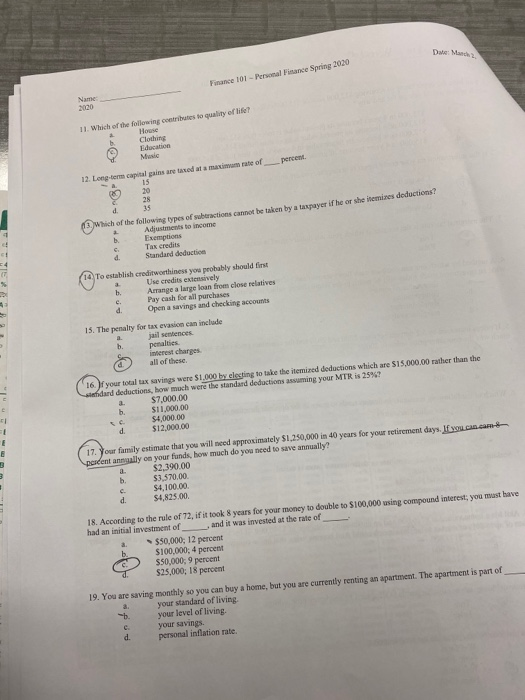

Finance 101 - Personal Finance Spring 2020 11. Which of the following contributes to quality of life? House Clothing Education Music ate of percent 12. Long-term capital gains are taxed at amm Which of the following types of suberactions cannot be taken by a taxpayer if he or she itemizes deductions Adjustments to income Exemptions Tax credits Standard deduction 14 To establish creditworthiness you probably should first Use credits extensively Arrange a large loan from close relatives Pay cash for all purchases Open a savings and checking accounts MERIT $ 15. The penalty for tax evasion can include jail sentences penalties interest charges all of these 16. your total tax savings were $1.000 by electing to take the itemized deductions which are $15.000.00 rather than the and deductions, how much were the standard deductions assuming your MTR is 25%? $7,000.00 $11,000.00 $4,000.00 $12,000.00 17. Your family estimate that you will need approximately $1,250,000 in 40 years for your retirement days. If you can. podent angully on your funds, how much do you need to save annually $2.390.00 53.570,00 $4,100.00 $4,825.00 18. According to the rule of 72, if it took 8 years for your money to double to $100,000 using compound interest, you must have had an initial investment of and it was invested at the rate of $50,000; 12 percent $100,000: 4 percent $50,000: 9 percent $25,000; 18 percent 19. You are saving monthly so you can buy a home, but you are currently renting an apartment. The apartment is part of your standard of living. your level of living. your savings personal inflation rate. b. Finance 101 - Personal Finance Spring 2020 11. Which of the following contributes to quality of life? House Clothing Education Music ate of percent 12. Long-term capital gains are taxed at amm Which of the following types of suberactions cannot be taken by a taxpayer if he or she itemizes deductions Adjustments to income Exemptions Tax credits Standard deduction 14 To establish creditworthiness you probably should first Use credits extensively Arrange a large loan from close relatives Pay cash for all purchases Open a savings and checking accounts MERIT $ 15. The penalty for tax evasion can include jail sentences penalties interest charges all of these 16. your total tax savings were $1.000 by electing to take the itemized deductions which are $15.000.00 rather than the and deductions, how much were the standard deductions assuming your MTR is 25%? $7,000.00 $11,000.00 $4,000.00 $12,000.00 17. Your family estimate that you will need approximately $1,250,000 in 40 years for your retirement days. If you can. podent angully on your funds, how much do you need to save annually $2.390.00 53.570,00 $4,100.00 $4,825.00 18. According to the rule of 72, if it took 8 years for your money to double to $100,000 using compound interest, you must have had an initial investment of and it was invested at the rate of $50,000; 12 percent $100,000: 4 percent $50,000: 9 percent $25,000; 18 percent 19. You are saving monthly so you can buy a home, but you are currently renting an apartment. The apartment is part of your standard of living. your level of living. your savings personal inflation rate. b