price themselves right out of business. Roy: And if we don't jump on this contract with Hitch, they're never going to call us again! I've been working 2 years to gain entry to this business, and now we have it in our hands. $30 million dollars of new business! We want to grow this company, here's growth! Sean: Is there any potential to take a portion of this order and not the full contact? Roy: Absolutely not. They want to deal with a single vendor and we don't want to let another competitor in the door Liam: I'd like time to proofread this spreadsheet, but I'm coming up with closer to 4.3% profit on this order. Roy: Again, the quantities on this order mean that our standard costs are over-stated. Liam: Somewhat Roy, but not by a lot. Kiara: Can you define "somewhat"? Liam: Umm.....not really. I mean, it would vary by each individual part number and we don't know exactly what the shipping quantities are going to be on this order. After we've been supplying the customer for a while, say 6 months or a year, I'll be able to go back and analyze what we've experienced to give you a solid number. But not at this point. Kiara: What can you give me now? Liam: Ok...umm...on average our shipping costs run about 6.5% of sales, so if you take a little off of that because the shipping quantities are larger, it could add a percent to the profitability Roy: I think you're being conservative with that estimate Liam. Neil: Of course you do Roy. (Roy glares at Neil) Nancy: Liam, the 6.5% you're referring to is in Selling Expense? a Sean: Of course, renting warehouse will add cost and building inventory has carrying costs; which will reduce our profitability to some extent. Kiara: What's the profit on this contract? Terri: Well, I haven't had the details long enough to come up with an exact number, but I think it will be around 5% operating profit. Neit: Oof! 5%? That's a third of our normal profit! Roy: Oh come on Neill You know O.E. business is a different animal. You don't get $30 million orders from a single customer very often either. Besides our standard product costs are built around smaller production runs and smaller shipping sizes, so the true profitability is understated for an order of this size. Liam: I'm not sure these quantities will have much of an impact on the size of our production runs, but you're right that the shipping quantities will probably be greater than our assumed order quantities. So, yes, shipping and packaging costs will probably be lower than what's included in the standard costs. Kiara: So Liam, is the 5% profit correct at standard? Liam: Uhh....I just got this detail. I can build a spreadsheet and come up with the answer right here.....give me a few minutes. Nancy: Another issue we should talk about is our overall plant capacity. Of course it varies based on specific product needs, labor, and order timing, but I estimate we're at 93% of our full capacity based on our budgeted sales and sales mix. When the planned plant expansion is completed in 18 months, if construction stays on schedule, our capacity will be bumped by 20% so it won't be a problem at that point. But until then, it's something we need to consider. Neil: I'm optimistic that we're going to beat our sales budget for aftermarket, will we be able to handle that? Rick: I need to plug this order into our capacity planning to give you a solid answer. It also depends on how much you're talking about when you say you'll beat your budget? Neil: I don't like to show my cards until I have to. Let's just say I'm optimistic. Kiara: That vague answer isn't going to cut it Neil. If you had to estimate, and let's pretend I'm saying you must, what would you estimate? Neil: Well...understand that it's only in the 2nd inning, but I'm optimistic we'll be able to beat the budget by up to 6%. The growth "last mile" delivery is going to help us. Elise: "Up to 6%"? You're hedging again Neil Nell: You betiam. It's too early in the year to be confident. And this talk of capacity concerns me! If one of our customers calls to order tires and we don't have the ability to deliver what he wants, he's going to call a competitor. And once we let a competitor in their door, we run proverbial shit is hitting the fan. He practically wrote the book on the company's ERP system and his management of the plant is considered one of the company's competitive advantages. Sean Finney, VP of Finance. He's a solid head of finance but is more comfortable reviewing the trial balance than doing analysis. He's quiet and avoids confrontation Liam Kim, Cost Analyst. Liam reports to Sean Finney. Llam is in late 20s with a background in accounting and finance. His role to maintain the accuracy of the company's product costing system and conduct profitability analysis. He's smart and cocky, Elise Verschelden, VP of International. While this particular sales opportunity has only an indirect impact on her area of responsibility, she is considered a key member of the executive team and is a part of all strategic decisions Finally, you, Kiara Sommit. President of Abgergriffen. Roy: Thanks for coming on such short notice. I've got some exciting news for us. You're all familiar with "Hitch" brand trailers. You can't drive down the highway without seeing their trailers on the road. They are, in fact, the largest flatbed and enclosed trailer manufacturer in the U.S. Well, for the past 4 years they've been purchasing all of their OE tires from the Asian manufacturer, Enatsu. I've been calling on Hitch for the past two years to develop a relationship and hopefully get a crack at this business. This effort has paid off. Due to both production issues and interruptions in international shipping, Enatsu's on-time delivery to Hitch has been...sporadic. Frustrated with Enatsu's performance, Hitch has offered us the contract if we match Enatsu's price. This is $30,000,000 of large volume, new business annually! They're ready for me to fly to St. Louis early next week to sign the contract and we'll start delivering product to them in 60 days. I just received the specifics on the tire sizes and quantities this morning. Terri has crossed their tires requirements to our part numbers and the information is on the table in front of you. This is a real homerun for us! We've been focused on this Hitch business for a couple years and we've finally cracked it. They're a growing company, so this $30 million will only go up in future years. My question, for Nancy and Rick, is do you see any problem with us starting deliveries in 60 days? Nancy: What's the timing on these items....I mean are they spread out evenly over the course of the year? Roy: It's my understanding that it's fairly even over the year, but with some bump in the spring which is their busiest sales season. Neil: That's our busiest season as well. Rick: Well....I'll have to dig into the details, but I'm pretty comfortable that we have capacity on an annual basis to add this production. We may have to build some inventory during the winter and temporarily rent some additional warehouse space to make sure we can cover everyone's needs during the busy spring season, but we can manage that. Manufacturing Tires are composed of numerous components: tread, cap plies, steel cord plies, casing and sidewall, and tire bead. Each of these components are manufactured by different machines in the plant and then the components are molded together. The final manufacturing process is for the tread pattern to be molded into the tire. After manufacturing and quality inspection, the tires are sent to the packaging. How the tires are packaged varies based on the sales channel and customer's specific requirements. The manufacturing plant is highly automated and capital intensive. Labor is used for the loading of some machines, material handling, inspection, and maintenance. The pace of the manufacturing process is dictated by the cycle time of key machines. To maximize the utilization of the expensive equipment, the plant runs 3,8 hour shifts per day, 6 days a week. On Sundays the plant is shut down for the maintenance personnel to perform required preventative maintenance and repair equipment as needed. The Meeting Roy has scheduled a meeting of key company managers to "share an exciting new sales DOMU achievement for the company and discuss the steps necessary for implementation". As the appointed meeting time approaches, the managers begin to file into the executive conference room. Roy arrives early to make sure the presentation is ready to go. With him is Terri Kim. Terri is the Director of OE Sales, reporting to Roy, and plays an integral role in every move the department makes. She's in her late 20s, but carries herself with the confidence beyond her years. Her education is in economics, and she is known for her analytical skills. Neil Glatter, who you've already met, arrives and takes a seat at the far end of the table. - Gene Black, VP of Product Engineering, Gene is an excellent engineer. He's short and fit and speaks with a low, booming voice. You might think he suffers from a bit of Napoleonic complex. Like many engineers, he's not afraid to spend time and money to achieve a high quality outcome; sometimes too much time and money, Nancy Youngman, VP of Manufacturing Operations. Nancy is in her early 40's. She started on the production line in the plant when she was 18 and has been climbing the ladder ever since. Nancy is a "big picture", strategic thinker. Everyone knows she's smart, competent, and with the backbone necessary to go toe-to-toe with anyone. Rick Kason, Operations Manager. Rick reports to Nancy and is responsible for the daily functions of the manufacturing plant. His primary areas of focus are manufacturing scheduling, capacity planning, and efficiency. Rick is a soft spoken "good ol boy". He remains calm even when the Growth Opportunity for Abgegriffen Tires Abgegriffen Tires is a manufacturer of tires for light, medium, and heavy trucks and trailers. The company was started in the late 1940s by J.A. Abgegriffen in Wisconsin. In the 1950s he relocated the operation to South Dakota where he was able to acquire some surplus WWII buildings for next to nothing. Since then, the company has grown to be a major player in the U.S. tire market with annual sales around $500 million. The company has developed a strong brand image as the "Heavy-Duty Tire People". Abgegriffen Tires are considered a premium quality product and, as a result, they are able to charge a premium price for their tires. Sales Structure Sales for the company are divided into three broad segments: Original Equipment (OE), Aftermarket, and International. The CE segment includes tires sold directly to the manufacturers of trucks and trailers where they're used as the original tires on vehicles produced. These companies purchase in large quantities, hundreds or thousands of tires per order. The competition amongst tire manufacturers to win these large orders is fierce, so Abgegriffen must price at a low margin to win OE orders. Several tire manufacturing companies focus heavily or even exclusively on the OE market. Historically Abgegriffen has focused on the aftermarket business and its entry into the OE business has occurred in only the last ten years. The OE sales unit is led by Vice President for OE Sales, Roy Laut. Roy is in his 50s, always impeccably dressed in a white oxford shirt and tie with his hair combed straight back. The Aftermarket segment sells replacement tires to thousands of tires shops, repair garages, and fleet service shops across the U.S. A tire shop is a business that focuses primarily on the sale and installation of replacement tires. A repair garage focuses on repairing vehicles, but they also sell tires to generate additional revenue for their business. Fleet service shops are owned/operated by a trucking or delivery company to maintain exclusively their fleet of vehicles. A few of the large tire shops and fleet service shops may order a hundred tires at a time, but the vast majority of orders are for 2-50 tires at a time. Because of Abgegriffen's reputation as a premium quality product, and resulting premium price, they are able to achieve a high profit margin on this business. The aftermarket segment is led by Vice President for Sales, Neal Glatter. Neal is around 60 years of age. He's jovial, casual, and sometimes commits a good gaffe. He's very much a "glass-half-full" personality. Aftermarket sales are divided into 4 regions in the U.S., each led by a Director of Regional Sales. Each region has 3-5 company employed salespeople that call directly on the tire shops, repair garages, and fleet service shops. The International segment is at this point only a small portion of the business. The tire market is mature in all developed countries with major manufacturers scattered across the globe. Abgegriffen only recently started to invest personnel and resources to focus on developing international opportunities