Answered step by step

Verified Expert Solution

Question

1 Approved Answer

finance 2 years ago, New York-based hedge fund Viewcrest Street Partners (VSP) purchased 12,000 units of a bond issued by the Mexican government. These bonds

finance

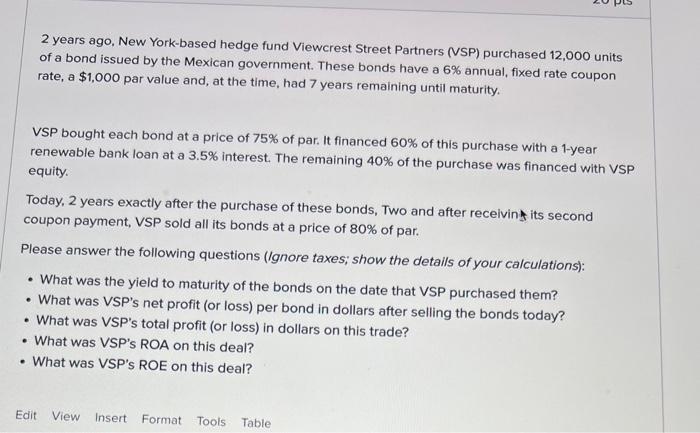

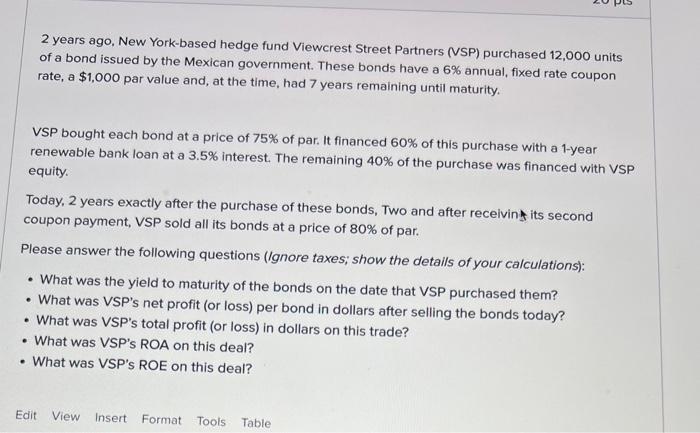

2 years ago, New York-based hedge fund Viewcrest Street Partners (VSP) purchased 12,000 units of a bond issued by the Mexican government. These bonds have a 6% annual, fixed rate coupon rate, a $1,000 par value and, at the time, had 7 years remaining until maturity. VSP bought each bond at a price of 75% of par. It financed 60% of this purchase with a 1 -year renewable bank loan at a 3.5% interest. The remaining 40% of the purchase was financed with VSP equity. Today, 2 years exactly after the purchase of these bonds, Two and after receivin 1 its second coupon payment, VSP sold all its bonds at a price of 80% of par. Please answer the following questions (Ignore taxes; show the detalls of your calculations): - What was the yield to maturity of the bonds on the date that VSP purchased them? - What was VSP's net profit (or loss) per bond in dollars after selling the bonds today? - What was VSP's total profit (or loss) in dollars on this trade? - What was VSP's ROA on this deal? - What was VSP's ROE on this deal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started