Finally, 21st Century is also considering Project Z Project Z has an up-front after-tax cost of $500,000, and it is expected to produce after-tax

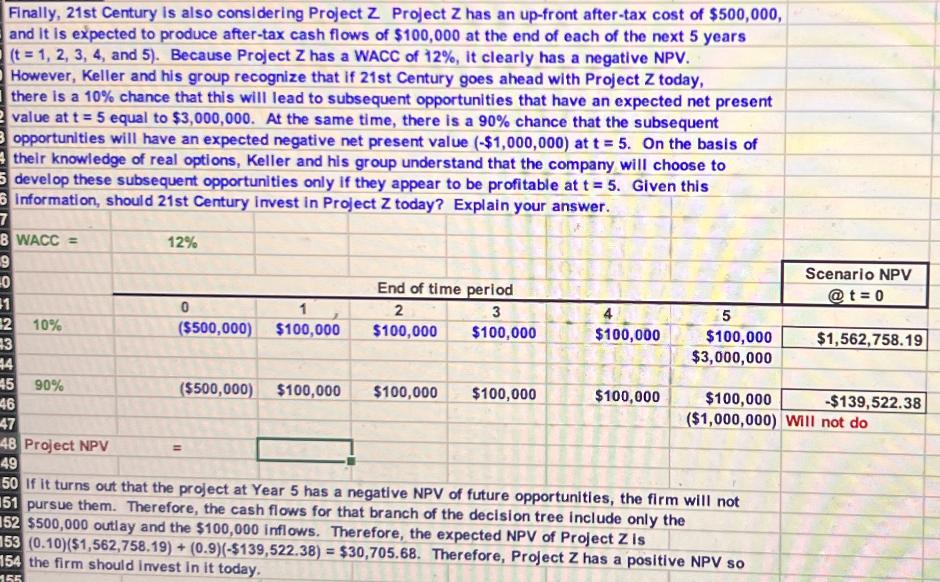

Finally, 21st Century is also considering Project Z Project Z has an up-front after-tax cost of $500,000, and it is expected to produce after-tax cash flows of $100,000 at the end of each of the next 5 years (t=1, 2, 3, 4, and 5). Because Project Z has a WACC of 12%, it clearly has a negative NPV. However, Keller and his group recognize that if 21st Century goes ahead with Project Z today, there is a 10% chance that this will lead to subsequent opportunities that have an expected net present value at t=5 equal to $3,000,000. At the same time, there is a 90% chance that the subsequent Bopportunities will have an expected negative net present value (-$1,000,000) at t=5. On the basis of their knowledge of real options, Keller and his group understand that the company will choose to 5 develop these subsequent opportunities only if they appear to be profitable at t=5. Given this 6 Information, should 21st Century invest in Project Z today? Explain your answer. 7 8 WACC= 12% 9 Scenario NPV 0 End of time period @t=0 1 1 2 3 2 10% ($500,000) $100,000 $100,000 $100,000 4 $100,000 5 43 $100,000 $3,000,000 $1,562,758.19 44 45 90% ($500,000) $100,000 $100,000 $100,000 $100,000 46 $100,000 ($1,000,000) Will not do -$139,522.38 47 48 Project NPV 49 50 If it turns out that the project at Year 5 has a negative NPV of future opportunities, the firm will not 51 pursue them. Therefore, the cash flows for that branch of the decision tree include only the 52 $500,000 outlay and the $100,000 inflows. Therefore, the expected NPV of Project Z is 153 (0.10)($1,562,758.19)+(0.9)(-$139,522.38) = $30,705.68. Therefore, Project Z has a positive NPV so 154 the firm should invest in it today. 155

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here is the stepbystep analysis to determine if 21st Century should invest in Project Z today using ... View full answer

Get step-by-step solutions from verified subject matter experts

100% Satisfaction Guaranteed-or Get a Refund!

Step: 2Unlock detailed examples and clear explanations to master concepts

Step: 3Unlock to practice, ask and learn with real-world examples

See step-by-step solutions with expert insights and AI powered tools for academic success

-

Access 30 Million+ textbook solutions.

Access 30 Million+ textbook solutions.

-

Ask unlimited questions from AI Tutors.

Ask unlimited questions from AI Tutors.

-

Order free textbooks.

Order free textbooks.

-

100% Satisfaction Guaranteed-or Get a Refund!

100% Satisfaction Guaranteed-or Get a Refund!

Claim Your Hoodie Now!

Study Smart with AI Flashcards

Access a vast library of flashcards, create your own, and experience a game-changing transformation in how you learn and retain knowledge

Explore Flashcards