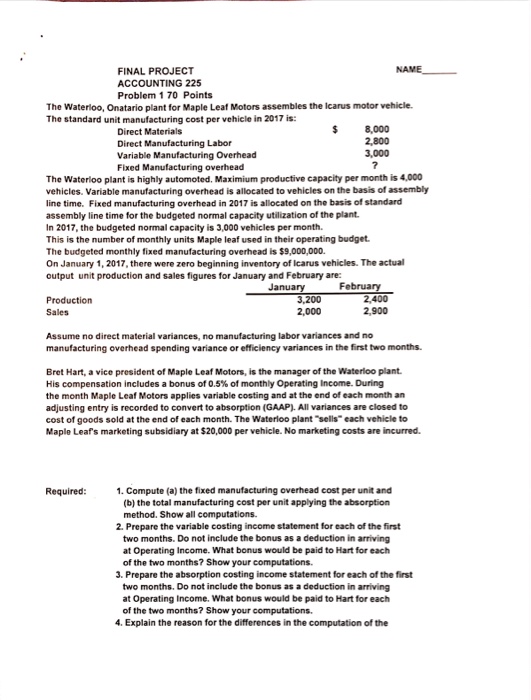

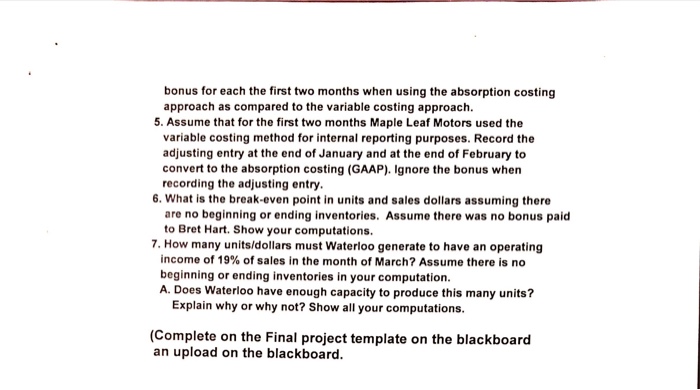

FINAL PROJECT ACCOUNTING 225 Problem 1 70 Points The Waterloo, Onatario plant for Maple Leaf Motors assembles the lcarus motor vehicle. The standard unit manufacturing cost per vehicle in 2017 is: Direct Materials Direct Manufacturing Labor Variable Manufacturing Overhead Fixed Manufacturing overhead $ 8,000 2,800 3,000 The Waterloo plant is highly automoted. Maximium productive capacity per month is 4,000 vehicles. Variable manufacturing overhead is allocated to vehicles on the basis of assembly line time. Fixed manufacturing overhead in 2017 is allocated on the basis of standard assembly line time for the budgeted normal capacity utilization of the plant In 2017, the budgeted normal capacity is 3,000 vehicles per month. This is the number of monthly units Maple leaf used in their operating budget The budgeted monthly fixed manufacturing overhead is $9,000,000 On January 1,2017,there were zero beginning inventory of Icarus vehicles. The actual output unit production and sales figures for January and February are: January February Production Sales 3,200 2,000 2,400 2,900 Assume no direct material variances, no manufacturing labor variances and no manufacturing overhead spending variance or efficiency variances in the first two months. Bret Hart, a vice president of Maple Leaf Motors, is the manager of the Waterloo plant His compensation includes a bonus of 0.5% of monthly Operating Income. During the month Maple Leaf Motors applies variable costing and at the end of each month an adjusting entry is recorded to convert to absorption (GAAP).All variances are closed to cost of goods sold at the end of each month. The Waterloo plant sells" each vehicle to Maple Leafs marketing subsidiary at $20,000 per vehicle. No marketing costs are incurred. Required: 1. Compute (a) the fixed manufacturing overhead cost per unit and (b) the total manufacturing cost per unit applying the absorption method. Show all computations. 2. Prepare the variable costing income statement for each of the first two months. Do not include the bonus as a deduction in arriving at Operating Income. What bonus would be paid to Hart for each of the two months? Show your computations. 3. Prepare the absorption costing income statement for each of the first two months. Do not include the bonus as a deduction in arriving at Operating Income. What bonus would be paid to Hart for each of the two months? Show your computations. 4. Explain the reason for the differences in the computation of the