Answered step by step

Verified Expert Solution

Question

1 Approved Answer

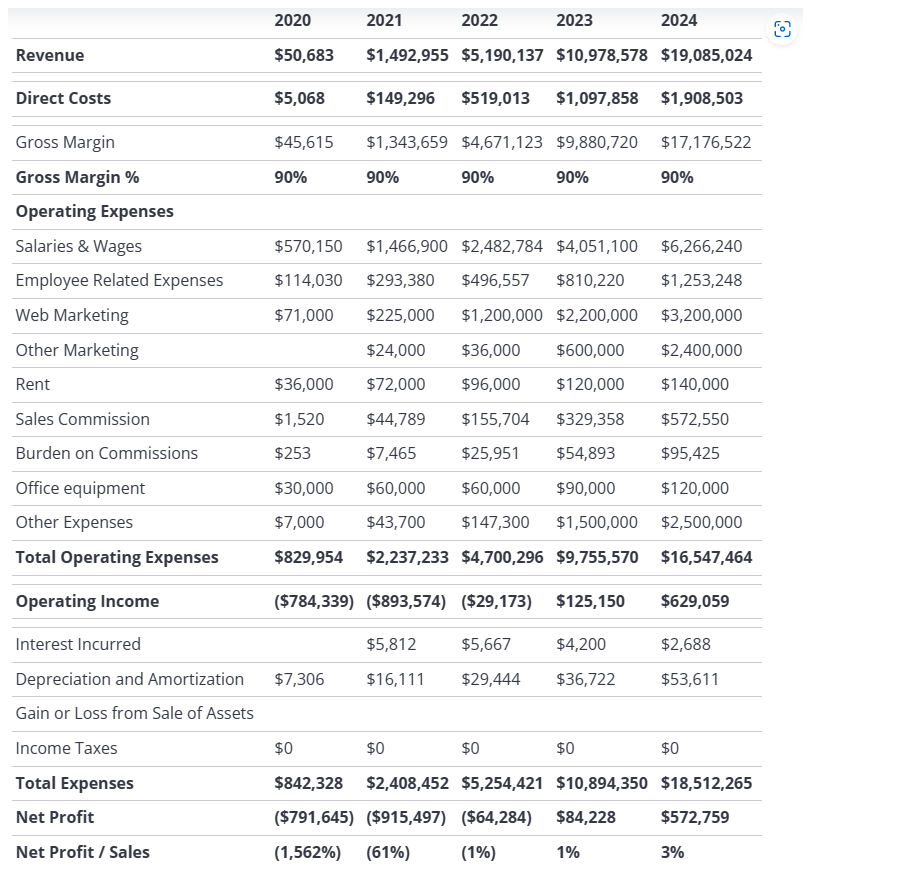

final projection based on subscriptions on an app for example $5/monthly, and a population size of 1.9 million people. assume that in the first two

final projection based on subscriptions on an app for example $5/monthly, and a population size of 1.9 million people. assume that in the first two years I get 100 subscribers. need a simple spread sheet of the first 4 yrs and how profit is calculate.

2020 2021 2022 2023 2024 Revenue Direct Costs Gross Margin $50,683 $1,492,955 $5,190,137 $10,978,578 $19,085,024 $5,068 $149,296 $519,013 $1,097,858 $1,908,503 $45,615 $1,343,659 $4,671,123 $9,880,720 $17,176,522 Gross Margin % 90% 90% 90% 90% 90% Operating Expenses Salaries & Wages Employee Related Expenses $570,150 $1,466,900 $2,482,784 $4,051,100 $6,266,240 Web Marketing Other Marketing $114,030 $293,380 $496,557 $810,220 $1,253,248 $71,000 $225,000 $1,200,000 $2,200,000 $3,200,000 $24,000 $36,000 $600,000 $2,400,000 Rent Sales Commission Burden on Commissions Office equipment Other Expenses Total Operating Expenses $36,000 $72,000 $1,520 $44,789 $253 $7,465 $30,000 $60,000 $60,000 $90,000 $120,000 $7,000 $43,700 $147,300 $1,500,000 $2,500,000 $829,954 $2,237,233 $4,700,296 $9,755,570 $16,547,464 $54,893 $96,000 $120,000 $140,000 $155,704 $329,358 $572,550 $25,951 $95,425 Operating Income ($784,339) ($893,574) ($29,173) $125,150 $629,059 Interest Incurred Depreciation and Amortization $7,306 $5,812 $16,111 $5,667 $29,444 $4,200 $2,688 $36,722 $53,611 Gain or Loss from Sale of Assets Income Taxes $0 $0 $0 $0 $0 Total Expenses Net Profit $842,328 $2,408,452 $5,254,421 $10,894,350 $18,512,265 ($791,645) ($915,497) ($64,284) $84,228 Net Profit / Sales (1,562%) (61%) (1%) 1% $572,759 3% 8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started